Weekly updates

Ep 132: TerraM token at $1.97, Liquidity Expands, Market Cap Nears $20K

| 49 seen

On February 27, 2026, the TerraM token traded at $1.97, up 4.23% week over week. On-chain activity was limited during the period, with two buys and no sells. For a nano crypto fund like ours, every on-chain transaction is an event worth noting.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.98% of total supply. As a result, total market capitalization, if fully distributed, increased by approximately $800, reaching $19,700 week over week. $20K feels within reach. Let’s aim to break above…

Ep 131: TerraM Liquidity Nears 3% Milestone as ETH Options Generate $99 Premium

| 164 seen

On February 20, 2026, the TerraM token traded at $1.89, up 3.84% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.95% of total supply. As a result, total market capitalization increased by approximately $700, reaching $18,900 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expected to reach this minor…

Ep 130: TerraM Token Rises 2.8% as ETH Strategy Gains 9%

| 193 seen

On February 13, 2026, the TerraM token traded at $1.82, up 2.82% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.90% of total supply. As a result, total market capitalization increased by approximately $500, reaching $18,200 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expect to cross this…

Ep 129: Capitulation, Reset, and a Return to Spot-First Discipline

| 251 seen

This week marked one of the most difficult moments in Terramatris’ history. The crypto market experienced a sharp and disorderly sell-off, and our portfolio entered what can only be described as a leverage-driven death spiral. At the peak of exposure, we were effectively controlling roughly 6 ETH with an average entry price above $3,500. Most of this exposure was expressed through perpetual futures and short put options, both of which moved deeply underwater as ETH collapsed. When Ethereum dipped below $2,000, the math stopped working.

At that point, we made a hard but necessary…

Ep 128: TerraM Token Rises to $2.83 (+2.9%) Despite Massive Crypto Selloff

| 134 seen

On January 30, 2026, the TerraM token traded at $2.83, up 2.9% week over week. Trading activity increased following the launch of a 1 TerraM token weekly reward for liquidity staking. Automated trading bots quickly identified the incentive and began purchasing and staking TerraM tokens.

For most of the week, TerraM traded tightly around $2.90, before slipping to $2.83 on Friday morning amid short-term profit-taking by trading bots.

This bot trading development is positive. We estimate that 70–90% of DeFi activity is bot-driven, and as long as these bots are deploying real…

Ep: 127: TerraM Token Growth to $2.75 Despite Fund Drawdowns

| 115 seen

On January 23, 2026, the TerraM token traded at $2.75 (+2.23%). Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we increased liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.48% of total supply bringing our total market cap to $27,500 (+$600).

Our larger objective is to expand the liquidity pool to 10%, but the next key milestone is getting past 2%. We anticipate achieving this within 4–5 weeks. Until liquidity improves, slippage will continue to be significant.

TerraM Multi Asset Fund…Ep 126: TerraM Token and Multi-Asset Fund Update: Liquidity, Buyback Plans, and 9.45% Weekly Gain

| 121 seen

On January 16, 2026, the TerraM token traded at $2.69. Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we also added liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.35% of total supply bringing our total market cap to $26,900.

Slippage remains elevated due to shallow liquidity. This is not ignored—we are actively working on liquidity depth, pool balance, and execution efficiency as part of the broader TerraM token mechanics.

