As of October 31, 2025, the TerraM Multi-Asset Crypto Options Fund achieved another week-over-week gain of +2.42%.

Meanwhile, the Solana Covered Call Growth Fund maintained its consistent performance, generating steady options income that was fully reinvested into SOL to strengthen the fund’s core long position. The NAV per unit closed at $0.88, reflecting a modest -1.52% weekly decline.

Activity around the TERRAM token increased notably this week, with the price stabilizing at $3.13 by week’s end. Trading bots have begun interacting with the token — a positive sign, as these algorithms are deploying real USDC. This suggests that TERRAM has reached sufficient liquidity and trading volume to attract automated market participants, signaling growing interest that may continue to expand in the coming weeks.

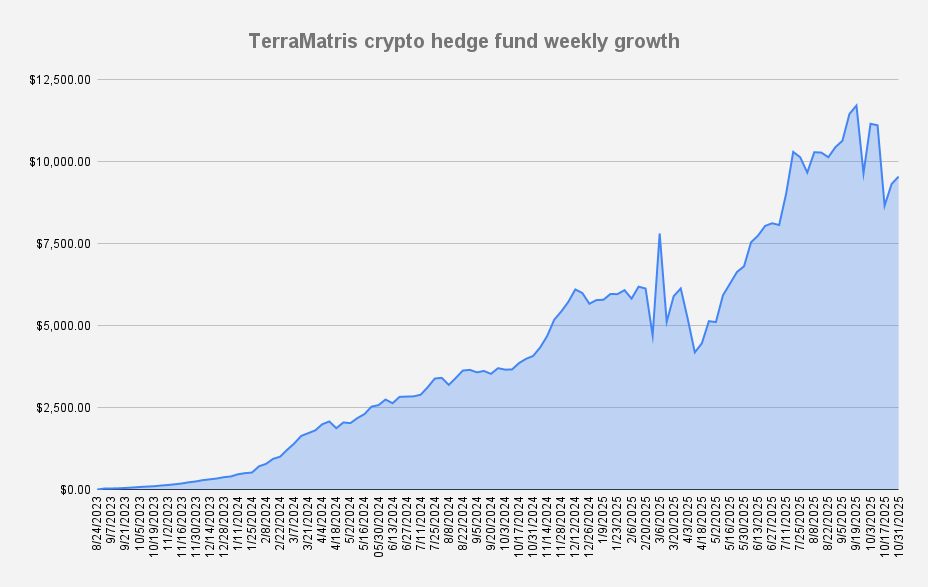

TerraM Multi-Asset Crypto Options Fund

This week was another roller-coaster ride for our Multi-Asset Crypto Fund — from an almost full recovery to another dip, followed by a partial rebound. While a full recovery is still ahead, we’re steadily strengthening our positions by reducing leverage and reinvesting option premiums into spot holdings rather than opening new leveraged trades.

Our primary focus remains on BTC, ETH, and SOL, with smaller allocations in altcoins. This week, we added modest positions in XRP, MNT, and DOGE.

From the previous all-time high, we’re still down –18.5%, while year-to-date performance remains at a healthy +68.15%.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Multi Asset Fund earned $363 in options premiums, translating to a 3.83% weekly return on capital. As our target is anything above 1%, we’re more than satisfied with this result.

Now we got a boost, as besides our weekly options trades, we established new monthly positions — a typical month-end boost in the form of options premiums, which we really enjoy.

Trades and Adjustments (USDT Settled / Weekly)

- 1.29 ETH – Break-even: $4,250 | Long calls: $4,100 (0.79), $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $209.35 | Long calls: $206

