On February 13, 2026, the TerraM token traded at $1.82, up 2.82% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.90% of total supply. As a result, total market capitalization increased by approximately $500, reaching $18,200 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expect to cross this threshold next week. Until liquidity deepens further, slippage is expected to remain elevated.

Ethereum Strategy

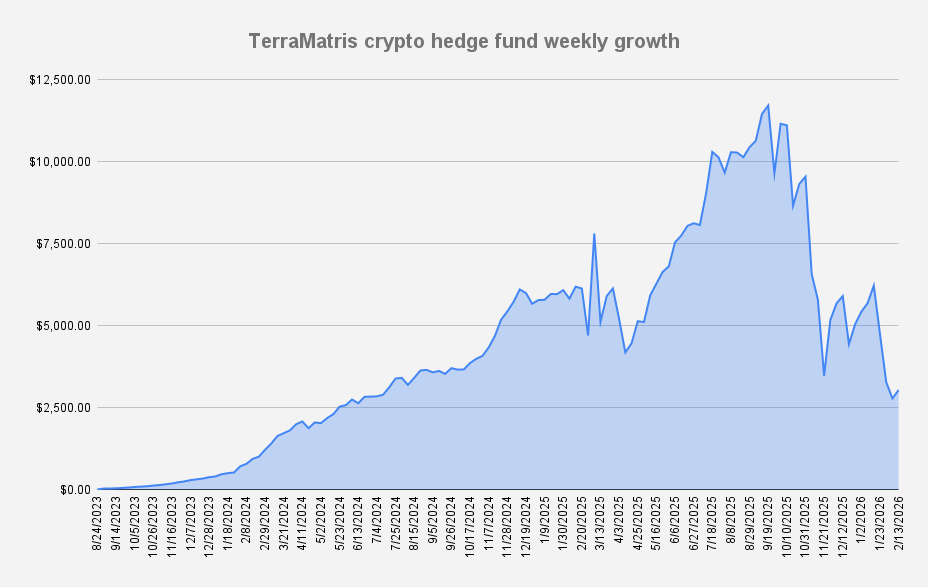

Our first week as ETH only fund was decent, with fund value growing +9.21 week over week.

From the all-time high in September 2025, the fund is still down -74.07%. While YTD performance stands at -43.57%, materially underperforming ETH itself, which is down 35.02% over the same period.

During the week, the ETH Strategy generated $80 in options premiums, reducing the effective ETH break-even price to $1,833. By week’s end, the strategy held 2.025ETH with an average acquisition price of $1,982.

From the options premium received, we reduced margin to –$1,724. The immediate objective is to bring margin back to zero without selling any ETH. After that, depending on market conditions, we may increase exposure by adding 1 additional ETH on margin. Time will determine the right moment.

At an average premium of $80 per week, it would take approximately 22 weeks to eliminate the remaining margin balance — roughly mid-July.

Until then, trading activity on the spot side is expected to remain relatively quiet. Stability at this stage is a positive outcome.

Besides that, last Sunday our CEO attended the ETH Tbilisi event. Although he originally planned to join the hackathon and code something creative using AI, he ended up networking with crypto people - many of them trying to lure him into various schemes. That’s part of the crypto world: plenty of opportunists, and,thanks god, even more true hackers. In any case, the free beer was refreshing.

Solana Covered Call Growth Fund

The Solana strategy declined slightly by 0.15%, while NAV remained unchanged at $0.48.

By the end of the week, we increased our long spot position to 51.29 SOL, with an average break-even price of $153.44. With Solana trading at $78.99 at the time of writing, the position is significantly underwater.

At current volatility and premium levels, selling covered calls provides only limited downside offset and does not materially compensate for the unrealized losses.

During the week, we collected a modest $9 in option premium from selling one covered call expiring March 27.

At this stage, we remain cautious. Rather than deploying capital aggressively, we are using a dollar-cost averaging approach to build exposure gradually, without attempting to time short-term market moves.

The larger strategic question around Solana remains unchanged: will this blockchain still be relevant in 5–10 years? That uncertainty continues to generate recurring waves of doubt and volatility.

The Bottom Line

Liquidity in TerraM is gradually improving, ETH exposure is stabilizing through disciplined premium collection, and Solana remains a high-conviction but high-drawdown position.

Near term, the priority is straightforward:

- expand TerraM liquidity toward the 3% milestone and ultimately 10%,

- eliminate ETH margin without selling core holdings, and

- continue harvesting option premiums while avoiding forced risk expansion.

Performance remains heavily influenced by past drawdowns, and recovery will require time, consistency, and controlled risk — not aggressive positioning. For now, the strategy favors balance sheet repair, steady premium income, and incremental liquidity growth over bold directional bets.