Hello and welcome! My name is Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund. Today, you are watching our weekly update on the latest happenings in our hedge fund. Let’s get started.

First, I want to apologize to our regular viewers for missing a few weeks of updates. I was busy with some of our real estate projects and wasn’t physically present in Georgia. However, I remained active in the markets during this time, even though I couldn't record videos. I'll do my best to ensure this doesn’t happen again and commit to weekly updates.

TerraMatris is a private crypto hedge fund managed by me, Reinis Fischer. The fund is privately held and not publicly registered, though it is available for investment through decentralized liquidity pools like Radium. The fund operates primarily from Georgia, but I manage it remotely when traveling.

Investments in stocks, funds, bonds, or cryptos carry risks. You could lose some or all of your money. Please conduct your own due diligence before investing in any asset.

Trading Strategy

At TerraMatris, we primarily sell one-day-to-expire put options on Bitcoin and covered calls on established positions like Ethereum and Solana. We recently started selling covered calls on Bitcoin as well. We reached 0.01 BTC in our trading account through put premiums, but due to market volatility, our Bitcoin got called away. We decided to take the money and roll out, reinvesting all premiums back into crypto.

Our portfolio includes Bitcoin, Ethereum, Stellar Lumens, USDC, Solana, Jupiter TokenFI, and PAXG. However, we plan to narrow our focus to Bitcoin, Ethereum, and Solana while maintaining exposure in USDC.

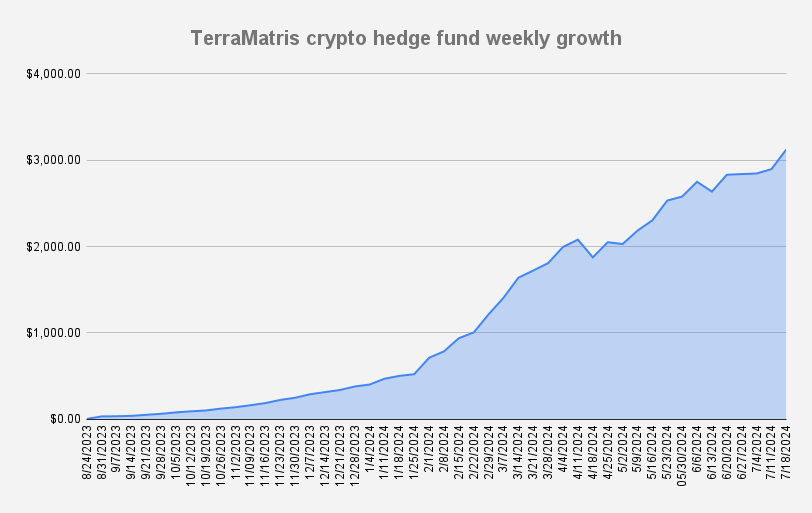

We practice dollar-cost averaging by buying coins daily. This is week 48 since the start of the fund, and this week we have been reinvesting premiums into Bitcoin and Solana.

Our risk management strategy involves trading put options with a high probability of expiring worthless. If a trade goes against us, we roll it forward for a credit and may hedge with futures. Recently, we went long with Bitcoin perpetual futures contracts when the price dropped from $63,000 to $54,000. We started selling covered calls against these positions, and despite the challenges, we believe our risk management strategy will help us recover.

This week, we aim to generate a minimum of $17 daily from options premiums. However, due to trade adjustments, we haven’t reached this goal. Instead, we are reinvesting USDC from selling Bitcoin back into crypto.

I'm thrilled to announce that as of July 18, 2024, we have reached an all-time high of $3,124! Reaching this milestone has been challenging, but we’re excited about the progress. We have also added more TerraM tokens to the liquidity pool and started our first buyback, which has increased the token price.

Bitcoin is currently trading above its 50 and 200-day moving averages, around $64,000. However, a possible pullback to $59,000 is not excluded. We remain cautious and continue our strategy.

TerraM Token Update

There are 10,000 TerraM tokens minted on the Solana blockchain. They can be swapped for USDC on Raydium or Jupiter. Currently, 409 tokens are available in the liquidity pool, with the price increasing weekly due to our buyback strategy.

This week has been incredible with our portfolio reaching new heights. I’m excited about the future and the growth of TerraMatris. If you have any questions or comments, please reach out. Thanks for watching, and see you soon!