Blog

Ep 132: TerraM token at $1.97, Liquidity Expands, Market Cap Nears $20K

| Weekly updates | 76 seen

On February 27, 2026, the TerraM token traded at $1.97, up 4.23% week over week. On-chain activity was limited during the period, with two buys and no sells. For a nano crypto fund like ours, every on-chain transaction is an event worth noting.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.98% of total supply. As a result, total market capitalization, if fully distributed, increased by approximately $800, reaching $19,700 week over week. $20K feels within reach. Let’s aim to break above that level next week.

That said, these figures are still useful as a reference point — without meaningful liquidity, slippage becomes excessive.

Our broader objective remains expanding…

Ep 131: TerraM Liquidity Nears 3% Milestone as ETH Options Generate $99 Premium

| Weekly updates | 167 seen

On February 20, 2026, the TerraM token traded at $1.89, up 3.84% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.95% of total supply. As a result, total market capitalization increased by approximately $700, reaching $18,900 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expected to reach this minor milestone already this week. However, two buybacks removed roughly 0.05% of liquidity from the pool, slightly delaying the move. We remain confident that the milestone will be reached next week.

…Ep 130: TerraM Token Rises 2.8% as ETH Strategy Gains 9%

| Weekly updates | 193 seen

On February 13, 2026, the TerraM token traded at $1.82, up 2.82% week over week. On-chain activity was limited during the period, with two buys and no sells, which is a positive signal.

During the week, we added additional TerraM liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 2.90% of total supply. As a result, total market capitalization increased by approximately $500, reaching $18,200 week over week.

Our broader objective remains expanding liquidity coverage to 10%, with the next milestone set at 3%. We expect to cross this threshold next week. Until liquidity deepens further, slippage is expected to remain elevated.

Ethereum StrategyOur first week as ETH only fund was decent, with fund value growing +9.21 week over week.…

Ep 129: Capitulation, Reset, and a Return to Spot-First Discipline

| Weekly updates | 251 seen

This week marked one of the most difficult moments in Terramatris’ history. The crypto market experienced a sharp and disorderly sell-off, and our portfolio entered what can only be described as a leverage-driven death spiral. At the peak of exposure, we were effectively controlling roughly 6 ETH with an average entry price above $3,500. Most of this exposure was expressed through perpetual futures and short put options, both of which moved deeply underwater as ETH collapsed. When Ethereum dipped below $2,000, the math stopped working.

At that point, we made a hard but necessary decision: unwind, realize losses, and move forward. We do not know whether this is the market bottom, nor whether a sharp recovery could follow quickly. What we do know is that continuing to operate under…

Ep 128: TerraM Token Rises to $2.83 (+2.9%) Despite Massive Crypto Selloff

| Weekly updates | 135 seen

On January 30, 2026, the TerraM token traded at $2.83, up 2.9% week over week. Trading activity increased following the launch of a 1 TerraM token weekly reward for liquidity staking. Automated trading bots quickly identified the incentive and began purchasing and staking TerraM tokens.

For most of the week, TerraM traded tightly around $2.90, before slipping to $2.83 on Friday morning amid short-term profit-taking by trading bots.

This bot trading development is positive. We estimate that 70–90% of DeFi activity is bot-driven, and as long as these bots are deploying real capital, their participation improves liquidity and market efficiency.

Bots, Rewards, and TerraM: Unexpected Signals from DeFi Liquidity

Looking ahead, we plan to continue using staking rewards…

Ep: 127: TerraM Token Growth to $2.75 Despite Fund Drawdowns

| Weekly updates | 116 seen

On January 23, 2026, the TerraM token traded at $2.75 (+2.23%). Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we increased liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.48% of total supply bringing our total market cap to $27,500 (+$600).

Our larger objective is to expand the liquidity pool to 10%, but the next key milestone is getting past 2%. We anticipate achieving this within 4–5 weeks. Until liquidity improves, slippage will continue to be significant.

TerraM Multi Asset FundMeantime TerraM Multi-Asset Crypto Options Fund experienced another massive -23.86% week-over-week drop, marking first negative week in 2026. The past few months have felt like one step forward,…

Ep 126: TerraM Token and Multi-Asset Fund Update: Liquidity, Buyback Plans, and 9.45% Weekly Gain

| Weekly updates | 121 seen

On January 16, 2026, the TerraM token traded at $2.69. Trading activity remained modest, with transactions skewed mostly toward buys. During the week, we also added liquidity to the Raydium pool, increasing the share of fully USDC-backed TerraM tokens to 1.35% of total supply bringing our total market cap to $26,900.

