Good morning, ladies and gentlemen. My name is Reinis Fischer. Today is May 10th, 2024. I am at Tbilisi, the famous Axis Towers, with my friend Dino in the background. I'm recording this video for the Happenings in the TerraMatris Crypto Hedge Fund.

I have to apologize for recording one day late, as I usually tend to record these videos every Thursday. However, yesterday in Georgia, it was a public holiday, and we had a day off from school. We enjoyed a nice day off without recording videos. That doesn't mean the fund wasn't working. The fund was operating quite well, and with one day's delay, I'm recording this video. So, let's begin.

Swap USDC for TerraM on Raydium

In case you don't know what TerraMatris is, let me give you a brief overview. Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. The fund is privately held and not publicly registered, but it's always available for investment. Our decentralized liquid pool fund is mostly operated from Tbilisi, Georgia.

A quick disclaimer: investments in stocks, funds, bonds, or cryptos are risky. You could lose some or all of your money. Do your own due diligence before investing in any kind of asset.

Trading strategy here at Terramatris mostly involves trading one-day-to-expire put options on Bitcoin and additionally selling covered calls on already established positions. Right now, we're selling covered calls on Ethereum. Although our core trading strategy mostly involves one-day-to-expire put options, we sometimes adjust our positions and trade longer time expiries. But one thing is for sure: all the premium earned from those put options is reinvested back into crypto itself.

So far, we have chosen several cryptocurrencies: Bitcoin, Ethereum, Stellar Lumens, USDC stablecoins, Solana, Jupiter, and Token.

Token is one of our latest additions to the portfolio. This is a real-world asset token in which we are very bullish for the three to five-year term. By doing this reinvestment back into coins itself, we are forming a dollar-cost averaging, having coins with a nice average buy price. We're not going all in; instead, we're buying bit by bit, resulting in a favorable entry point. T

his has been week 38 since the start of the fund, and this week, we reinvested back into Ethereum, the second-largest cryptocurrency.

Risk management is one of the main focuses of any successful fund, especially in a hedge fund. When looking for trades, we're seeking high-probability options trades that are likely to expire worthless. Trading such short-term options means we're looking for trades under Delta minus 0.10. In case our trades go against us, we consider rolling forward for a credit, meaning we buy back the losing options contract and sell new ones with a later expiry for a credit.

When trading cryptocurrencies, it's very popular to trade Futures. While we're not actively trading Futures, we use them as a hedge in case something goes against us. We might use stop losses and additionally buy more than 45 days to expire long put options as protection in case something goes down.

This week, we targeted a minimum of $7 daily from options premium while reinvesting it all back into Ethereum itself.

For most of the week, it worked quite well. On some days, we weren't actively trading as we have a few Bitcoin put option contracts expiring this month, so we're keeping our powder dry. However, on the days when we traded, we made much more than $7 daily on average, all reinvested back into premium itself, growing our Ethereum holdings.

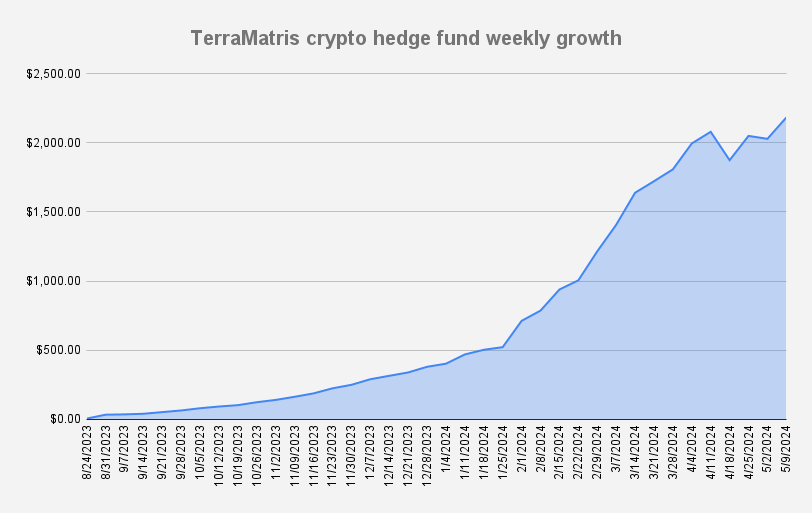

Now, let's talk about the weekly results. On May 9th, our hedge fund reached another all-time high, reaching $2,183,191, which represents a week-over-week growth of over 7% in dollar terms, equivalent to $154.73.

You can see on this chart, around the start of April, it was quite a turbulent month, and the start of May was also uncertain. However, this week, we managed to break above the previous all-time high, which makes us really happy. We are looking to crack $2,500 anytime soon.

Regarding trade adjustments, in our portfolio, there are currently 0.07 Bitcoin put options with several strike prices and expiry dates in May. One of them expires today, Friday, May 10th, with a strike price of $65,000. As Bitcoin is trading around $62-63,000 today, we are considering rolling forward, most probably for next week's expiry. Next week, we will have 0.02 Bitcoin put option contracts. If they are still in the money, we might consider rolling forward by downsizing this position and extending the expiry to September or December. A lot of things can happen in one week in the crypto space, so we adjust accordingly.

Market trend and analysis

We are currently in a bearish market condition. We are moving towards some price action, which might mean we are either going to shoot up or go down. As a manager of the hedge fund, I'm looking for a possible fallback to around $56,000 or even $52,000. However, before that, there is a high probability that we will touch $66,000. If we break above this moving average to 50/200 days, there is a chance we will reach $100,000, or at least touch $73,000. But as a put seller by heart, I'm always looking for downside movements to trade safe and balance the portfolio accordingly.

Now, let's talk about how you can possibly participate in Terramatris Crypto Hedge Fund.

One way is via investments through term tokens. Let me briefly tell you about term tokens. There are 10,000 Terramatris tokens available, and they are minted on the Solana blockchain. You can swap USDC for term tokens on Radium or even Jupiter networks. At the moment, there are 344 TerraM tokens available, with a starting price of $1.17 per token. If you want to buy more than what is currently available on the exchange but limited to 200 TerraM tokens, it's possible to buy over the counter or by connecting directly with me on LinkedIn, YouTube, or my personal blog. We can discuss how you could benefit from TerraM token performance.

Swap USDC for TerraM on Raydium

Thank you for watching. It seems it has been a good week, and it seems like a good week ahead. Trade safe and grow big. Thank you for watching, and see you next week.