Our CEO announced his intention to initiate a 52-week TerraM…

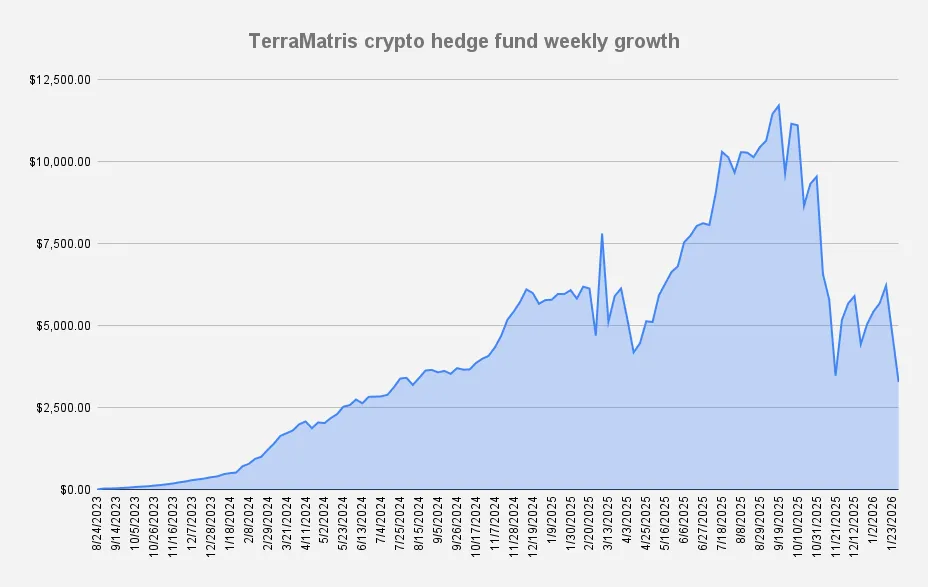

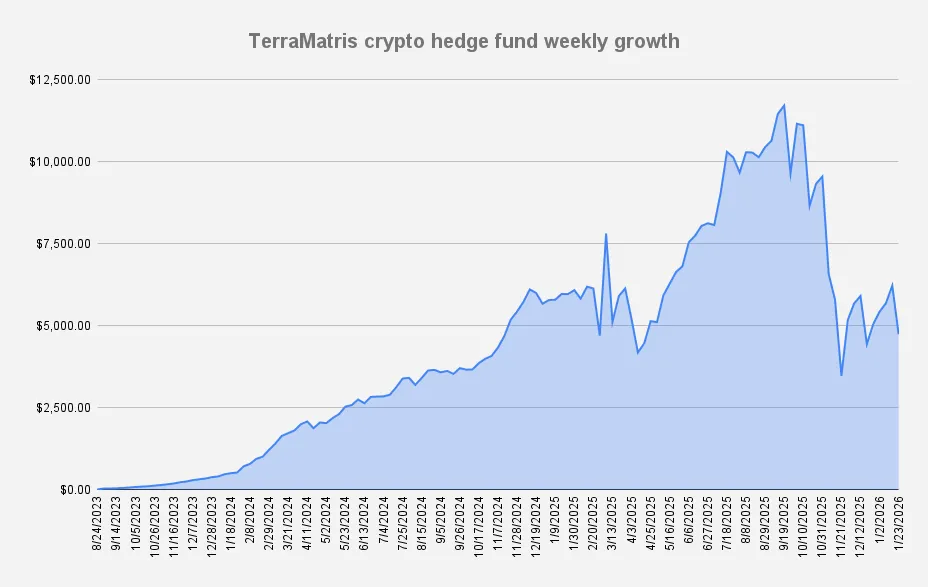

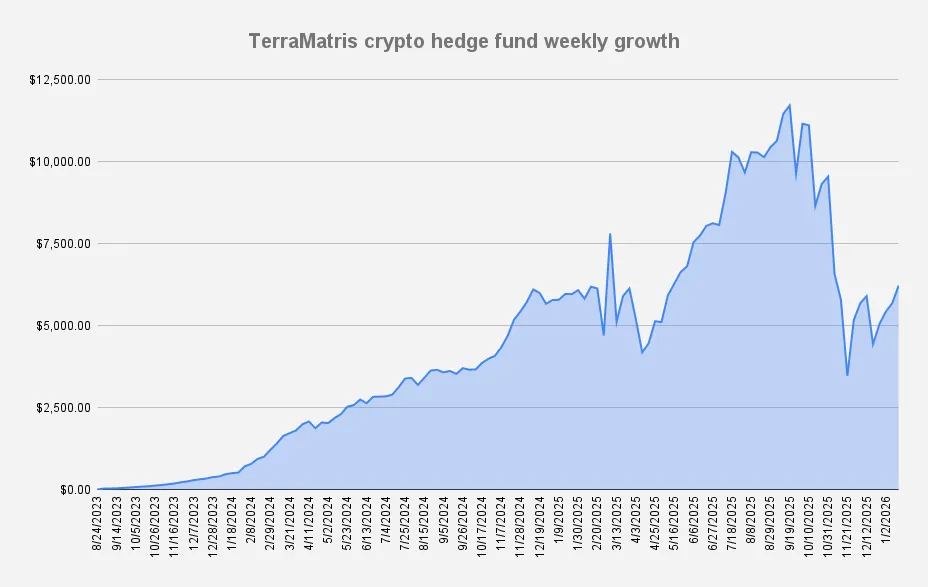

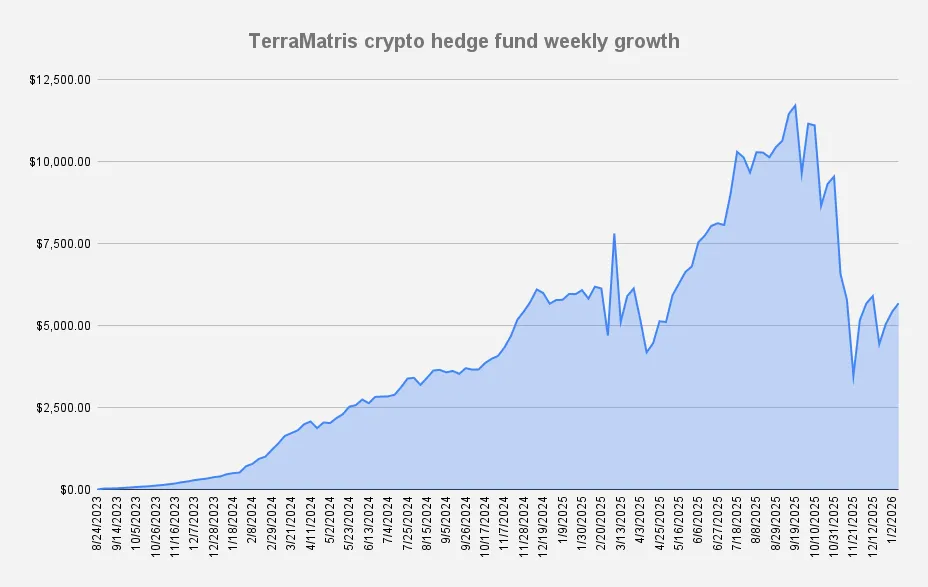

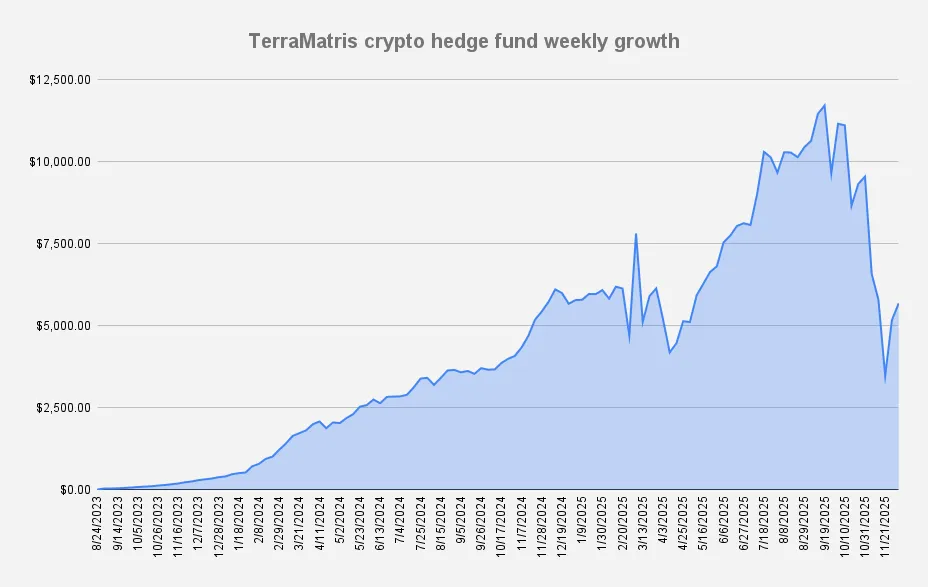

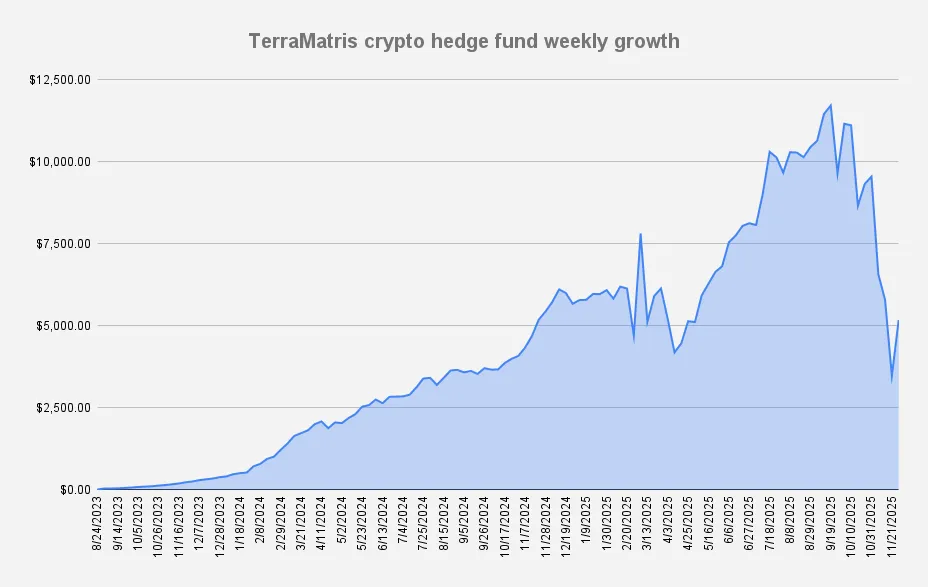

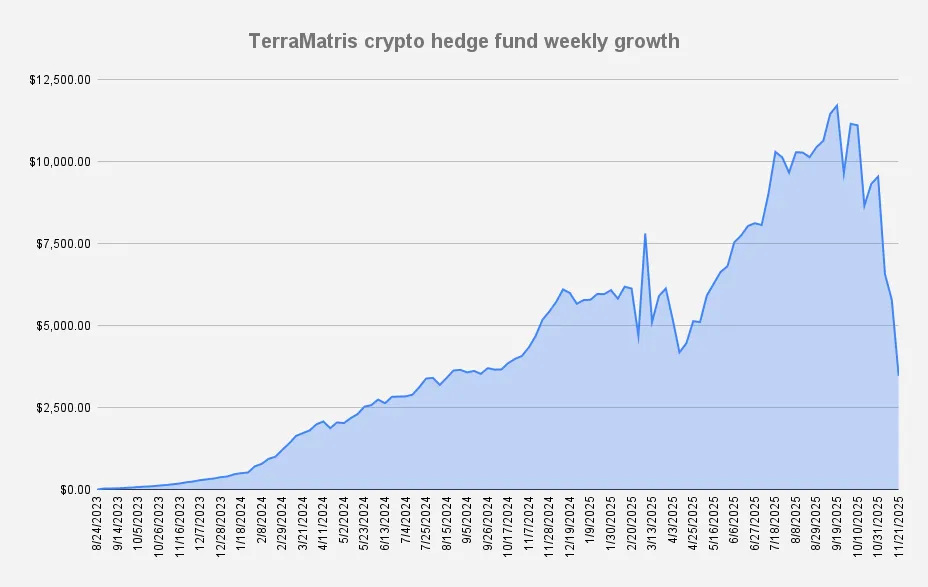

Ep 125: TerraM Fund Update: +4.73% Weekly Gain, but Drawdown Still −51% From ATH

| 68 seen

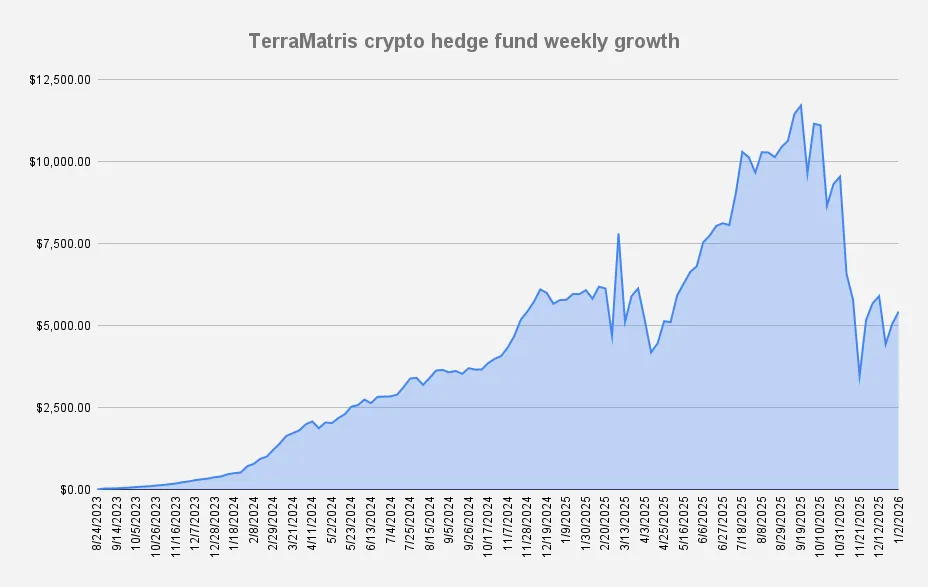

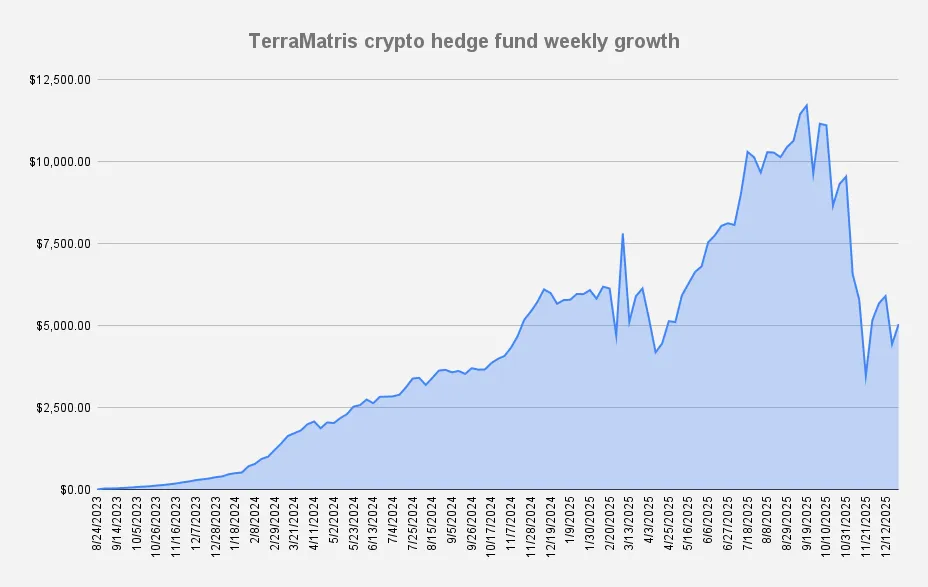

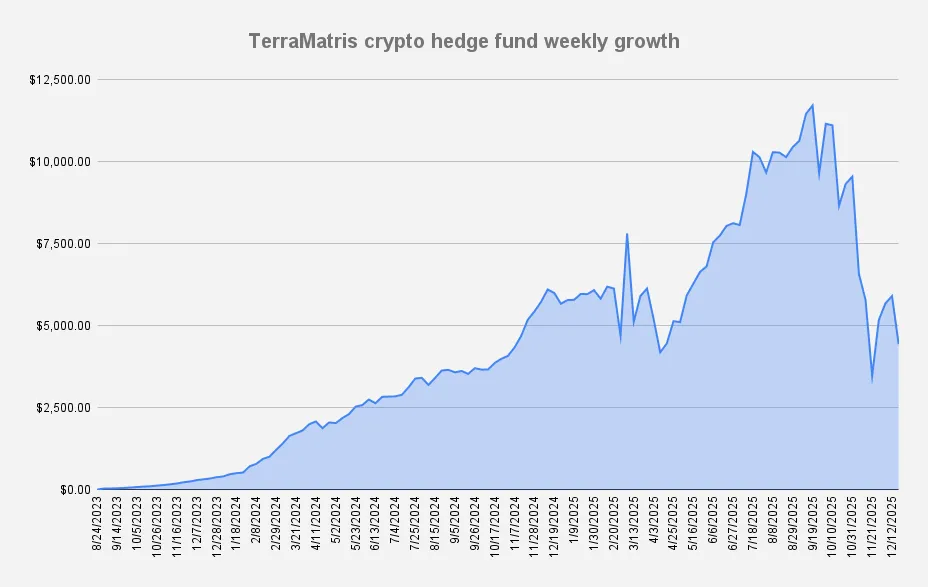

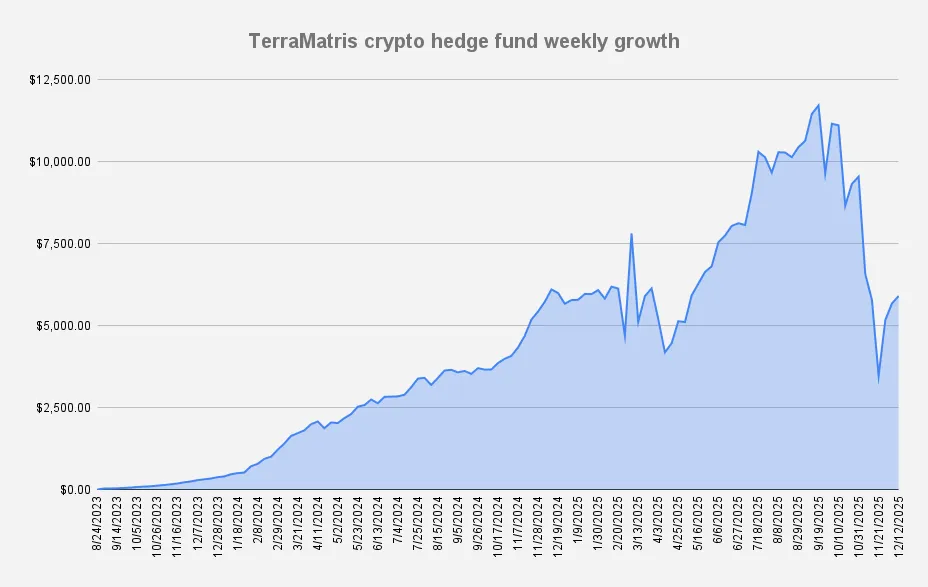

As of January 9, 2026, the TerraM Multi-Asset Crypto Options Fund is up +4.73% week-over-week, marking the second consecutive week of gains in 2026. Broader crypto market conditions remain constructive, though this outlook remains subject to invalidation.

TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –51.47%. While YTD fund is up 6.14%, outperforming Bitcoin (+3.81%) and ETH (+4.55%).

Market Outlook (Bitcoin)Bitcoin has finally broken above its 50-day moving average, trading at $90,600 as of writing this article. While a short-term…

Ep 124: TerraM Multi-Asset Crypto Options Fund: +7.57% Weekly Gain to Start 2026

| 54 seen

Greetings in 2026. The Terramatris team has traveled to the beautiful Palolem Beach in Goa, India, and with great excitement we are preparing the first weekly review of the new year. We wish everyone a strong and successful start to 2026.

As of January 2, 2026, the TerraM Multi-Asset Crypto Options Fund is up +7.57% week-over-week, encouraging start of the new year. While the crypto market remains in a consolidation phase, still trying to decide its next move, last week was relatively calm, with most gains coming from expiring options positions.

TerraM Multi-Assets Fund…

Ep 123: How TerraM Generated 5.4% Weekly Returns Using In-the-Money Covered Calls

| 66 seen

As of December 26, 2025, the TerraM Multi-Asset Crypto Options Fund is up +13.77% week-over-week, encouraging result after previous weeks sharp drop. With only a few days left in 2025, crypto appears to be searching for a footing as it heads into 2026.

TerraM Multi-Assets Fund drawdown from all time high back in September is –56%. While Year-to-date, our Fund is down –11.12%, underperforming Bitcoin (–4.57%) and ETH (–10.59%).

Options IncomeThis week, the TerraM Multi-Asset Fund generated $276 in options premiums, what is impressive 5.4% weekly return on capital. The…

Ep 122: TerraM Multi-Asset Crypto Options Fund Down 24.86% WoW as ETH Weakness Persists

| 66 seen

As of December 19, 2025, the TerraM Multi-Asset Crypto Options Fund is down (again) -24.86% week-over-week, discouraging result after brief relief for the past few weeks. Apparently the worst is not over. Unless momentum shifts, ETH likely revisits sub-$2,500 levels before any real recovery.

Overall drawdown is –62%. Year-to-date, the Fund is down –21.87%, underperforming Bitcoin (–6.97%) and ETH (–12.47%). This confirms our returns are still highly directional and closely correlated with the broader market—largely riding the wave, while aiming to add incremental income through…

Ep 121: Crypto Options Fund Up 3.94% $170 Premiums This Week

| 96 seen

As of December 12, 2025, the TerraM Multi-Asset Crypto Options Fund is up +3.94% week-over-week, encouraging result after the steep drawdown just a few weeks ago.

Our overall drawdown stands at –49%, while YTD Fund value is up +3,98%, slightly outperforming Bitcoin (–1.29%) and ETH (–2.65%). This highlights that our returns remain highly directional and strongly correlated with the broader market - largely “riding the wave” while seeking to extract incremental income through our yield/option overlays.

Options IncomeThis week, the TerraM Multi-Asset Fund generated $…

Ep 120: Rolling Up, Collecting Credit: TerraM Earns $231 Options Premium as Fund Jumps +9.87%

| 167 seen

As of December 5, 2025, the TerraM Multi-Asset Crypto Options Fund is up +9.87% week-over-week, giving as a hope that the worst is behind us, and we should focus on growth.