Slippage remains elevated due to shallow liquidity. This is not ignored—we are actively working on liquidity depth, pool balance, and execution efficiency as part of the broader TerraM token mechanics.

Our CEO announced his intention to initiate a 52-week TerraM buyback challenge. If executed consistently, this could result in him personally holding up to ~5% of the TerraM token supply over the course of a year.

TerraM Multi Asset FundTerraM Multi-Asset…

Ep 125: TerraM Fund Update: +4.73% Weekly Gain, but Drawdown Still −51% From ATH

| Weekly updates | 68 seen

As of January 9, 2026, the TerraM Multi-Asset Crypto Options Fund is up +4.73% week-over-week, marking the second consecutive week of gains in 2026. Broader crypto market conditions remain constructive, though this outlook remains subject to invalidation.

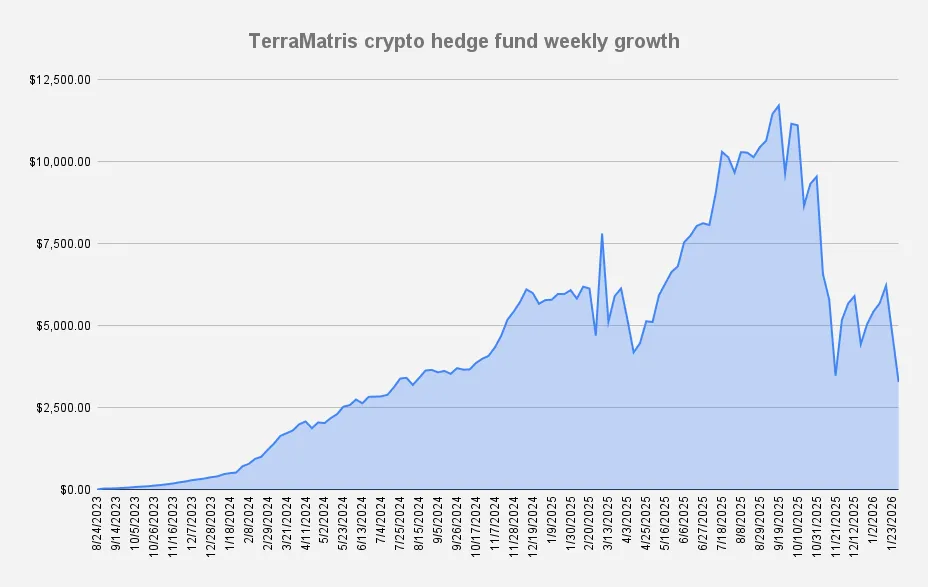

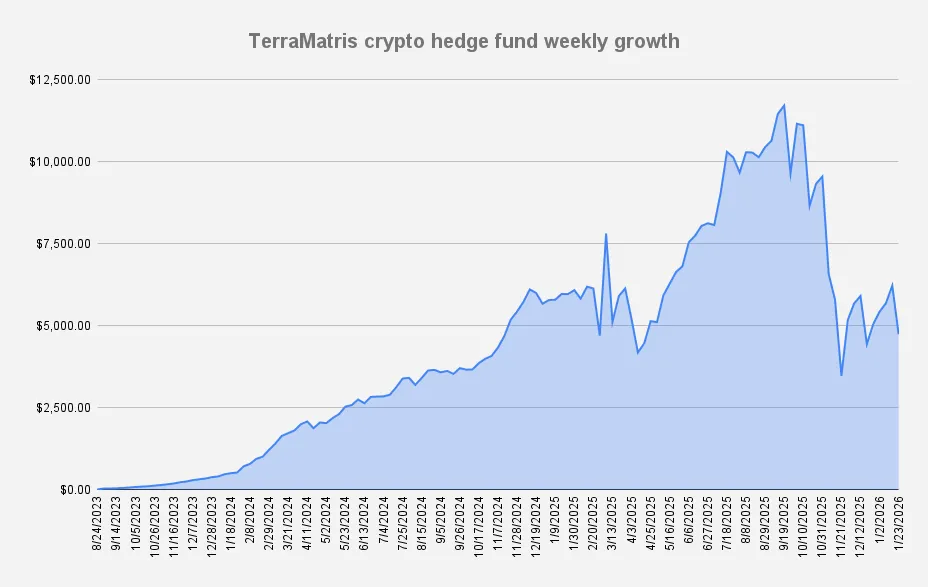

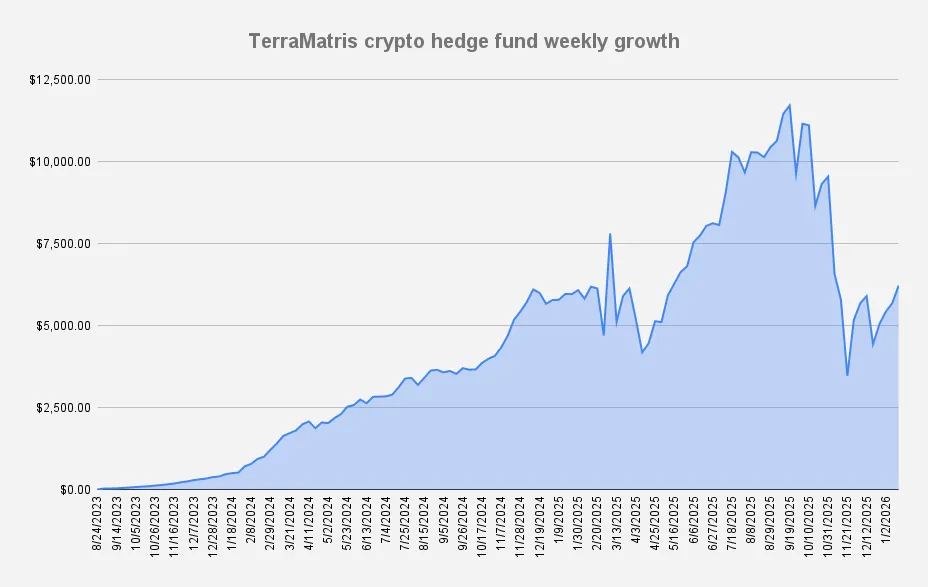

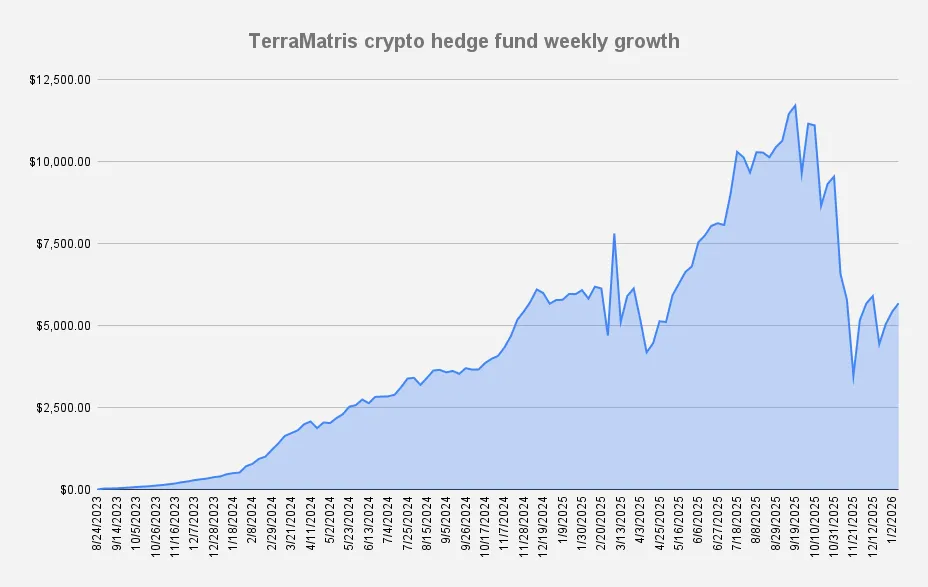

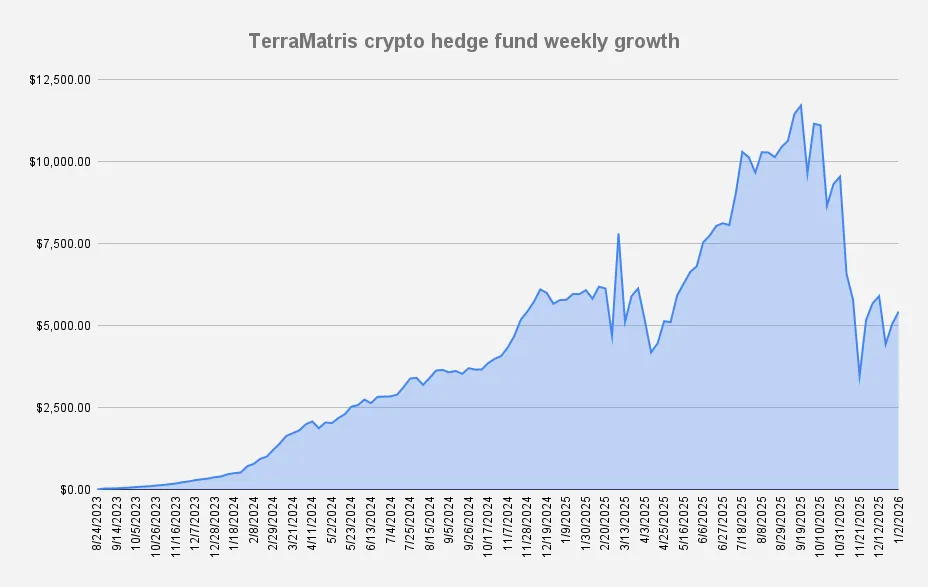

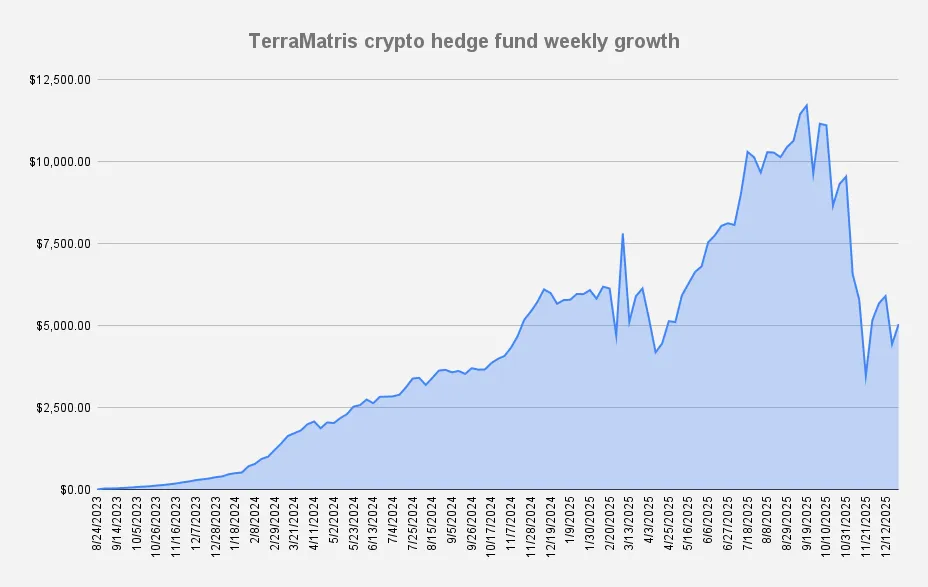

TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –51.47%. While YTD fund is up 6.14%, outperforming Bitcoin (+3.81%) and ETH (+4.55%).

Market Outlook (Bitcoin)Bitcoin has finally broken above its 50-day moving average, trading at $90,600 as of writing this article. While a short-term pullback has followed, a steeper recovery toward the 200-day moving average near $106,000 remains plausible. That said, it is still too early to confirm this scenario: bears could regain control, pushing BTC…

Ep 124: TerraM Multi-Asset Crypto Options Fund: +7.57% Weekly Gain to Start 2026

| Weekly updates | 54 seen

Greetings in 2026. The Terramatris team has traveled to the beautiful Palolem Beach in Goa, India, and with great excitement we are preparing the first weekly review of the new year. We wish everyone a strong and successful start to 2026.

As of January 2, 2026, the TerraM Multi-Asset Crypto Options Fund is up +7.57% week-over-week, encouraging start of the new year. While the crypto market remains in a consolidation phase, still trying to decide its next move, last week was relatively calm, with most gains coming from expiring options positions.

TerraM Multi-Assets Fund drawdown from all time high back in September 2025 is –53%. While Year-to-date, our Fund is up 0.85%, underperforming Bitcoin (+1.76%) and ETH (+2.06%).

Options IncomeThis week, the TerraM Multi-…

Ep 123: How TerraM Generated 5.4% Weekly Returns Using In-the-Money Covered Calls

| Weekly updates | 67 seen

As of December 26, 2025, the TerraM Multi-Asset Crypto Options Fund is up +13.77% week-over-week, encouraging result after previous weeks sharp drop. With only a few days left in 2025, crypto appears to be searching for a footing as it heads into 2026.

TerraM Multi-Assets Fund drawdown from all time high back in September is –56%. While Year-to-date, our Fund is down –11.12%, underperforming Bitcoin (–4.57%) and ETH (–10.59%).

Options IncomeThis week, the TerraM Multi-Asset Fund generated $276 in options premiums, what is impressive 5.4% weekly return on capital. The increase in options income comes from selling in-the-money covered calls below our breakeven, which raises premium income but caps upside. On the positive side, we continue selling below breakeven and are…