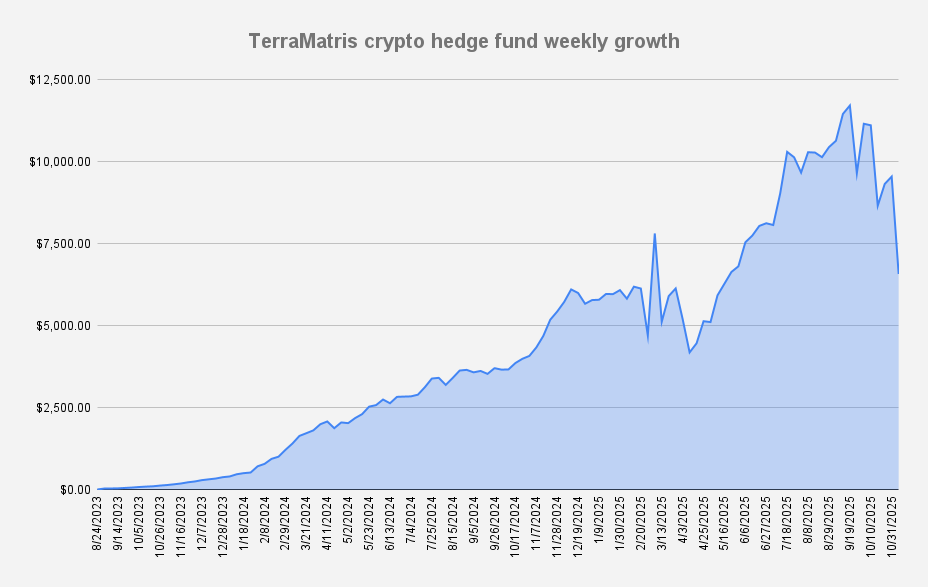

As of November 7, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by -31.12%. While this may appear to be our worst week-over-week result, it is not unprecedented — on March 13, 2025, the fund experienced an even steeper drop of -34%.

Let’s hope it stays that way, as there’s no reason to challenge that record. The current decline stems from a broad weakening in the crypto market and the fact that several positions remain leveraged.

We’ve been actively reducing leverage over the past few weeks, and despite the market stress, the fundamentals remain intact. There are no margin calls, just an exceptionally tense view on the charts.

Drawdown from the all-time high, recorded in mid-September, stands at -43%.

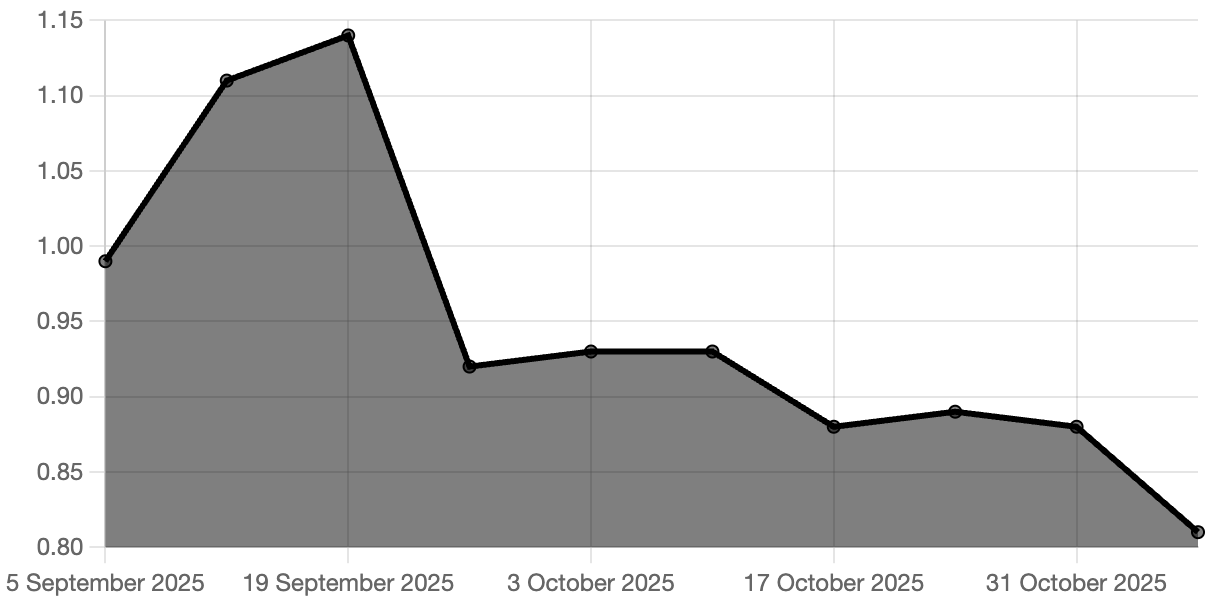

Our open-ended Solana Covered Call Growth Fund also came under pressure this week, declining by -8.15%, with the NAV per unit now at $0.81. Although Solana itself retraced more than 15%, we operate without leverage in this fund, so there’s no cause for concern. This is a normal market correction, which we aim to offset through additional covered call selling.

Our native TerraM token also came under pressure this week, as automated traders liquidated several positions, pushing the price below $3 per token. While we’re not pleased with the decline in price, we’re encouraged by the increased trading activity on DeFi platforms, showing that algorithmic traders are recognizing the token’s speculative potential.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Multi-Asset Fund generated $202 in options premiums, representing a 3.07% weekly return on capital.

For the sake of transparency, the higher options income comes with certain trade-offs. We rolled one ETH position out to March 2026 expiry, and for several other adjusted positions, we sold covered calls below our break-even levels. This means that if the market experiences a strong rally, we may forgo part of the upside potential.

Trades and Adjustments (USDT Settled / Weekly)

- 1.29 ETH – Break-even: $4,198 | Long calls: $3,500 (0.79), $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $207.45 | Long calls: $175

- 0.02 BTC – Break-even: $114,050 | Long calls: $108,000

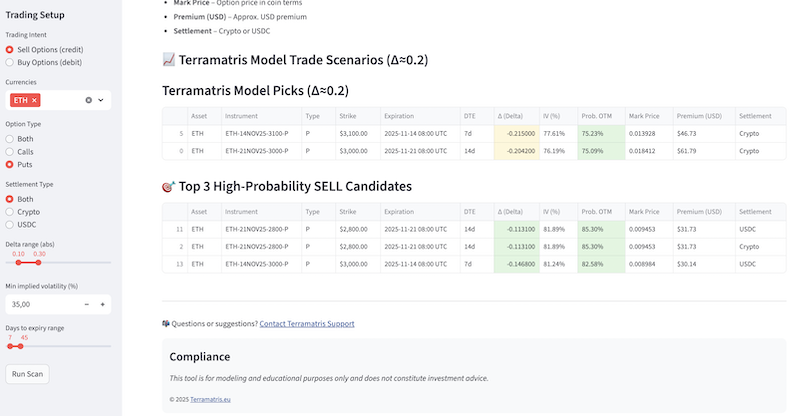

Crypto Options Scanner

Besides all above written, our biggest achievement this week was the launch of our own Crypto Options Scanner, designed to help identify potentially profitable crypto options trades. We built it using Python and Streamlit, and we’d like to invite you to test it out and share your feedback.

Check it out here: scanner.terramatris.eu

Disclaimer: This communication is confidential and intended solely for designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein is provided for informational purposes only and does not constitute investment advice or solicitation.

Participation in Terramatris-managed funds is restricted and not available to U.S. citizens or residents.