Our overall drawdown has now improved to –51%, a meaningful recovery, though still well below the fund’s mid-September all-time high. Year-to-date, we are up +0.04%, slightly outperforming Bitcoin (–1.63%) and modestly outperforming ETH (–5.32%). This highlights that our returns remain highly directional and strongly correlated with the broader market—largely “riding the wave” while seeking to extract…

Ep 119: Weekly Update: +48.85% Rebound, Drawdown Recovery, and Options Income Surge

| 147 seen

As of November 28, 2025, the TerraM Multi-Asset Crypto Options Fund is up +48.85% week-over-week, marking our strongest weekly gain to date. However, this surge is largely a retracement following last week’s –40% drawdown, rather than new growth.

Our overall drawdown has now improved to –55.87% - a meaningful recovery, though still far from the fund’s all-time high reached in mid-September. This past week offered welcome relief, and we hope the positive momentum continues, but we remain cautious and do not rule out the possibility of another sharp decline.

It has now been more…

Ep 118: TerraM Fund Reports Record –40% Weekly Loss as Drawdown Reaches –70%

| 97 seen

As of November 21, 2025, the TerraM Multi-Asset Crypto Options Fund is down –40.00% week-over-week, marking our worst weekly result to date. The overall drawdown has deepened to –70.35%, placing the fund firmly in distressed territory. The crypto bear market has hit us hard, and leverage remains the primary problem. Core positions are still intact, but another week of similar magnitude could put us at serious risk without additional external capital.

Last week’s outlook turned out correct: BTC slipped toward the previously noted $84,000 level. While we’re not issuing price…

Ep 117: Bitcoin Death Cross Worries Grow as TerraM Fund Drops Further

| 68 seen

As of November 14, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by another -11.97%. Our drawdown has reached a new low of –50.58% in just a few weeks — a striking reminder of how quickly conditions can deteriorate. Even though most indicators are washed out and a recovery could be near, we remain cautious and do not rule out further downside. We still hope to be wrong.

There is one major event worrying us: a death cross on the Bitcoin chart. In fact, it’s not just potential it’s looking increasingly inevitable.

A death cross occurs when the…

Ep 116: Volatile Week in Crypto: TerraM Fund Drops 31%, Solana Fund Down 8%

| 23 seen

As of November 7, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by -31.12%. While this may appear to be our worst week-over-week result, it is not unprecedented — on March 13, 2025, the fund experienced an even steeper drop of -34%.

Let’s hope it stays that way, as there’s no reason to challenge that record. The current decline stems from a broad weakening in the crypto market and the fact that several positions remain leveraged.

We’ve been actively reducing leverage over the past few weeks, and despite the market stress, the fundamentals remain…

Ep 115: TerraM Multi-Asset Crypto Options Fund Gains +2.42% While Solana Covered Call Slips –1.52%

| 34 seen

As of October 31, 2025, the TerraM Multi-Asset Crypto Options Fund achieved another week-over-week gain of +2.42%.

Meanwhile, the Solana Covered Call Growth Fund maintained its consistent performance, generating steady options income that was fully reinvested into SOL to strengthen the fund’s core long position. The NAV per unit closed at $0.88, reflecting a modest -1.52% weekly decline.

Activity around the TERRAM token increased notably this week, with the price stabilizing at $3.13 by week’s end. Trading bots have begun interacting with the token — a positive sign, as these…

Ep 114: TerraM Fund Rebounds; SOL Fund Surpasses 1% Weekly Income

| 43 seen

As of October 24, 2025, the TerraM Multi Asset Crypto Options Fund reported a net asset value of $9,325, showing decent recovery of +7.67% from the previous week.

