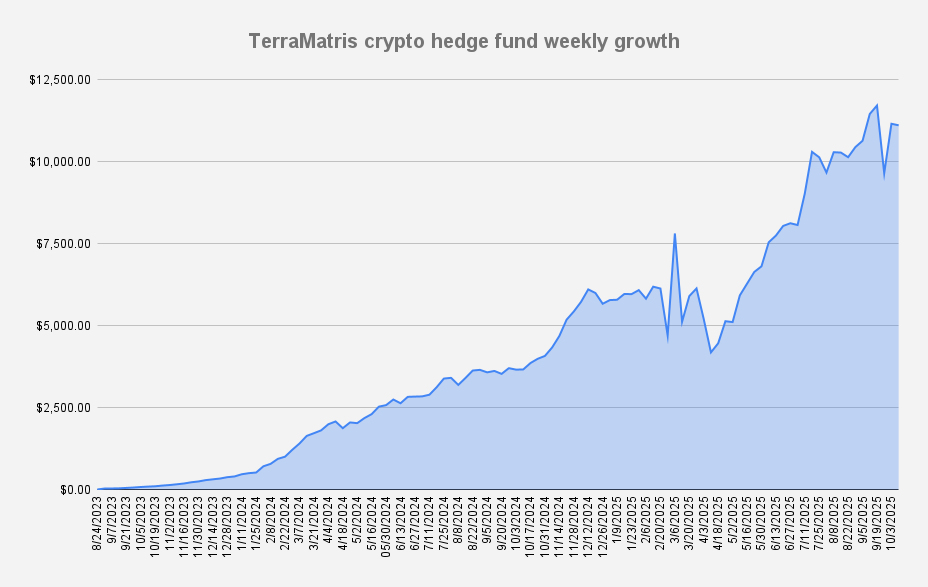

As of October 10, 2025, the TerraM crypto fund value stood at $11,115 what is a slight decrease of -0.42% if compared to the last week.

When analyzing the overall crypto market, it appears we are entering a choppy phase — characterized by sharp drops, quick recoveries, and even sharper subsequent declines. History shows we’ve been here before. Looking at current trading charts, the probability of large downside moves ahead cannot be excluded.

In such an environment, traders should focus less on chasing short-term swings and more on risk management and protection strategies.

From the previous all time high we are still -5.15% away, while YTD funds value has been at 95.7%.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, TerraM fund earned $208 from options premiums, translating to a 1.87% weekly return on capital. As our target is anything above 1%, we're more than satisfied with this result.

For October, we’ve set a baseline target of at least $165 per week in options premium, and so far the plan is performing well. We’re genuinely astonished to have cracked $200 for the second row in a week, in a regular week without the usual month-end boost.

Trades in Adjustment (USDT Settled / Weekly)

- 1.5 ETH – Break-even: $4,400 | short puts: $4,200

- 13 SOL – Break-even: $218.08 | short puts: $212

Provided that no major market disruptions occur in the coming weeks, we expect to finally recover the positions that have been under adjustment since March–April. The recovery process itself has been a constructive experience—allowing us to move away from speculative guessing and focus instead on generating consistent returns from existing positions across varying market conditions. Once these trades are fully recovered, we are considering doubling the position size and using this structure as the baseline for our weekly options strategy.

TerraM token

There haven't been much movement with our native TerraM token last week, for mot of the week it stayed flat. Good. We do not anticipate any significant price appreciation until our fund’s value reaches $12,000, at which point we plan to initiate treasury operations.

- Solana blockchain

- Fully Diluted Market cap: $31,300

- Total supply: 10,000

- In circulation: 1,932 (19.33%)

- On Liquidity pool: 481 (4.81%)

