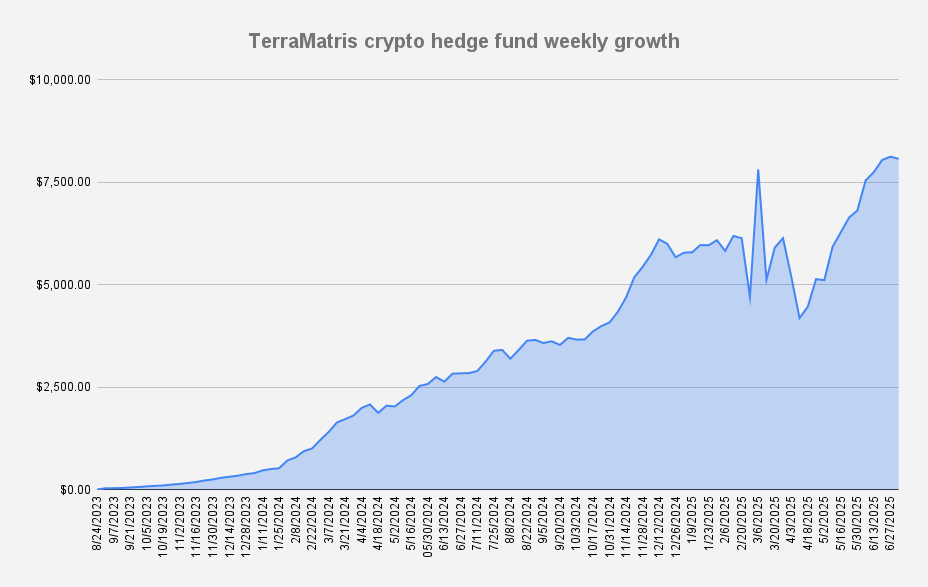

As of July 4, 2025, the Terramatris crypto hedge fund value has grown to $8,073, slightly dipping by 0.66% (-54$ in dollar terms) weekly over week. Never less, last week we returned loan of almost $500, and we believe the result is decent.

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $122,644 | Short puts: $104,000

- 1.8 ETH – Break-even: $3,0172 | Short puts: $2,400

- 5 SOL – Break-even: $160.03 | Short puts: $150

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $133.40 from options premiums, translating to a 1.65% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

TerraM Token Update

The TerraM token remains stable at $2.74, with no price movement in past weeks.

- Solana blockchain

- Fully Diluted Market cap: $27,400

- Total supply: 10,000

- In circulation: 1,610 (16.1%)

- On Liquidity pool: 342 (3.42%)

- Price per token: $2.74 | Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

TerraM token’s market cap is now standing at $27,400, which is nano-cap compared to other crypto tokens — but as long as there is growth, we are happy. Our next liquidity increase and buyback is planned after our fund’s value reaches $8,500.

This week has primarily been a period of consolidation in the markets, with limited volatility as participants assess upcoming catalysts. As we enter July, marking the beginning of Q3 and the second half (H2) of the year, the early tone has been constructive.

While the start of Q3 has shown positive momentum, we remain cautious and fully aware that the market could experience significant price movements in either direction. We are closely monitoring conditions and stand ready to respond to emerging trends or shifts in sentiment.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.