The past few weeks have been characterized by significant volatility, with the market showing no clear directional bias. As option sellers, we remain aware of the possibility of a substantial correction before any sustained recovery occurs. Current conditions remain choppy, though we certainly hope this cautious outlook proves unnecessary.

The Solana Covered Call Growth Fund continued its steady performance,…

Ep 113: TerraM Crypto Fund Suffers -22% Weekly Drop, NAV Falls to $8,661

| 55 seen

As of October 17, 2025, the TerraM Crypto Fund reported a net asset value of $8,661, representing another massive -22.08% decline from the previous week. This seems to be our biggest drawdown so far in 2025 — let’s hope it stays that way.

Wow, what a week — from the dramatic drop following last Friday’s announcement of a 100% tariff on China, to quickly recover by Monday, and then yet another decline even more harsh than last week.

As mentioned earlier, the crypto market has entered a rather choppy phase, and we are not excluding the possibility of further drawdowns. We…

Ep 112: Crypto Market Turns Choppy: TerraM Fund Maintains Discipline, Records 1.87% Weekly Gain on Options Premiums

| 34 seen

As of October 10, 2025, the TerraM crypto fund value stood at $11,115 what is a slight decrease of -0.42% if compared to the last week.

When analyzing the overall crypto market, it appears we are entering a choppy phase — characterized by sharp drops, quick recoveries, and even sharper subsequent declines. History shows we’ve been here before. Looking at current trading charts, the probability of large downside moves ahead cannot be excluded.

In such an environment, traders should focus less on chasing short-term swings and more on risk management and protection…

Ep 111: TerraM Fund’s Strong Recovery Marks 15.66% Weekly Gain and 96.53% YTD Growth

| 50 seen

As of October 3, 2025, the TerraM crypto fund value stood at $11,162 what is an increase of 15.66% or +$1,511 in dollar terms when compared to the last week. That comes as a strong relief recovery after a sharp decline last week.

We’re still puzzled about what exactly happened last week, aside from it being quarter-end. We’re now using this comeback to strengthen our positions, reduce leverage, and ensure that when the next market selloff arrives, we’ll be better prepared.

From the previous all time high we are still -4.75% away, while YTD funds value has been at 96.53…

Ep 110: TerraM Fund Sees Worst Week of 2025, Yet Holds +69.92% YTD Gain

| 39 seen

As of September 26, 2025, the TerraM crypto fund value stood at $9,651 what is a decrease of -17.64% or -$2,067 in dollar terms when compared to the last week.

That was definitely one of the worst-performing weeks of the year, rivaling late March/early April when our fund dropped by a similar percentage. Back then, however, the pain felt more. Lessons learned.

Because we use only a very small amount of leverage, we are indeed affected by market moves—but we move together with the broader market.

Certainly such massive move stings for small-sized funds like…

Ep 109: TerraM Fund Weekly Report – Value at $11,719, +2.25% Weekly, +106% YTD

| 40 seen

As of September 19, 2025, the TerraM crypto fund value stood at $11,719 what is an increase of +2.25% or +$257 in dollar terms when compared to the last week. Absolutely brilliant!

Last few weeks have been quite rewarding in crypto markets, with some type of consolidation forming.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our main TerraM fund is +106.33%. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options IncomeWe sell weekly…

Ep 108: Fund Surges +7.69% This Week, Doubling Value in Under 9 Months

| 51 seen

As of September 12, 2025, the Terramatris crypto hedge fund value stood at $11,461 what is an increase of +7.69% or +$818 in dollar terms when compared to the last week. Absolutely brilliant!

The week turned out better than expected, with bold moves - particularly in Solana. Most cryptocurrencies are trending higher, and to our surprise, the small position we began building in Plume just a few weeks ago is already up 40%.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +101.79%. Absolutely remarkable - we’…

Episode 107 / Fund Grows 1.86% | New Solana Covered Call Fund & JUP Staking

| 82 seen

As of September 5, 2025, the Terramatris crypto hedge fund value stood at $10,643 what is an increase of +1.86% or +$194 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

The past week started with some active moves — we even adjusted one ETH position by rolling it down and forward. However, as the days progressed, market activity slowed, and the week ended relatively calm, with little movement in crypto markets.

At this point, we might be entering a consolidation phase, setting the stage for a binary outcome — either the start of…

Episode 106 / Ethereum Nears $5K as Terramatris Fund Surges +83.97% YTD

| 161 seen

As of August 29, 2025, the Terramatris crypto hedge fund value stood at $10,448 what is an increase of +3.02% or +$306 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

Just like the previous week, this one was also marked by significant volatility. Ethereum (our bread and butter) surged to nearly $5,000 — a new all-time high — before pulling back to $4,360at the time of writing. We believe that if ETH breaks above $5,000, another major rally could follow — perhaps toward $7,000? That’s just speculation, of course. Nevertheless, as put…

Episode 105 / ETH Volatility, Options Income of $170, and New Plume Position

| 136 seen

As of August 22, 2025, the Terramatris crypto hedge fund value stood at $10,142 what is a decrease of -1.37% or -$140 in dollar terms when compared to the last week.

The past week has been quite turbulent, with Ethereum fluctuating between 4,600 and 4,000. At one point, we even considered hedging by shorting part of our position with perpetual contracts, but ultimately decided against it. The week ended on a positive note, as all of our weekly options expired worthless. The decline in portfolio value mainly came from the depreciation of our long-term holdings.

Despite…

Episode 104 / Wyoming LLC Launch, Ethereum Rally & $137 Weekly Income

| 85 seen

As of August 15, 2025, the Terramatris crypto hedge fund value stood at $10,283 what is a decrease of -0.11% or -$10 in dollar terms when compared to the last week. As we had some small business expenses last week (Registered agent service fee – Wyoming LLC incorporation), for which we used part of our fund’s capital, we still consider it another stellar week.

We are still just a few dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

YTD our crypto hedge fund is +81.06%.

Current Long Perpetual…Episode 103 / Crypto Hedge Fund Update: $10,294 Value, SOL Strategy Shift, and TerraM Airdrop

| 63 seen

Greetings from Thessaloniki, Greece

This week, the Terramatris team has traveled to beautiful Thessaloniki to celebrate a special occasion—our CEO’s 40th birthday!

With fresh sea breezes, delicious local cuisine, and surprisingly excellent bulk wine, this coastal city has proven to be a true hidden gem in the heart of Europe. Thessaloniki offers a perfect balance between modern energy and historic charm, and it’s been the ideal backdrop for both celebration and exploration.

As we've immersed ourselves in the culture, we've also taken note of the local financial…

Episode 102 / Options Premiums Hit $125 This Week – 1.29% Weekly Return for Crypto Fund

| 37 seen

As of August 1, 2025, the Terramatris crypto hedge fund value has dropped to $9,673 what is a decrease of -4.59% or -$465 in dollar terms when compared to the last week. Considering we returned more than $500 in loan capital last week, the performance remains encouraging.

YTD our crypto hedge fund is +70.31%.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $124,002 | Short puts: $108,0001.7 ETH – Break-even: $3,954| Short puts: $3,3005 SOL – Break-even: $163.27 | short puts: $168As long as SOL stays above 168 by next Friday's expiry we will be…

Episode 101 / Crypto Fund Hits Record Options Premium Week with $418 Earned

| 37 seen

As of July 25, 2025, the Terramatris crypto hedge fund value was $10,138 what is a slight decrease of -1.61% or -$166 in dollar terms when compared to the last week. A healthy pullback after few strong weeks. YTD our crypto hedge fund is +78.50%. Awesome!

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $125,277 | Short puts: $109,0001.7 ETH – Break-even: $3,448 | Short puts: $3,3005 SOL – Break-even: $173.87 | short puts: $170We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we…

Episode 100 / $10K Achieved! Terramatris Crypto Fund Celebrates Week 100 with Strong Gains

| 34 seen

Welcome to Episode 100 – A Historic Milestone!

On this special 100th episode dated July 18, 2025, we’re thrilled to announce that the Terramatris Crypto Hedge Fund has reached a major milestone: $10,304 total fund value, breaking the $10K barrier for the first time ever!

This week alone, we posted a strong +14.04% gain, or +$1,268 in dollar terms. Absolutely awesome!

It took us exactly 100 weeks to grow to $10,000, and while the first ten grand was a grind, we’re optimistic the next $10K won’t take nearly as long. In fact, we’re aiming to double the fund’s value…

Episode 99 / Terramatris Crypto Fund Weekly Report: +$963 Growth, ETH Rally, and New Synthetic Covered Calls

| 28 seen

As of July 11, 2025, the Terramatris crypto hedge fund value has grown to $9,036 showing very strong weekly growth of +11.93% or +$963 in dollar terms. Week after week, we continue breaking milestones — and this week, we’ve set a new all-time high. Absolutely awesome! As we’ve just crushed several of our key milestones, another TerraM token buyback and liquidity boost is now in the pipeline.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $129,070 | Short puts: $112,0001.8 ETH – Break-even: $3,448 | Short puts: $2,7005 SOL – Break-even: $165.86 | Long calls: $156…

Episode 98 / TerraM Token Stable at $2.74, Fund Earns $133 in Options as Q3 Begins

| 39 seen

As of July 4, 2025, the Terramatris crypto hedge fund value has grown to $8,073, slightly dipping by 0.66% (-54$ in dollar terms) weekly over week. Never less, last week we returned loan of almost $500, and we believe the result is decent.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $122,644 | Short puts: $104,0001.8 ETH – Break-even: $3,0172 | Short puts: $2,4005 SOL – Break-even: $160.03 | Short puts: $150We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $…

Episode 97 / Nano-Cap, Major Moves: TerraM Token $2.74 while Crypto Fund Hits $8,127

| 57 seen

As of June 27, 2025, the Terramatris crypto hedge fund value has grown to $8,127 showing yet another weekly growth of +1.02% or +$81 in dollar terms. Week after week, we continue breaking milestones — and this week, we’ve set a new all-time high. Absolutely awesome!

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $119,026 | Short puts: $100,0001.9 ETH – Break-even: $3,047 | Short puts: $2,2505 SOL – Break-even: $164.01 | Long calls: $148We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in…

Episode 96 / Crypto Hedge Fund Hits $8K Milestone — Weekly Options Yield 1.25% Return

| 95 seen

As of June 20, 2025, the Terramatris crypto hedge fund value has grown to $8,045 showing yet another weekly growth of +3.8% or +$294 in dollar terms. Also for the first time since inception we have cracked $8,000 officially, and that mean just one - increased liquidity and buyback for our native TerraM token. More on that bellow

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $115,188 | Short puts: $96,0001.9 ETH – Break-even: $3,19 | Short puts: $2,3005 SOL – Break-even: $166.1| Long calls: $158We sell weekly options every Friday, which is why this update is…

Episode 95 / Crypto Fund Earns 1.85% Weekly ROI Through Options Premiums

| 94 seen

As of June 13, 2025, the Terramatris crypto hedge fund value stood at $7,750 showing yet another weekly growth of +2.71% or +$204 in dollar terms.

Just like the previous week, our fund’s value remained well above $8,000 for most of the time. However, a slip occurred once again, and at the time of writing this article, we’ve fallen below that threshold.

Despite the growth, we are still -0.82% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +36.46%

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-…Episode 94 / Crypto Fund Surges 10.76% Weekly / XRP Backed Loan

| 92 seen

As of June 6, 2025, the Terramatris crypto hedge fund value stands at $7,546 showing very strong weekly growth of +10.76% or +$733 in dollar terms.

At one point during the week, the fund briefly exceeded the $8,000 mark, setting a new all-time high. Unfortunately, by week’s end, its value experienced a pullback.

Nevertheless, it was an impressive and encouraging week overall.

The growth primarily stems from securing an XRP-backed loan, which we are using as collateral to generate yield by selling options on ETH. We are still evaluating the impact and structure of…

Episode 93 / Crypto Fund Grows to $6,812 (+2.59%) as Crypto Markets Surge in May 2025

| 117 seen

As of May 30, 2025, the Terramatris crypto hedge fund value stands at $6,812, showing another strong weekly growth of +2.59% or +209 in dollar terms.

That still puts as -12.82% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +19.95%. The past few weeks have been very strong for crypto markets and right now we are not excluding some pullback, consolidation before next move, despite overall optimism, we are concerned about - Sell the May and go Away phenomena, meaning next few months might be challenging. We hope to be…

Episode 92 / Crypto Fund Grows 5.69% Weekly / TerraM token Staking Opportunity Ahead

| 134 seen

As of May 23, 2025, the Terramatris crypto hedge fund value stands at $6,640, showing another strong weekly growth of +5.69% or +$357 in dollar terms.

Despite the strong market recovery, we are still -15.02% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +16.92%. The past few weeks have been very strong for crypto markets and also for our fund.

Anyhow, despite strong growth we are not opening new put positions until our fund is reaching at least $8,000 in value, in optimistic scenario we hope to get there…

Episode 91 / Crypto Fund Climbs to $6,283, Surging +6.02% This Week

| 73 seen

As of May 16, 2025, the Terramatris crypto hedge fund value stands at $6,283, reflecting another weekly increase of +6.02% or +$356 in dollar terms. Nice. The boost comes from strong gains in crypto prices and expired options premiums today.

Though we are still -19.59% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +10.63%.

We’re continuing our strategy to gradually unwind underperforming positions, aiming to buy back a bit each month. The goal is to eventually close or break even on them. In the meantime, we're…

Episode 90 / Crypto Fund Surges 15.92% Weekly

| 45 seen

As of May 9, 2025, the Terramatris crypto hedge fund value stands at $5,926, reflecting a weekly increase of 15.92% or +814.15 in dollar terms. Nice. The boost comes from strong gains in crypto prices and expired options premiums today.

Although we are still -24.16% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +4.35%.

We’re continuing our strategy to gradually unwind underperforming positions, aiming to buy back a bit each month. The goal is to eventually close or break even on them. In the meantime, we'…

Episode 89 / ETH Buybacks & $95 in Weekly Premiums Earned

| 56 seen

As of May 2, 2025, the fund's value stands at $5,122, reflecting a small weekly decrease of 0.5% or -$25. Despite this dip, it was actually a strong week for us — the drop is primarily due to repaying $276 in debt, not poor performance.

We are still -34.58% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is -9.98%.

Portfolio ActivityThis week, we bought back 0.1 ETH from our perpetual futures and converted it into spot holdings. Our spot ETH now totals 1.94, while our ETH perpetual position is down to 2.

We’re…

Episode 88 / Crypto Fund Surges 15.1% Weekly with Options Roll & Market Rally

| 103 seen

As of April 25, 2025, the fund’s value has increased to $5,138 marking another significant +15.1% week-over-week increase, equivalent to a +$673 increase in dollar terms. Despite increase, we still stand -34.25% below our all-time high of $7,811, recorded on March 6, 2025. While our YTD value has dropped to -9.53%

This week’s growth has come from both the broader market bounce and our weekly options trades. In addition, we rolled forward our monthly call options today.

Current positions in long perpetual futures (settled in USDC):

0.02 BTC (break-even: $110,590)|…Episode 87 / Fund Grows +6.62% This Week, Value Reaches $4,464

| 56 seen

As of April 18, 2025, the fund’s value has increased to $4,464, marking a +6.62% week-over-week increase, equivalent to a +$277 increase in dollar terms. Despite increase, we still stand -42.87% below our all-time high of $7,811, recorded on March 6, 2025. While our YTD value has dropped to -21.40%

Current positions in long perpetual futures (settled in USDC):

0.02 BTC (break-even: $105,976) lowered by -$601 | strike $85,000 / $78,000 (short)2.1 ETH (break-even: $2,570) lowered by -$19| strike $1500 (short)5 SOL (break-even: $159.06) increase by +$5.75 | strike $134 (short)…Episode 86 / Crypto Hedge Fund Falls to $4,187.39 After another - 19.52% Weekly Drop

| 110 seen

As of April 11, 2025, the fund’s value has declined to $4,187.39, marking a -19.52% drop week-over-week, equivalent to a -$1,015 decrease in dollar terms. This marks the second consecutive week of losses, further highlighting the ongoing instability in the broader market.

We now stand -44.03% below our all-time high of $7,811, recorded on March 6, 2025, a sobering reminder of the persistent volatility that continues to shape the current macroeconomic landscape. YTD crypto hedge fund has dropped to -26.28%

This week’s downturn was largely driven by escalating geopolitical…

Episode 85 / Crypto Hedge Fund Plummets 34.18% in March 2025

| 206 seen

The Terramatris crypto hedge fund endured a punishing March, with brief recoveries eclipsed by a dramatic late-month collapse. As of March 31, 2025, the fund’s value stood at $5,142, reflecting a steep -34.18% drop month-over-month. Year-to-date, our fund is down -9.45%, underscoring the relentless challenges we’ve faced.

March 2025 has been a grueling period for Terramatris, with our performance trailing major cryptocurrencies.

Bitcoin (BTC) ended the month down -2.98%, a modest decline compared to our -34.18% plunge.Ethereum (ETH), a core holding, fell -17.39%, magnifying our…Episode 84 / Crypto Hedge Fund Grows 3.95% to $6,138

| 65 seen

The Terramatris crypto hedge fund has continued its upward trajectory this week.

As of March 27, 2025, the fund’s value has increased to $6,138, reflecting a 3.95% week-over-week growth (or +$233 in dollar terms). This follows last week’s significant rebound, where the fund grew to $5,904—a 15.31% gain. Despite these gains, we remain -21.46% below our all-time high of $7,811, recorded on March 6, 2025, underscoring the broader market’s persistent volatility.

This week’s recovery comes amid a fragile but stabilizing crypto market. Ethereum, our most impacted position, has…

Episode 83 / Crypto Hedge Fund Sees 15.31% Growth, Reaching $5,904

| 41 seen

The Terramatris crypto hedge fund has rebounded significantly this week, with the fund’s value increasing to $5,904, representing a 15.31% gain compared to the previous week. However, the drawdown from the all-time high still stands at -24.44%, reflecting the broader market’s ongoing volatility.

This recovery follows a highly turbulent period, during which Ethereum dipped below $2,000, triggering forced liquidations and widespread panic selling. As of now, market sentiment remains fragile, but some relief rallies have taken place and Ethereum (our most suffered position, has climbed…

Episode 82 / Crypto Hedge Fund Sees -34.49% Drop – What’s Next?

| 41 seen

As of March 13, 2025, the Terramatris crypto hedge fund’s value has sharply declined to $5,120, representing an enormous drop of -34.47% from last week. This decline follows a massive selloff in the crypto markets, pushing Ethereum below $2,000 and amplifying market-wide panic. Additionally, we repaid a $950 investment that we had received just last week, further impacting our capital reserves.

Market OverviewThe past week has been one of the most turbulent in recent months. Speculation-driven panic selling and macroeconomic instability have fueled a severe downturn in crypto prices…

Episode 81 / Portfolio Jumps to $7.8K After Strategic Restructuring

| 45 seen

As of March 6, 2025, the fund’s value has surged to $7,814.78, reflecting a 66.17% week-over-week growth ( +$3,111.80). This marks a new all-time high, surpassing all previous NAV records. The gain follows a strategic restructuring and capital injection aimed at preparing the fund for increasingly volatile conditions.

This week’s performance was driven not just by market momentum but by a deliberate consolidation into a single unified portfolio, designed to improve capital efficiency and resilience. To support this shift, $4,532 in new funds were added—borrowed capital that will be…

Episode 80 / Crypto Fund Plunges 23% as Ethereum Crashes

| 34 seen

As of February 27, 2025, the fund's value dropped sharply to $4,702.98, marking a $1,432.79 loss compared to the previous week. That’s a steep -23.35% week-over-week decline — the single largest percentage drop since inception.

