Greetings from Thessaloniki, Greece

This week, the Terramatris team has traveled to beautiful Thessaloniki to celebrate a special occasion—our CEO’s 40th birthday!

With fresh sea breezes, delicious local cuisine, and surprisingly excellent bulk wine, this coastal city has proven to be a true hidden gem in the heart of Europe. Thessaloniki offers a perfect balance between modern energy and historic charm, and it’s been the ideal backdrop for both celebration and exploration.

As we've immersed ourselves in the culture, we've also taken note of the local financial landscape. Interestingly, we’ve come across several brokerage names during our time here, suggesting that crypto investing and digital asset funds are gaining traction in Greece.

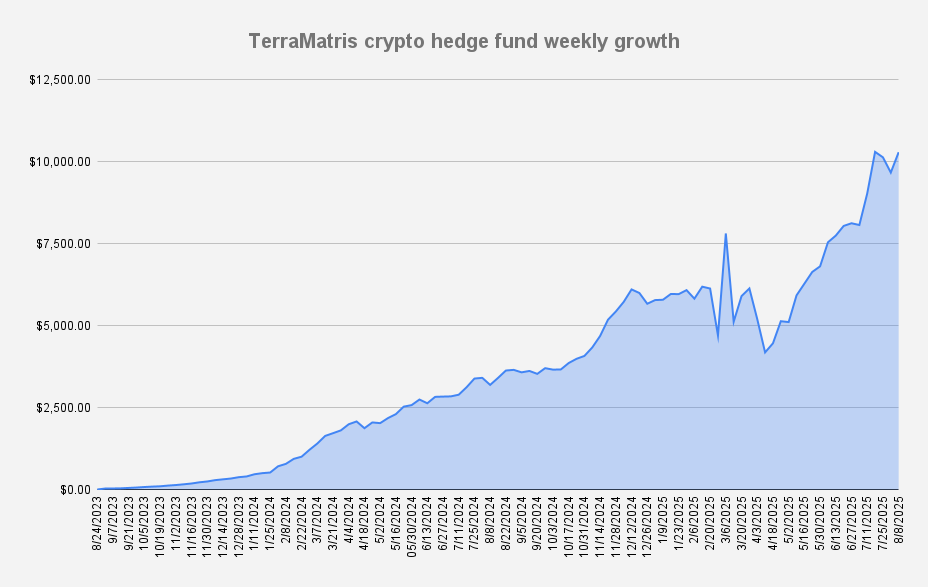

That said: As of August 8, 2025, the Terramatris crypto hedge fund has once again crossed the $10K threshold, reaching a portfolio value of $10,294. This marks a weekly increase of +6.42%, or +$620 in absolute dollar terms.

We are now just a few dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

YTD our crypto hedge fund is +81.24%.

Current Long Perpetual Futures (USDT Settled)

- 1.7 ETH – Break-even: $4,178 | Short puts: $3,550

- 13 SOL – Break-even: $189.56 | short puts: $168

This week, we made several adjustments to our recovery trades, originally initiated during the March/April market crash.

Most notably, we’ve now fully recovered our capital from the 5 SOL trades that had been tied up since that downturn. With this capital freed up, we agreed to make a minor portfolio adjustment: reallocating 0.02 BTC into 13 SOL.

The goal for this new position is to gradually recover value over the next few months, primarily by collecting premiums through options strategies. This move reflects our ongoing commitment to agile portfolio management and disciplined capital recovery.

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $142 from options premiums, translating to a 1.37% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

Looking ahead, we don’t anticipate generating more than $200 per week in premiums through the end of August, barring any major volatility spikes or strategy changes.

TerraM Token Update

This week, we successfully completed a Terram Token airdrop, granting all token holders a 1% increase in their holdings. This distribution reflects our continued commitment to rewarding long-term participation and supporting the growth of the Terram ecosystem.

- Solana blockchain

- Fully Diluted Market cap: $31,400

- Total supply: 10,000

- In circulation: 1,657 (16.57%)

- On Liquidity pool: 394 (3.94%)

- Price per token: $3.14 | Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

Thank you for being part of this journey!

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions