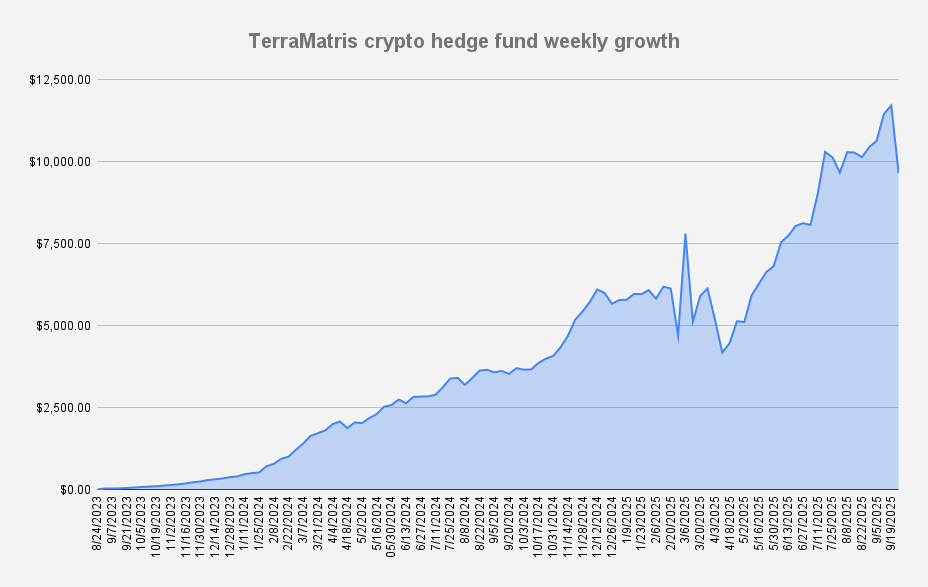

As of September 26, 2025, the TerraM crypto fund value stood at $9,651 what is a decrease of -17.64% or -$2,067 in dollar terms when compared to the last week.

That was definitely one of the worst-performing weeks of the year, rivaling late March/early April when our fund dropped by a similar percentage. Back then, however, the pain felt more. Lessons learned.

Because we use only a very small amount of leverage, we are indeed affected by market moves—but we move together with the broader market.

Certainly such massive move stings for small-sized funds like ours, but it also serves as a reminder of just how volatile crypto markets can be. This week’s drop is largely driven by the broader decline in crypto prices — nothing unexpected. Theoretically, we could have been better prepared, as this is something we were expecting for the past few weeks, but at this stage there’s no point in complaining. We view it as a healthy pullback.

Year-to-date, our main TerraM fund remains up +69.92%. Now, let’s see what Q4 will bring.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $305 from options premiums, translating to a 3.16% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

As this was the last Friday of the month, we had both weekly and monthly options expiring, which provided a boost at month-end.

Trades in Adjustment (USDT Settled / Weekly)

- 1.5 ETH – Break-even: $4,665 | Long calls: $4,300

- 13 SOL – Break-even: $227.82 | Long calls: $215

For hedging, we use long perpetual futures, and this week, through assignment, we took long positions in ETH and SOL.

TerraM token

The past week saw increased activity on DEX, with a few trades briefly pushing the Terram token price above $3.33 before retreating to $3.13 by week’s end. This marks a week-over-week decline from our recently stable level of $3.26, but we welcome the renewed movement on DEX. With the total fund value down, we remain further away from the $12,000 milestone that will trigger additional liquidity injections and buybacks.

- Solana blockchain

- Fully Diluted Market cap: $31,300

- Total supply: 10,000

- In circulation: 1,932 (19.33%)

- On Liquidity pool: 481 (4.81%)

- Price per token: $3.13

Solana Covered Call Growth fund

Our newly established Solana Covered Call Fund probably hurted the most last week dropping its NAV from $1.14 to $0.94 well below our starting nav. Nevertheless, we attracted another HNWI and secured a $5,000 investment. This is not yet reflected in this week’s report but will appear in the next one. Entering at a NAV price of 0.94 may seem like a strong discount; however, given Solana’s volatility, it remains a high-risk, high-reward investment.

We will keep the fund open to subscriptions until it reaches $100,000 in total value. With current assets under management at $434 ($5,434), we are already 0.43% (5.45%) of the way toward our target.

When looking at Solana—or most other cryptocurrencies—it’s difficult to rely on fundamental analysis, so we place greater emphasis on technicals and a long-term investment philosophy. We were pleased, and admittedly a bit surprised, that our expectation from the previous week—predicting Solana could drop to 195—materialized. This call was based purely on technical indicators, specifically the 50- and 200-day moving averages.

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.