The primary driver behind this downturn was Ethereum’s severe price crash. ETH experienced a violent sell-off, dragging down overall portfolio performance. While market corrections are not uncommon, the magnitude and speed of this drop caught many by surprise.

The primary factor behind this decline is Ethereum's (ETH) substantial price drop. On February…

Episode 79 / Crypto Fund Slips Under $6,200

| 27 seen

As of February 20, 2025, the Terramatris Crypto Fund's value stands at $6,135.77, reflecting a slight decrease of $56.40 from the previous week, marking a 0.91% decline.

During this period, Ethereum (ETH) exhibited modest gains. On February 20, 2025, ETH's price closed at $2,738.98, up from $2,715.47 the previous day. This uptick contributed to stabilizing the fund's overall performance amid a fluctuating market.

The broader cryptocurrency market experienced slight growth, with the total market capitalization increasing by 0.99% to reach $3.21 trillion. Bitcoin (BTC) traded…

Episode 78 / Crypto Fund Surges 6.28% to $6,192

| 22 seen

As of February 13, 2025, the Terramatris Crypto Fund rose to a portfolio value of $6,192.17, marking a $365.82 increase from the previous week. This represents a 6.28% week-over-week growth — a solid continuation of the fund’s upward momentum.

The crypto market during mid-February 2025 showed increased resilience, with Ethereum and Bitcoin consolidating recent gains. ETH hovered around the $2,550–$2,650 range, supported by improving macro sentiment and cooling regulatory fears. Implied volatility trended slightly higher, offering better premiums for option sellers — ideal for our…

Episode 77: Sliding Back — Fund Drops 4.28% Amid Crypto Market Stagnation

| 20 seen

As of February 6, 2025, the fund’s value has declined to $5,826.35, marking a -4.28% drop week-over-week, equivalent to a -$260.48 decrease in dollar terms. After a period of relative stability, this decline signals a potential shift in sentiment, as uncertainty once again clouds the crypto landscape.

Ethereum (ETH) mirrored the broader market softness, hovering around the $2,300 mark but failing to break out of its consolidation range. Despite strong on-chain fundamentals and steady Layer 2 adoption, ETH faced headwinds from weakening trading volume and cautious sentiment in the…

Episode 76 / 🚀 How TerraM Token Hit $2.3 & Our Crypto Fund Grew to $6,086!

| 12 seen

As of January 30, 2025, the TerraMatris Crypto Hedge Fund reported a total value of $6,086.83, marking a weekly increase of $122.00, or +2.05%. This steady upward movement reflects the fund’s disciplined allocation strategy and responsiveness to broader market conditions.

TerraM Token UpdateThe fund's native token, TerraM, grew to $2.3, signaling consistent confidence in the TerraMatris ecosystem. As a core component of internal fund operations and governance, TerraM plays an increasingly strategic role as the fund scales.

With a strong start to Q1 2025, TerraMatris remains on…

Episode 72 / Crypto Hedge Fund Rises 1.98% in First Week of 2025

| 16 seen

On January 2, 2025, the total value of the Terramatris crypto fund reached $5,783.31. This marked a weekly increase of $112.24, representing a gain of 1.98% compared to the previous week's value.

On the same day, Bitcoin (BTC) closed at $96,891.27, registering a daily gain of approximately 2.6%. Ethereum (ETH) closed at $3,452.35, holding steady and contributing to overall market stability.

The fund’s growth closely mirrored the upward momentum seen in the broader crypto market, particularly driven by BTC’s rally and ETH’s solid performance. These price movements suggest that…

Episode 71 / Surprising Pengu Airdrop Amid Fund Value Drop to $5,671

| 6 seen

Greetings from sunny Palolem Beach in Goa, India! This week marks the 71st update for the TerraM Crypto Hedge Fund, a journey that started in August 2023. Although the fund faced a 5% decline in value, dropping to $5,671, the fundamentals remain intact, and we are committed to our long-term investment strategies. Let’s dive into the highlights of the week.

This week’s fund value dropped by $327.33, a notable dip due to broader market corrections following a significant crypto rally throughout November and early December. Such fluctuations are expected and viewed as part of a healthy…

Episode 70 / TerraM Crypto Hedge Fund Weekly Recap: XRP Joins the Portfolio, Fund Drops 1.8%

| 11 seen

Good afternoon, ladies and gentlemen. My name is Reinis Fischer, CEO and founder of TerraMatris Crypto Hedge Fund. Today is December 19, 2024. As the year approaches its end, I bring you this week’s recap from a more exotic location – the beautiful southern part of Goa, India.

What is TerraMatris?TerraMatris is a quantitative DeFi crypto hedge fund focusing on advanced option trading strategies, particularly in put options. Our mission is to maximize growth while minimizing risk in the cryptocurrency market. Investors can participate through our native TerraM token, available on the…

Episode 69 / TerraM Crypto Hedge Fund Hits $6,108 🚀 | 6.65% Weekly Growth + New OTC Investor

| 4 seen

My name is Reinis Fischer, I'm CEO and Founder of Terramatris, and today is December 12, 2024. I’m coming to you from my favorite spot in Tbilisi—though I had to switch positions because someone else snagged my usual spot! Never mind that; let’s dive right in.

For those unfamiliar with TerraMatris, let me give you a quick introduction. Terramatris is a crypto hedge fund that specializes in advanced options trading strategies. If you’re into crypto or looking for innovative ways to grow your portfolio, keep reading.

TerraM is a high-performance crypto hedge fund focused on:

…Episode 68 / TerraM Crypto Hedge Fund reaches $5,727 (+5.83% week over week) | Bitcoin Cracks $100K 🚀

| 3 seen

It’s great to see you again as we explore the latest and greatest from TerraMatris, your trusted partner in the world of decentralized finance (DeFi) and advanced trading strategies. Whether you’re a seasoned investor or a curious newcomer, you’ve landed in the right place.

What Is TerraMatris All About?If you’re new here (or just need a quick refresher), TerraMatris is a cutting-edge quantitative crypto hedge fund with a focus on advanced options trading strategies. We’re all about:

Selling Put Options: Maximizing growth while minimizing risk in volatile markets.…Episode 67 / Crypto Hedge Fund at 🚀 $5,435 All-Time High! | TerraM Token Hits $1.96

| 6 seen

As we gather this Thanksgiving to reflect and celebrate, it’s a pleasure to connect with you all for the weekly recap of TerraMatris Crypto Hedge Fund. Whether you're a seasoned investor or just exploring the crypto space, this update offers valuable insights into our operations, strategies, and performance. Let’s dive in!

TerraMatris is a quantitative decentralized finance (DeFi) crypto hedge fund specializing in advanced options trading strategies. Our primary focus is on selling high-probability put options, maximizing growth while minimizing risk. Our trading activities are…

Episode 66 / New TerraM Investor + $5,185 Milestone | ETH, SOL, TON, BNB Investments

| 7 seen

Today, I’m sharing insights into our latest trading strategies, fund performance, and market trends, highlighting why crypto options trading remains a powerful tool for minimizing risk and maximizing returns.

For those unfamiliar, Terramatris Crypto Hedge Fund is a quantitative DeFi hedge fund specializing in advanced options trading strategies. Our primary focus is selling put options and writing covered calls, balancing risk management with growth opportunities.

The fund operates fully within the decentralized finance (DeFi) space, with its native token, the TerraM Token,…

Episode 65 / Weekly Success for TerraM Crypto Hedge Fund: $4,688 Achieved with 8.88% Increase

| 7 seen

Ladies and gentlemen, welcome to this week’s update on the Terramatris Crypto Fund. My name is Reinis Fischer, I'm founder and CEO this DeFi-focused crypto hedge fund. Today, I’ll walk you through some of our recent strategies, trades, and market insights.

For those unfamiliar, Terramatis is a DeFi crypto hedge fund focusing on advanced options trading strategies. We primarily engage in selling “put options” to maximize gains while minimizing risk in the cryptocurrency market. Our native TerraM token is available on Web3 platforms like OKX and Phantom, providing investors with…

Episode 64 / Crypto Fund Reaches New All-Time High of $4,338 | TerraM Token Now on OKX

| 3 seen

Good morning, ladies and gentlemen! Today is November 7th, 2024. My name is Reinis Fischer, CEO and founder of TerraMatris Crypto Hedge Fund, and I’m excited to bring you incredible news about TerraM Fund.

For those new to TerraMatris, we’re a quantitative DeFi crypto hedge fund that specializes in advanced options trading strategies, primarily selling put options. This approach aims to maximize growth and reduce risk exposure in the volatile cryptocurrency markets. TerraM Fund investors can buy TerraM tokens, available on platforms like Raydium’s decentralized liquidity pool powered…

Episode 63 / Record-Breaking Growth! TerraM Fund Reaches $4,079 with Potential Partnerships Ahead

| 8 seen

Welcome to TerraMatris's weekly update! My name is Reinis Fischer, CEO of TerraMatris Crypto Hedge Fund, and today is October 31st, 2024. I'm here in Tbilisi, Georgia, my favorite spot for recording these weekly recaps. Let's dive right in and catch up on this week’s achievements and insights into our fund’s performance.

About TerraMatrisFor those who are new, let me introduce TerraMatris. We are a quantitative, DeFi-driven crypto hedge fund with a core focus on advanced options trading strategies, specializing in selling put options on key cryptocurrencies. Our goal is to maximize…

Episode 62 / TerraM Fund Hits New All-Time High: $3,991 | +3.34% Weekly Growth | ETH, SOL & TON Investments

| 4 seen

Hello everyone! I’m Reinis Fischer, CEO and founder of TerraMatris Crypto Hedge Fund. Today, I want to share our progress as of October 24, 2024, and dive into our trading strategies and risk management techniques. It’s been an exciting journey, and there’s a lot to cover, so let's get started.

