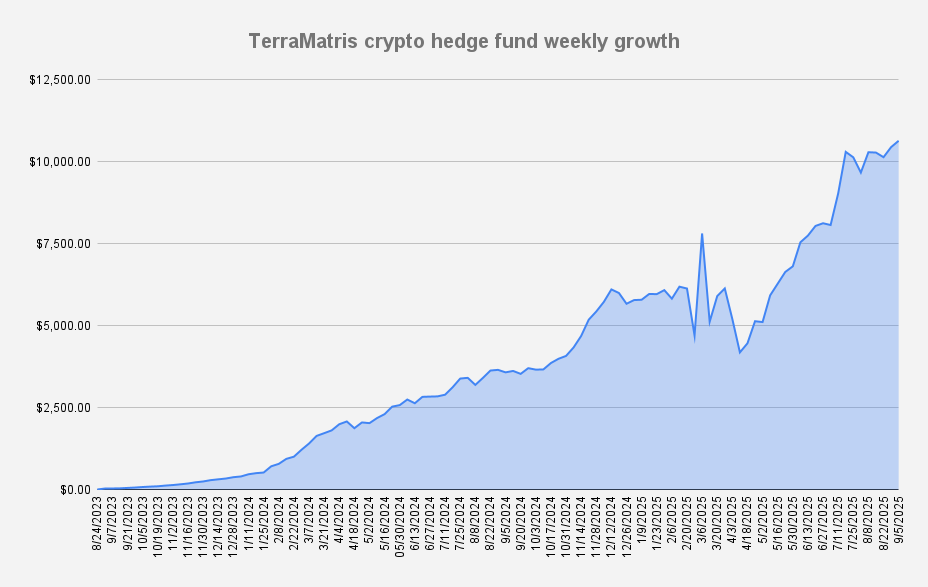

As of September 5, 2025, the Terramatris crypto hedge fund value stood at $10,643 what is an increase of +1.86% or +$194 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

The past week started with some active moves — we even adjusted one ETH position by rolling it down and forward. However, as the days progressed, market activity slowed, and the week ended relatively calm, with little movement in crypto markets.

At this point, we might be entering a consolidation phase, setting the stage for a binary outcome — either the start of a bullish run or a sharp bearish attack.

As put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +87.38%.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $199 from options premiums, translating to a 1.86% weekly return on capital. Ah, so close to $200, but still missing. Our target is anything above 1%, so we're satisfied with this result.

Looking ahead, we do not expect to exceed $200 per week in options premiums until the final week of September. For now, we have set a baseline target of $150 per week throughout the month.

Trades in Adjustment (USDT Settled)

- 1.6 ETH – Break-even: $4,461 | Short puts: $3,975 (1), $3,950 (0.6)

- 13 SOL – Break-even: $197.42 | short puts: $188

TerraM token

There hasn’t been much movement with our native TerraM token last week. We anticipate initiating treasury operations once the fund’s value reaches $11,000. Looking to bump slippage by a few percentage points. No buybacks planned until Fund reaches $12,000

- Solana blockchain

- Fully Diluted Market cap: $32,600

- Total supply: 10,000

- In circulation: 1,872 (18.72%)

- On Liquidity pool: 410 (4.10%)

- Price per token: $3.26

- Slippage per 200 TerraM tokens (-32.37%)*

Solana Covered Call Growth fund

On September 4, we launched a separate open private fund — the Solana Covered Call Growth Fund. The fund’s objective is to generate income premiums by selling covered calls on Solana, using both spot holdings and futures for leverage. Unlike traditional income-focused funds, we are not distributing yield at this stage; instead, our focus is on steadily growing the underlying Solana spot position.

The fund was launched with a starting NAV of $1. Accredited investors are welcome to explore opportunities to participate, with a current minimum investment of $5,000. At present, TerraM is the sole investor in the fund. Over the next 365 days, we are considering an allocation equivalent to 26 SOL tokens.

Jup staking

We are steadily increasing our position in JUP tokens, which we view as a potential moonshot candidate over the next five years. While dollar-cost averaging into JUP, we’ve also decided to stake our entire holdings in anticipation of the potential “Jupiary” event expected in January–February 2026.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions