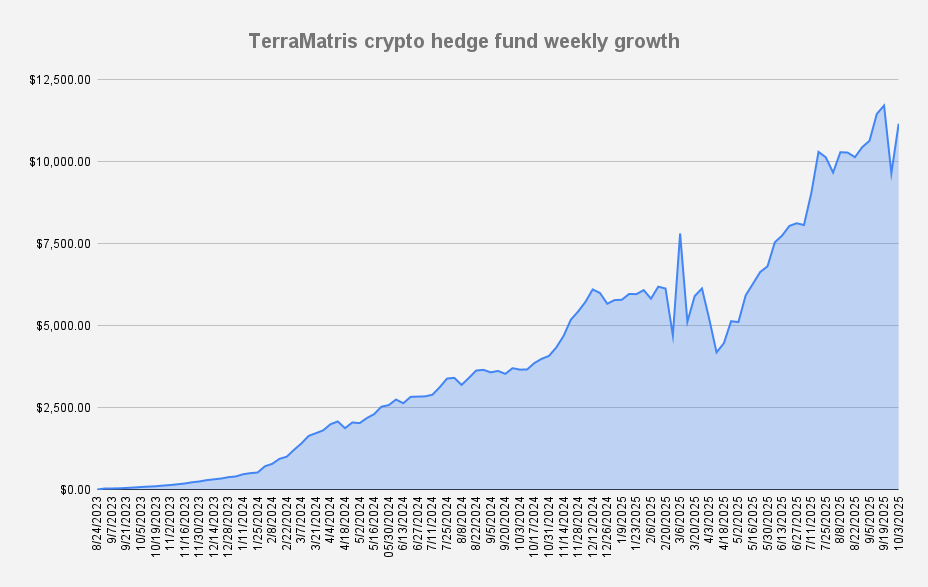

As of October 3, 2025, the TerraM crypto fund value stood at $11,162 what is an increase of 15.66% or +$1,511 in dollar terms when compared to the last week. That comes as a strong relief recovery after a sharp decline last week.

We’re still puzzled about what exactly happened last week, aside from it being quarter-end. We’re now using this comeback to strengthen our positions, reduce leverage, and ensure that when the next market selloff arrives, we’ll be better prepared.

From the previous all time high we are still -4.75% away, while YTD funds value has been at 96.53%.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, TerraM fund earned $203 from options premiums, translating to a 1.81% weekly return on capital. As our target is anything above 1%, we're more than satisfied with this result.

For October, we’ve set a baseline target of at least $165 per week in options premium, and so far the plan is performing well. We’re genuinely astonished to have cracked $200 in a regular week without the usual month-end boost.

Trades in Adjustment (USDT Settled / Weekly)

- 1.5 ETH – Break-even: $4,583 | short puts: $4,275

- 13 SOL – Break-even: $224.92 | short puts: $215

Things quickly turned around this week, and we shifted from hedging with long perpetuals back to selling put options.

TerraM token

Last week saw limited activity for TerraM token. The main highlight was onboarding our 17th token holder, who received 10 TerraM tokens as a welcome gift and token of appreciation for joining our newly launched Solana Covered Call Growth Fund (more on that below). Beyond this, there has been little movement. We do not anticipate any significant price appreciation until our fund’s value reaches $12,000, at which point we plan to initiate treasury operations.

- Solana blockchain

- Fully Diluted Market cap: $31,300

- Total supply: 10,000

- In circulation: 1,932 (19.33%)

- On Liquidity pool: 481 (4.81%)

- Price per token: $3.13

Solana Covered Call Growth fund

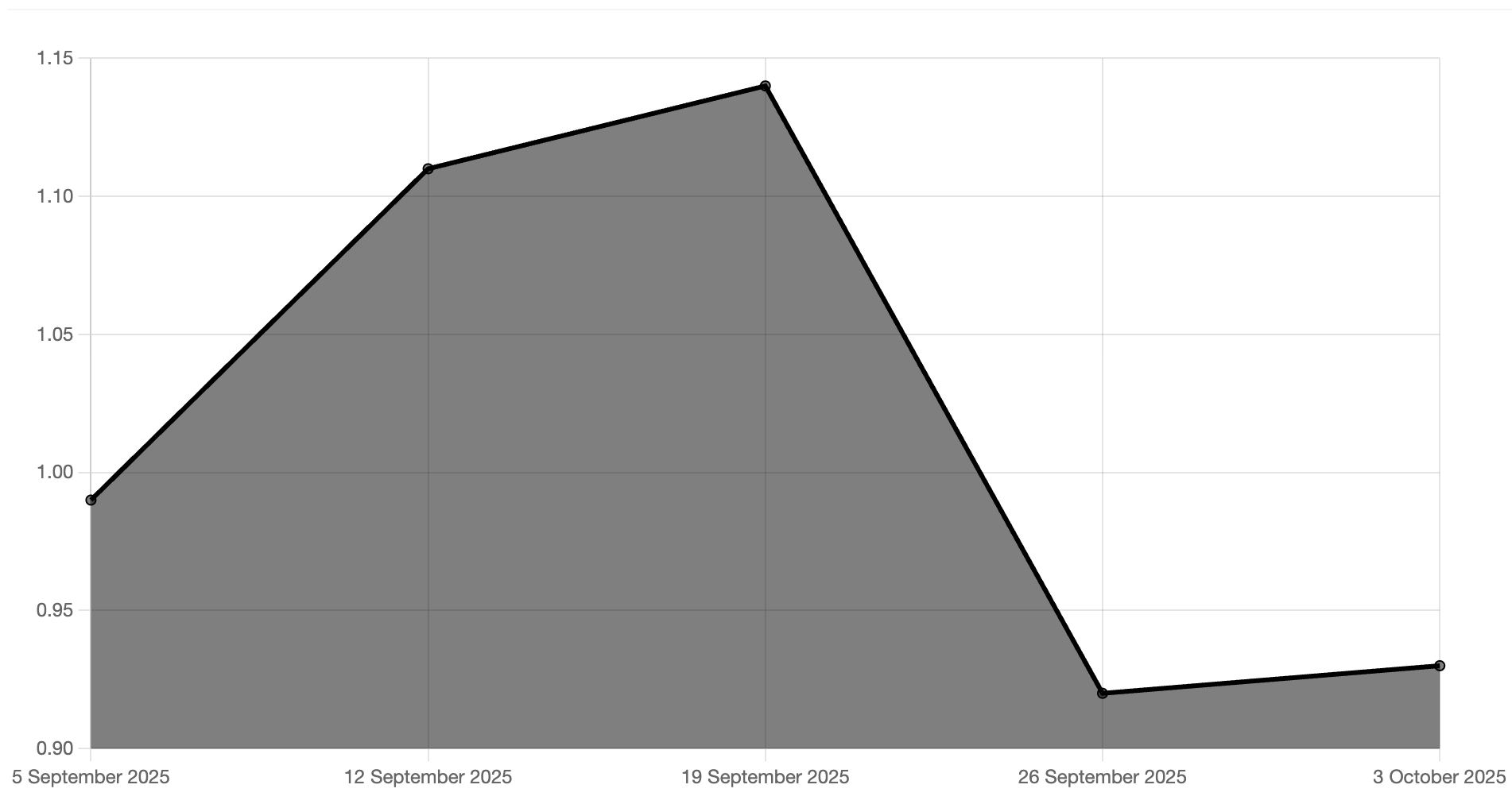

Our newly launched Solana Covered Call Growth Fund increased its NAV from $0.92 to $0.93 this week. While the NAV remains below the initial level of $1.00, this represents a solid 1.44% week-over-week gain.

As we attracted an additional $5,000 investment last week, we decided to include arbitrage trades in our strategy to provide fund subscribers with greater stability and peace of mind. These trades are delta-neutral, generating yield from the spread by buying spot and selling futures with a set expiry date.

Just like in our TerraM fund, we place strong emphasis on generating steady income through options trades while reinvesting the premiums into spot Solana. In addition to options premiums, we have now introduced basis trades to the strategy.

Last week, fund generated $72 in options premiums, which equates to a 1.26% return on capital. Similar to our main fund, we are very satisfied with achieving returns above 1% per week on deployed capital. All option premiums were reinvested into spot SOL, increasing the fund’s holdings to 2.64 SOL, while the remaining cash is reserved for put sales and arbitrage.

We will keep the fund open to subscriptions until it reaches $100,000 in total value. With current assets under management at $5,674, we are already 5.67% of the way toward our target.

During the week, we engaged in discussions with several potential subscribers for the fund. While no additional commitments have yet been secured, we remain steady and focused.

One area we remain mindful of is liquidity on Solana options trading desks. While we do not see this as an imminent risk, it is something we continuously monitor. The FTX collapse back in 2022, which pushed Solana below $10, is still fresh in memory. At that time, most options trading platforms delisted SOL, leaving traders stuck in long positions without a viable exit.

We do not expect a similar scenario to unfold now, but it serves as a reminder of the potential vulnerabilities. As part of our risk management, we regularly reassess liquidity conditions and factor this into our decision-making when trading Solana and Solana options.

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.