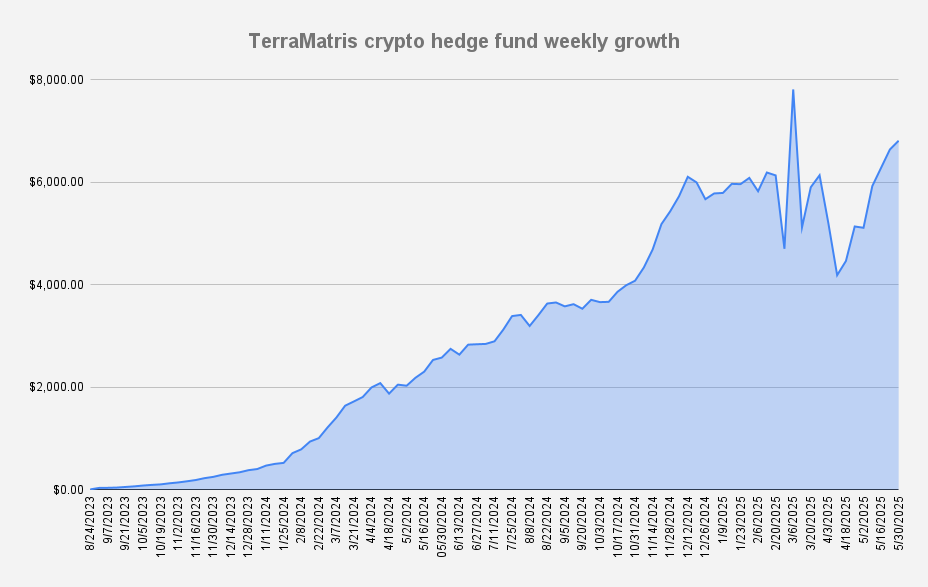

As of May 30, 2025, the Terramatris crypto hedge fund value stands at $6,812, showing another strong weekly growth of +2.59% or +209 in dollar terms.

That still puts as -12.82% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +19.95%. The past few weeks have been very strong for crypto markets and right now we are not excluding some pullback, consolidation before next move, despite overall optimism, we are concerned about - Sell the May and go Away phenomena, meaning next few months might be challenging. We hope to be wrong though!

This week, we capitalized on elevated crypto market conditions and sold our entire BNB position at a modest profit. While we continue to hold a few altcoins, our strategic focus for the remainder of 2025 will shift exclusively to Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Our plan is to gradually exit altcoin positions, but only when doing so results in a profit. This measured approach aligns with our broader goal of consolidating into high-conviction assets with stronger long-term potential and market resilience.

Monthly Covered Calls

Over the past 93 weeks, we’ve built a small but respectable long-term portfolio. To generate consistent income, we’ve been employing a disciplined strategy of selling monthly covered calls on our long positions.

With today marking the final day of the current options expiry cycle, we executed the following covered call sales:

- 1.7 ETH - 2400 / rolled up from 2300

- 6 SOL - 190 / rolled up from 180

This approach continues to provide steady cash flow while allowing us to manage risk and optimize returns in a dynamic market environment.

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $117,895 | Short strike: $98,000

- 1.9 ETH – Break-even: $3,286 | Short strike: $2,375

- 5 SOL – Break-even: $172.65 | Short strike: $155

We sell weekly options every Friday, which is why this update is published at the end of the week.

Additionally, we continued experimenting with our synthetic covered call strategy. At the start of the week, we also borrowed 0.01 BTC to initiate another covered call trade. So far, the results have been promising.

In total we earned $132.03 in premiums this week — combination from both long spot and recovery trades

TerraM Token Update

The TerraM token remains stable at $2.60, with little price movement in recent weeks. We're focused on improving liquidity, but no major buybacks or liquidity increases are planned until the fund reaches at least $8,000 in value.

Last week, we announced a potential staking initiative aimed at boosting the TerraM token. After further consideration, we have decided not to proceed with staking at this time, as the current fund size remains relatively small.

Instead, we are introducing a new incentive: once our total fund value reaches $10,000, we will distribute an additional 1% in TerraM tokens to all existing TerraM token holders.

For example, if you currently hold 200 TerraM tokens, you will automatically receive 2 additional TerraM tokens in your wallet when the fund hits the $10K milestone — a kind of airdrop.

After reaching this goal, we will likely revisit the staking opportunity and evaluate it further.

Past / Present / Future

Compared to a year ago, our fund has grown by more than 163%, translating to an increase of $4,222. If we can sustain this 163% growth rate over the next 12 months, we could reach a fund value of approximately $17,800. We like that number—and we're focused on getting there.

Thank you for your continued support and understanding.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.