- Price per token: $3.13

Solana Covered Call Growth fund

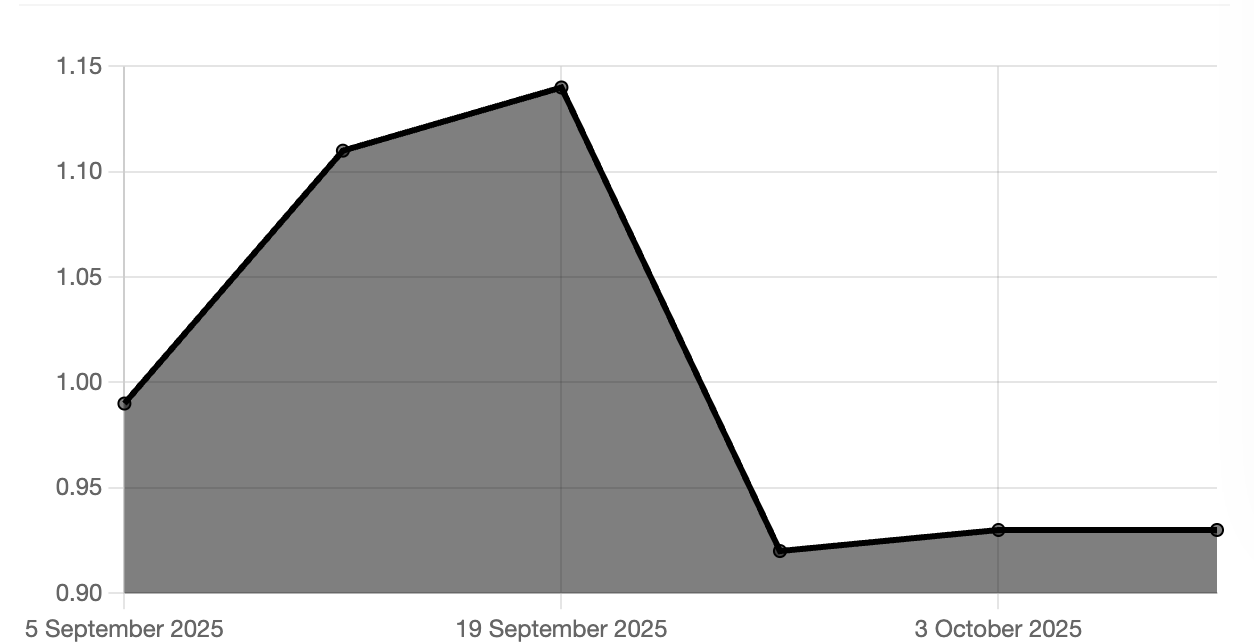

The recently launched Solana Covered Call Growth Fund remained largely unchanged this week, with the Net Asset Value (NAV) closing at $0.93. Although the NAV briefly rose to $0.94 during the week, it subsequently retraced to its previous closing level. Such short-term fluctuations are a normal part of the fund’s early performance phase.

Just like in our TerraM fund, we place strong emphasis on generating steady income through options trades while reinvesting the premiums into spot Solana..

Last week, fund generated $50.47 in options premiums, which equates to a 0.88% return on capital. This is slightly below our 1% weekly target, but considering that the fund is still in its early stages, we are quite satisfied with the result. All option premiums were reinvested into spot SOL, increasing the fund’s holdings to 3.68 SOL, while the remaining cash is reserved for put sales and arbitrage opportunities.

Derive - Fully Decentralized Options Trading

Last week we explored several crypto-native firms to set up accounts that could further support our growth. Most of our efforts were focused on opening an institutional account at Kraken, with the goal of executing basis trades using SOL.

Along the way, we accidentally came across Derive, an on-chain options trading exchange. We were truly impressed by its professional setup—no KYC required, just a MetaMask wallet and some ETH to get started.

To diversify our exchange risk, we decided to allocate a small portion of our funds to Derive and begin trading options natively on-chain. Our current plan is to transfer 100 USDC per week until we reach a total of 1,000 USDC on the platform.

During this process, we also explored the Arbitrum network, which provides a cheaper and faster way to transfer funds across the ecosystem. This adds another layer of efficiency to our operations and helps us optimize costs while experimenting with decentralized infrastructure.

What else is brewing:

Last week, we conducted research on Georgian tax residency, received a surprise ASR reward from Jupiter, and decided to add the Wormhole token to our Moonshot Portfolio. Selected reference links are provided below.

- Georgian Tax Residency: A Strategic Option for HNWIs and Crypto Individuals

- Why We Added Wormhole (W) to the TerraM Portfolio?

- ASR Reward from JUP Makes Us Happy

Disclaimer: This communication is strictly confidential and intended solely for its designated recipients. It is not for public distribution, reproduction, or forwarding. The information contained herein does not constitute investment advice and is provided for informational purposes only. Participation is restricted, and this material is not directed at or intended for distribution to citizens or residents of the United States.