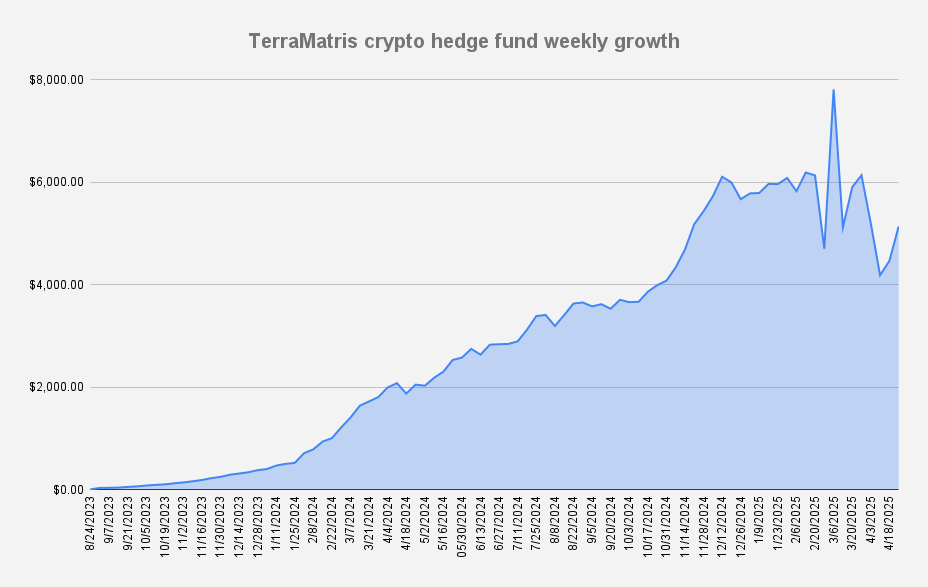

As of April 25, 2025, the fund’s value has increased to $5,138 marking another significant +15.1% week-over-week increase, equivalent to a +$673 increase in dollar terms. Despite increase, we still stand -34.25% below our all-time high of $7,811, recorded on March 6, 2025. While our YTD value has dropped to -9.53%

This week’s growth has come from both the broader market bounce and our weekly options trades. In addition, we rolled forward our monthly call options today.

Current positions in long perpetual futures (settled in USDC):

- 0.02 BTC (break-even: $110,590)| strike $88,000 (short)

- 2.1 ETH (break-even: $2,690) | strike $1650 (short)

- 5 SOL (break-even: $163.93) | strike $134 (short)

Over the past several weeks (and months), we've been generating options premium primarily through trade adjustments rather than initiating new positions. Despite the challenging circumstances and the underperformance of our existing holdings, we still managed to collect $139.29 in premium this week from these ongoing adjustments—a modest but meaningful contribution under the circumstances.

No new capital has been injected into the fund, and liquidity remains a top priority.

TerraM Token Update

There haven't been much movement with TerraM token in the last weeks and the token price has kept stable at $2.60.

We are committed to improving liquidity for TerraM, but given current market conditions, we do not anticipate a significant liquidity increase or another buyback until the total fund value reaches $8,000.

This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.