- 0.02 BTC – Break-even: $114,675 | Long calls: $117,000

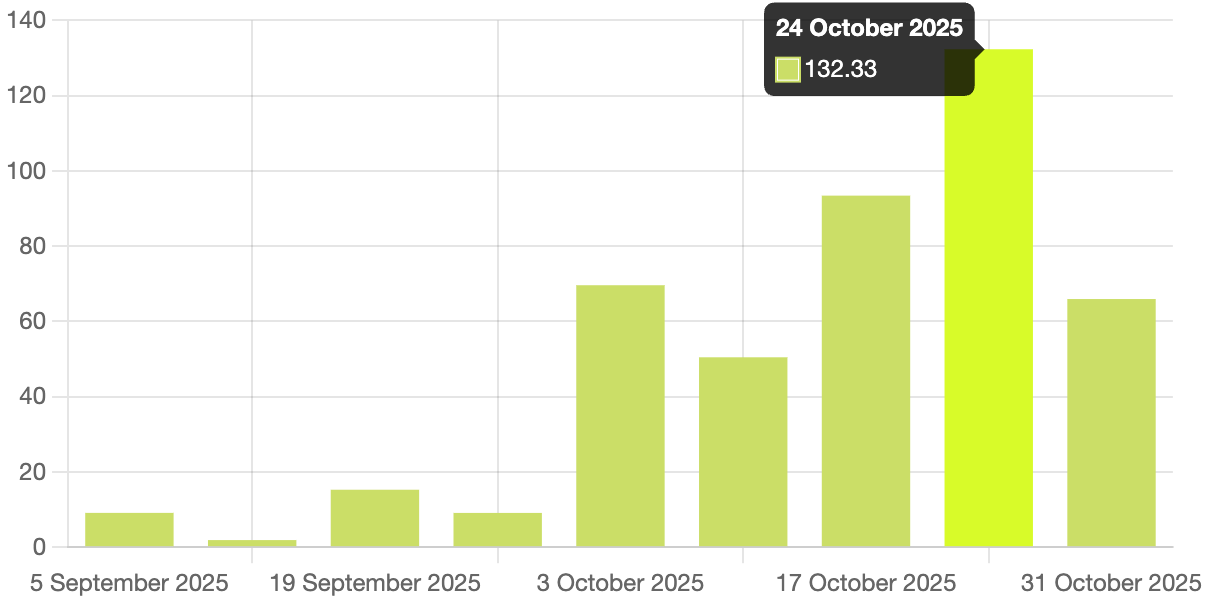

Solana Covered Call Growth Fund

The Solana Covered Call Growth Fund value decreased a bit this week with NAV per unit standing at $0.88 which is a decrease of -1.52% week over week.

During the week, we generated $65 in options premiums, equal to a 0.61% weekly return on capital. All proceeds were reinvested into spot SOL, bringing the fund’s total holdings to 25.40 SOL at an average cost of $207.23 while the break even price is $190.92

We don’t expect to consistently exceed $100 per week until the end of November. In the meantime, we anticipate weekly premiums in the range of $50–$60.

TERRAM Token

To enhance liquidity in the TERRAM:USDC trading pair, Terramatris has allocated 19% of the options-generated income from the TerraM Multi-Asset Crypto Options Fund to liquidity provisioning and an additional 1% to token buybacks aimed at supporting market stability.

Automated trading activity has recently increased around the TerraM token, with small but consistent buy and sell transactions observed — an encouraging indicator of growing market participation. With over 5% of the total token supply now provided as liquidity, we anticipate continued algorithmic trading activity in the pool.

- Solana blockchain

- Fully Diluted Market cap: $31,300

- Total supply: 10,000

- In circulation: 1,969 (19.69%)

- On Liquidity pool: 514 (5.14%)

- Price per token: $3.13 | Swap on Raydium, Jupiter or OKX.com (Solana supported wallet required)

Additionally, we’ve reintroduced the Separately Managed Account option for a more personal and tailored crypto trading experience. We’ve also been in talks with a few hedge funds recently — let’s just say there’s been a lot of discussion but not much movement yet. Still, we believe that when the time comes, we’ll be ready.

We’ve also noticed a significant spike in website traffic this month. While much of it comes from bots (and in this case, they’re not particularly useful), it still gives us the sense that something big — and positive — is on the horizon for our fund(s).

Lastly, with options trading now available on the Bybit platform for XRP, MNT, and DOGE, we initiated small positions in these assets within the TerraM Multi-Asset Crypto Options Fund. We begin with our preferred strategy — selling put options — and use the premiums received to accumulate the underlying assets.

Disclaimer

This communication is confidential and intended solely for designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein is provided for informational purposes only and does not constitute investment advice or solicitation.

Participation in Terramatris-managed funds is restricted and not available to U.S. citizens or residents.