About TerraMatrisFor those of you who may be new, TerraMatris is a quantitative DeFi hedge fund, focused on advanced options trading strategies, particularly put options, to maximize growth and minimize risk in the crypto market. Our fund operates primarily out of Georgia, utilizing the Solana…

Episode 61 / All-Time High at $3,862 | Prague Market Makers Meetup & Safe ETH Trading Strategy

| 5 seen

Hello, my name is Reinis Fischer, CEO and founder of TerraMatris Crypto Hedge Fund. Welcome to our weekly recap for October 17, 2024. This week, I'm coming to you from the beautiful city of Prague, recording from the lobby of Belvedere Hotel Prague. Let's dive into this week's highlights.

For those unfamiliar with TerraMatris, we are a quantitative DeFi crypto hedge fund specializing in advanced options trading strategies. Our focus is primarily on selling put options while aiming to maximize growth and minimize risk in the cryptocurrency market.

Investments in our fund are…

Episode 60 / Crypto Review: ETH, SOL & TON Investments | ETH Trading Below 50/200 Day Moving Average

| 9 seen

Morning, ladies and gentlemen! My name is Reinis Fischer, and today is October 10th, 2024. I'm in my favorite spot, the Axis Tower in Tbilisi, and it's time for our weekly review of happenings in the crypto world. Let me start by giving you an overview of what TerraMatris is and what we’re doing here.

TerraMatris is a quantitative DeFi hedge fund that focuses on advanced options trading strategies, particularly put options, to maximize growth while minimizing risk in the cryptocurrency market. It’s available for investment through Raydium, using the TerraM token, which is powered by…

Ep 59: Crypto Fund Declines - 1.21% to $3,661.52

| 1 seen

On October 3, 2024, the total value of the Terramatris fund stood at $3,661.52.

This represented a weekly decrease of $44.72, translating to a -1.21% return week over week.

Fund Value: $3,661.52Weekly Change: -$44.72Weekly Return: -1.21%Options Income Generated: ~$97.54During the week, approximately $97.54 was generated through options income. However, adverse market movement and portfolio revaluation more than offset the premium collected, resulting in a net decline.

The divergence between strong income generation and negative net performance highlights the impact of…

Episode 58 / Crypto Hedge Fund Hits All-Time High (+4.93%) | Aggressive ETH Put Selling + TON Hackathon in Tbilisi

| 6 seen

Greetings from TerraMatris! I'm Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund, bringing you the latest updates. Today, I'm thrilled to announce that our fund has reached another all-time high on September 26, 2024, after weeks of strategic trading, growing by 4.53% this week. We've taken a more aggressive approach, particularly with ETH put selling, while continuing to invest in Ethereum (ETH), Solana (SOL), and Toncoin (TON). I’ll also discuss the upcoming TON Hackathon in Tbilisi this October, an event I'm excited to attend and explore more about the TON ecosystem.

…Episode 57 / -2.46% Loss Due to Accounting Error, Reinvesting in BTC, JUP & XLM

| 12 seen

On September 19, 2024, we recorded this week's update from my favorite spot in Tbilisi, the Axis Tower. It has been quite a busy morning here, with many tourists around, but let’s dive into the latest happenings at Terramatris.

Terramatris is a private crypto hedge fund that I manage. The fund is available for investment through our Raydium Liquidity Pool. As a private, closed-end fund, we prioritize a robust trading strategy and meticulous risk management to grow our portfolio.

Trading StrategyOur trading strategy is centered around simplicity and consistency. We primarily…

Episode 56 / Crypto Hedge Fund: 1.2% Growth This Week + New Yield from Riga Rental Income

| 13 seen

Good Morning Ladies and Gentlemen, my name is Reinis Fischer, and I’m the CEO and Founder of TerraMatris Crypto Hedge Fund. Today is September 12, 2024, and as usual, I’m recording this weekly recap from the Axis Tower in the Vake neighborhood of Tbilisi, Georgia, with my trusty friend—the skeleton of a dino—in the background.

This past week has been eventful. I’ve traveled extensively across Georgia, enjoying outdoor activities, including swimming in scenic pools. I also flew to Riga for some property investment management work, which I’ll talk about later in this video.

But…

Episode 55 / Crypto Fund Faces -2% Dip Amid Market Selloff | Investing in BTC, PAXG & TokenFI

| 9 seen

Hello, everyone! My name is Reinis Fischer, and I’m the CEO and founder of TerraMatris Crypto Hedge Fund. Today is September 5, 2024, and I’m here to provide a weekly recap of what’s been happening in our fund.

Before diving into the details, let me give you a quick overview of what TerraMatris is all about and how we operate. TerraMatris is a private crypto hedge fund that I manage personally. It’s not publicly registered, but it is available for over-the-counter investments or through the Raydium DEX liquidity pool.

Investing in stocks, bonds, funds, or cryptocurrencies is…

Episode 54 / Crypto Hedge Fund reaches $3,654.39 (+0.56% wow growth)

| 10 seen

Good morning, ladies and gentlemen. My name is Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund. Today is August 29, 2024, and I’m excited to share the latest developments within TerraMatris Crypto Hedge Fund, as well as significant happenings in the broader cryptocurrency landscape. Let’s dive in.

For those new to our community, TerraMatris is a private crypto investment hedge fund managed by me, Reinis Fischer. TerraMatris is privately held and not publicly registered, making it exclusively available for investment through our decentralized liquidity pool on Raydium…

Episode 53 / Fund +6.62% as Ethereum Hits $2,630 and Bitcoin Holds $61,168

| 7 seen

As of August 22, 2024, the Terramatris crypto hedge fund value stood at $3,633.98, marking a weekly growth of $225.68, or +6.62%. This was a strong week for the fund, driven by disciplined options strategies and supportive market conditions.

On this date, Ethereum was trading around $2,630. ETH had shown renewed strength compared to earlier months, consolidating above the $2,500 support zone while still facing resistance near $2,700.

This price level created an attractive environment for our short-put strategies, where premiums were elevated enough to justify selective exposure…

Ep 52: $64.55 Options Premium Drives 6.65% Gain

| 1 seen

On August 15, 2024, the total value of the Terramatris fund reached $3,408.30.

This represented a weekly increase of $212.66, translating to a +6.65% gain week over week.

Fund Value: $3,408.30Weekly Growth: +$212.66Weekly Return: +6.65%Options Premium Collected: ~$64.55Approximately $64.55 of the weekly increase was generated through options premium income. The remaining growth resulted from favorable market movement and portfolio positioning.

At this capital level, a 6–7% weekly return required meaningful nominal performance. As assets under management moved beyond the $…

Episode 51 / Bitcoin Drops to $51K: How Terramatris Navigated a Challenging Week

| 11 seen

Good Morning, Ladies and Gentlemen!

My name is Reinis Fischer, CEO and Founder of Terramatris, a private crypto hedge fund. Today is August 8th, 2024, and I'm here to share an update on the happenings in our crypto portfolio over the past week. But before we dive into the details, let me briefly introduce you to Terramatris and what we do.

Terramatris is a private crypto investment hedge fund, managed by me, Reinis Fischer. The fund is privately held and not publicly registered, but it’s available for investment via a decentralized Radium liquidity pool through our TerraM token…

Episode 50 / Crypto Hedge Fund reaches $3,411.24 (+0.65% wow growth), TerraM token grows to $1.55

| 6 seen

Good morning, ladies and gentlemen. My name is Reinis Fischer, CEO of TerraMatris, a crypto hedge fund. Today, on August 1st, 2024, I’m excited to share the latest developments within TerraMatris, our TerraM token, and the strategic approaches we're adopting to drive growth.

As always, I want to remind everyone that investing in stocks, funds, bonds, or cryptocurrencies carries inherent risks. You could lose some or all of your money. Please do your due diligence before making any investment decisions.

Investment StrategyAt TerraMatris, our strategy revolves around trading…

Episode 49 / Crypto Hedge Fund Hits $3,389 – 8% Weekly Growth

| 8 seen

Hello, my name is Reinis Fischer, CEO and Founder of the Terramatris Crypto Hedge Fund. Today is July 25th, 2024, and I’m excited to share the latest developments from our hedge fund.

Terramatris is a private crypto investment hedge fund managed by me. It is privately held and not publicly registered, making it available for investment over decentralized automated market makers.

Investments in stocks, funds, bonds, or cryptocurrencies carry risk. You could lose some or all of your money. Always perform your own due diligence before investing in any asset, including…

Episode 48 / How to Maximize Crypto Profits with TerraMatris Hedge Fund: $3,124 Milestone

| 14 seen

Hello and welcome! My name is Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund. Today, you are watching our weekly update on the latest happenings in our hedge fund. Let’s get started.

First, I want to apologize to our regular viewers for missing a few weeks of updates. I was busy with some of our real estate projects and wasn’t physically present in Georgia. However, I remained active in the markets during this time, even though I couldn't record videos. I'll do my best to ensure this doesn’t happen again and commit to weekly updates.

Investments in stocks,…

Ep 47: Crypto Fund Posts 1.79% Weekly Return as TerraM Holds at $1.13

| 5 seen

On July 11, 2024, the total value of the Terramatris fund reached $2,896.27.

This represented a weekly increase of $51.00, translating to a +1.79% gain week over week.

Fund Value: $2,896.27Weekly Growth: +$51.00Weekly Return: +1.79%Options Income Generated: ~$48.44Approximately $48.44 of the weekly increase was generated through options income, accounting for the majority of total growth. The remaining gain was driven by modest favorable market movement.

After two near-flat weeks, this period showed a return to positive but controlled expansion. At this capital level, sub…

Ep 46: Crypto Fund Rises 0.22% to $2,845.27

| 5 seen

On July 4, 2024, the total value of the Terramatris fund reached $2,845.27.

This represented a weekly increase of $6.36, translating to a +0.22% gain week over week.

Fund Value: $2,845.27Weekly Growth: +$6.36Weekly Return: +0.22%Options Income Generated: ~$56.66During the week, approximately $56.66 was generated through options income. However, the net portfolio increase was only $6.36, indicating that market movement and portfolio revaluation offset most of the premium collected.

This marks a second consecutive low-volatility week in percentage terms. While income…

Ep 45: Crypto Fund Edges Up 0.28% to $2,838.91

| 7 seen

On June 27, 2024, the total value of the Terramatris fund reached $2,838.91.

This represented a weekly increase of $7.87, translating to a +0.28% gain week over week.

Fund Value: $2,838.91Weekly Growth: +$7.87Weekly Return: +0.28%Options Income Generated: ~$63.45During the week, approximately $63.45 was generated through options income. However, the net portfolio increase was only $7.87, indicating that broader market movement and position adjustments offset the majority of premium gains.

A near-flat week at this capital level reflects consolidation rather than…

Episode 44 / Crypto Fund Rises Sharply to $2,831.04

| 25 seen

Good morning, ladies and gentlemen. My name is Reinis Fischer, CEO and founder of Terramatris Crypto Hedge Fund. Today is June 20, 2024, and I’m recording our weekly recap of happenings in Terramatris Crypto Hedge Fund f

Let me give you a brief overview of Terramatris. We are a private crypto investment hedge fund managed by me, Reinis Fischer. Our fund is privately held and not publicly registered, though it is available for investment via the Raydium decentralized liquidity pool.

Disclaimer: Investments in stocks, funds, bonds, or cryptocurrencies are risky, and you…

Ep 43: Crypto Fund Declines 4.13% to $2,635.77

| 7 seen

On June 13, 2024, the total value of the Terramatris fund stood at $2,635.77.

This represented a weekly decrease of $113.45, translating to a -4.13% return week over week.

Fund Value: $2,635.77Weekly Change: -$113.45Weekly Return: -4.13%Options Income Generated: ~$56.43Despite generating approximately $56.43 in options income, the fund recorded a net decline for the week. This implies that adverse market movement and portfolio exposure outweighed structured premium gains.

At this capital scale, downside weeks reflect mark-to-market volatility rather than structural…

Episode 42 / Crypto Hedge Fund Surges 6.62% in a Week

| 16 seen

As of June 6, 2024, the Terramatris crypto hedge fund reached a value of $2,749.22, marking a robust weekly increase of +6.62% or +$170.68 in dollar terms. This performance underscores the fund's resilience amid a dynamic cryptocurrency market landscape.

On this date, the cryptocurrency market exhibited mixed movements:

Bitcoin (BTC): Closed at $70,776.75, experiencing a slight daily decline of 0.5%. Ethereum (ETH): Settled at $3,842.00, reflecting a modest decrease of 0.69% for the day. Market Sentiment and Influencing FactorsSeveral factors influenced the cryptocurrency…

Episode 41 / Crypto Hedge Fund Hits $2,578: Bitcoin, Ethereum, Solana Lead Gains

| 27 seen

As of May 30, 2024, the TerraMatris Crypto Hedge Fund's value has risen to $2,578.54, marking a $45.93 increase from the previous week—a 1.81% gain week-over-week.

The crypto market experienced moderate growth during the week, with key assets showing the following performance:

Bitcoin (BTC): Closed at $68,378.32Ethereum (ETH): Traded at $3,784.98Solana (SOL): Closed at $168.11These movements indicate a stable yet positive trend in the market, contributing to the fund's performance.

The recent gains can be attributed to several factors:

Bitcoin Halving…Ep 40: Crypto Fund Surges 9.93% to $2,532.61

| 8 seen

On May 23, 2024, the total value of the Terramatris fund reached $2,532.61.

This represented a weekly increase of $228.81, translating to a +9.93% gain week over week.

Performance OverviewFund Value: $2,532.61Weekly Growth: +$228.81Weekly Return: +9.93%Options Income Generated: ~$82.34Approximately $82.34 of the weekly increase was attributable to options income. The remaining performance resulted from favorable market movement and portfolio positioning.

A near-10% weekly expansion at this capital level reflects both effective premium capture and constructive market…

Ep 39: Crypto Fund Posts 5.49% Weekly Return as TerraM Rises to $1.13

| 8 seen

On May 16, 2024, the total value of the Terramatris fund reached $2,303.80.

This represented a weekly increase of $119.89, translating to a +5.49% gain week over week.

Performance OverviewFund Value: $2,303.80Weekly Growth: +$119.89Weekly Return: +5.49%Options Premium Collected: ~$61.34Approximately $61.34 of the weekly increase was generated through options premium income, accounting for roughly half of the total gain. The remainder was driven by favorable market conditions and portfolio positioning.

As the fund continued operating above the $2,000 level, percentage…

Ep 38: Crypto fund Posts 7.63% Weekly Return as TerraM Rises to $1.12

| 7 seen

On May 9, 2024, the total value of the Terramatris fund reached $2,183.91.

This represented a weekly increase of $154.73, translating to a +7.63% gain week over week.

Performance OverviewFund Value: $2,183.91Weekly Growth: +$154.73Weekly Return: +7.63%Options Premium Collected: ~$53.76Of the total weekly increase, approximately $53.76 was generated through options premium income. The remaining performance was driven by favorable market movement and portfolio positioning.

At this capital level, mid-single-digit weekly percentage growth required meaningful nominal gains.…

Episode 37 / Bitcoin drops under $57,000, acquiring RWA tokens

| 7 seen

Good morning, ladies and gentlemen. My name is Reinis Fischer, I'm CEO and founder of Terramatris Crypto Hedge Fund. Today is May 2nd, 2024, and it's time for our weekly wrap-up about happenings in the fund, crypto markets, and life in general. So let's begin.

Before we dive into the details about the interesting happenings in the crypto market, let me give you a brief overview of what Terramatris Crypto Hedge Fund is.

Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. It is privately held and not publicly registered, though it's…

Episode 36 / Portfolio Climbs 9.37% Following Bitcoin Halving

| 27 seen

The TerraMatris crypto hedge fund closed the week ending April 25, 2024, on a strong note, posting a portfolio value of $2,050.41. This marks a $175.68 gain or an impressive 9.37% increase compared to the previous week.

This week’s positive performance is a testament to TerraMatris’s strategy of steady, systematic trading—focusing on selling options (puts and covered calls) on major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), while reinvesting premiums into spot holdings to compound returns over time.

The broader crypto market was energized by a major…

Episode 35 / Ethereum Drops Below $1,900: Weekly Crypto Fund Down Nearly 10%

| 27 seen

As of April 18, 2024, the fund’s value has declined to $1,874.73, marking a -9.87% drop week-over-week, equivalent to a -$205.23 decrease in dollar terms. This marks one of the steepest weekly losses in recent memory and underscores the heightened volatility across the cryptocurrency market.

Ethereum (ETH), which often acts as a bellwether for broader altcoin sentiment, was particularly hard-hit this week. The price tumbled below the critical $1,900 level, landing at approximately $1,875. This represents a dramatic correction and brings ETH back to levels not seen in months.

…

Episode 34 / Fund's Value Reaches $2,079.96 (+4.22% week over week growth)

| 45 seen

Ladies and gentlemen, welcome to another weekly review of the happenings at Teramatris Crypto Hedge Fund. I'm Reinis Fischer, the founder and CEO of Teramatris, and today, on April 11, 2024, we're delving into the insights of our portfolio's performance for this week. So, let's dive in!

Teramatris is a private crypto investment hedge fund managed by yours truly, Reinis Fischer. This week operating from the picturesque Kārļa Muiža in Latvia, Teramatris offers investment opportunities through decentralized liquidity pool. Before we proceed, a quick disclaimer: investments in stocks,…

Episode 33 / Crypto Hedge Fund's Value Reaches $1,995.67 (+10.36% week over week growth, amidst Bitcoin pullback)

| 9 seen

Welcome back to another weekly update from Teramatris Crypto Hedge Fund! I'm Reinis Fischer, the CEO and founder, coming to you from our base in Capšu Zeme, Latvia. Today, amidst installing hardwood floors, I'm excited to share our latest insights, strategies, and results with you.

Our strategy revolves around one-day expiry put options, occasional call options, and futures trading. We focus on high-probability trades, constantly adjusting and reinvesting premiums into our chosen cryptocurrencies, including Bitcoin, Ethereum, Stellar Lumens, USDC stablecoin, Solana, and Jupiter.

…Ep 32: Crypto Fund Reaches $1,808.36 – +4.98% Weekly Growth

| 6 seen

On March 28, 2024, the total value of the Terramatris fund reached $1,808.36.

This represented a weekly increase of $85.82, translating to a +4.98% gain week over week.

Fund Value: $1,808.36Weekly Growth: +$85.82Weekly Return: +4.98%Options Premium Collected: ~$65.43A significant portion of the weekly increase — approximately $65.43 — was generated through options premium income. This indicates that performance was primarily driven by structured income rather than aggressive directional exposure.

As the fund continued to scale toward the $2,000 level, percentage growth…

Ep 31: Crypto Fund Posts 5.09% Weekly Return as TerraM Holds at $0.82

| 6 seen

On March 21, 2024, the total value of the Terramatris fund reached $1,722.54.

This represented a weekly increase of $83.47, translating to a +5.09% gain week over week.

Fund Value: $1,722.54Weekly Growth: +$83.47Weekly Return: +5.09%Options Premium Collected: ~$73.47The majority of the weekly increase — approximately $73.47 — was generated through options premium income. This indicates that performance during this period was largely income-driven, with limited reliance on strong directional market moves.

As the fund continued scaling, percentage gains moderated compared…

Ep 30: Crypto Fund Grows +16.50% With $82 in Options Premium

| 8 seen

On March 14, 2024, the total value of the Terramatris fund reached $1,639.07.

This represented a weekly increase of $232.12, translating to a +16.50% gain week over week.

Fund Value: $1,639.07Weekly Growth: +$232.12Weekly Return: +16.50%Options Premium Collected: ~$82The fund continued its strong upward momentum in mid-March. Approximately $82 of the weekly increase came from options premium income, with the remaining gain driven by favorable market movement and portfolio positioning.

At this capital level, generating a 16.5% weekly return required substantial nominal…