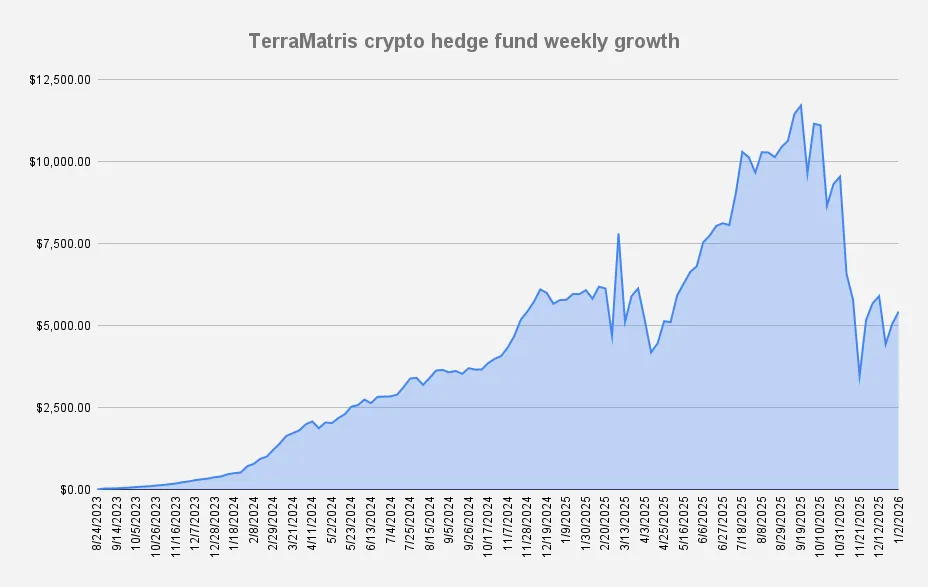

Greetings in 2026. The Terramatris team has traveled to the beautiful Palolem Beach in Goa, India, and with great excitement we are preparing the first weekly review of the new year. We wish everyone a strong and successful start to 2026.

As of January 2, 2026, the TerraM Multi-Asset Crypto Options Fund is up +7.57% week-over-week, encouraging start of the new year. While the crypto market remains in a consolidation phase, still trying to decide its next move, last week was relatively calm, with most gains coming from expiring options positions.

TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –53%. While Year-to-date, our Fund is up 0.85%, underperforming Bitcoin (+1.76%) and ETH (+2.06%).

Options Income

This week, the TerraM Multi-Asset Fund generated $193 in options premiums, what is impressive 3.56% weekly return on capital. The increase in options income comes from selling in-the-money covered calls below our breakeven, which raises premium income but caps upside. On the positive side, we continue selling below breakeven and are now rapidly approaching breakeven, at least for Ethereum.

This week, we also purchased put and call options expiring next week to improve portfolio hedging against both downside and upside moves.

Trades and Adjustments (USDT Settled / Weekly)

| Asset | Position Size | Break-even | Long Calls |

|---|---|---|---|

| ETH | 2.8 ETH | $3,348 | $3,050 |

| SOL | 19 SOL | $181.44 | $132 |

| BTC | 0.02 BTC | $107,665 | $93,500 |

We use long perpetual positions (rather than spot) for our challenged trades, with the goal of gradually converting them into spot holdings over time. Our long-term plan is to reduce perpetual exposure to zero, leaving the portfolio fully spot-backed.

We didn’t convert perps to spot this week, because we’re also prioritizing a reduction in our margin debt, which currently stands at -2,573 USDT (as of today). If we can consistently set aside $193 per week, we’ll eliminate our margin debt in about 13 weeks.

Solana Covered Call Growth Fund

Solana Covered Call Growth Fund climbed for the second week in a row by +2.3%, increasing the NAV per unit to $0.73. At the end of week we were able to increase our long spot holdings to 40.7 SOL with break even price $170.27

Options selling generated $33.88 this week all reinvested back into spot SOL.

Our goal is to gradually grow the fund to 100 SOL. Although we have liquid cash available, we remain cautious about unexpected market moves. The main challenge with SOL options is limited liquidity and a lack of suitable roll dates when positions come under pressure.

All option premium earned this week came from selling bull put credit spreads expiring on January 30, 2026.

TerraM token

Our native TerraM token for another week held steady at $3.27. Week after week we keep adding more liquidity back to the Raydium liquidity pool, allocating 20% of the TerraM Multi-Asset Fund’s options income to support it.

The bottom line

In short, this was another strong week: we generated solid income, improved our breakeven levels, and are well positioned for a strong start to 2026.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.