Good morning, ladies and gentlemen. My name is Reinis Fischer, and I'm the CEO and founder of Terramatris Crypto Hedge Fund.

Today is May 31st, 2024. It's Friday, and I'm recording with updates on our fund and activities from the past week. I must apologize for missing a day; I usually record these videos on Thursdays, but yesterday I was a bit busy with other matters.

Therefore, all the information in this video might be delayed by one day, but it still remains relevant.

Let's begin, as usual, with a quick overview. Terramatris is a private crypto investment hedge fund managed by me. This fund is privately held and not publicly registered, so it is available for investment through Raydium Liquidity Pool, or direct investment.

The fund is primarily operated from Georgia.

Disclaimer: investments in stocks, funds, bonds, or cryptos are risky, and you could lose some or all of your money. Please do your own due diligence before investing in any assets. At Terramatris, our trading strategy focuses on selling one-day-to-expiry put options. Additionally, we might sell covered calls on already established positions, currently held in Ethereum and Solana.

We are raising funds and aiming to start selling call options on Bitcoin. One of our ultimate goals is to have fully covered options on Bitcoin. While selling these one-day-to-expiry options, we reinvest the premiums back into crypto assets. We have a few select coins we are considering for our investment basket, including Bitcoin, Ethereum, Stellar Lumens, Solana, Jupiter, and PAXG.

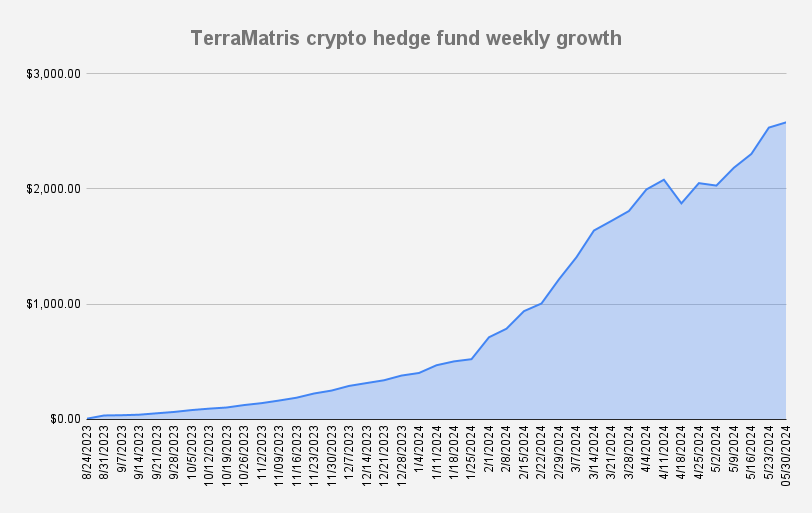

We are forming a diversified portfolio with a weighted average price, which we believe helps us avoid unnecessary market risks. This marks week 41 since we started the fund, and this week we decided to invest in Ethereum and Stellar Lumens. It's been a while since we last bought Stellar Lumens, and we felt it was time to increase our holdings.

Let me briefly explain why we believe Stellar Lumens is a great coin for our portfolio. We see great potential for Stellar Lumens to reach previous highs of at least $0.60-$0.70 per coin. With today's average price around $0.10-$0.11 per coin, we see significant potential returns. Although we don't know when or if it will happen, we want to be prepared.

Risk management is at the core of our trading strategy. When entering these options trades, we first and foremost look for high-probability trades that will expire worthless, meaning we trade options with a delta of -0.10 at least. However, the market can still move against us, and if that happens, we will look to roll forward, buying back those positions and selling them for a credit loss.

We might hedge with futures if necessary. By hedging with futures, I mean we might use Bitcoin perpetual futures, which we currently have access to but haven't yet used for hedging. Alternatively, we might use stop losses if we are seriously challenged with no other way out of the trade. However, as we avoid overusing leverage, the chances of needing stop losses are slim.

Additionally, we may keep buying long-duration put options, meaning if the market goes against us, we can gain from these long put options. Every week, we set some weekly goals for our fund. This week, our goal was to target at least $10 daily from options premiums while reinvesting these premiums back into Ethereum. So far, this strategy is working well.

Yesterday, on May 30th, 2024, our fund reached an all-time high of $2,578.35, a week-over-week growth of just under 2%, or $45.93 in dollar terms. While this isn't the fastest growth in our portfolio, we are slightly concerned about a possible pullback due to a lack of strong demand.

We are confident in our fund's strategies, although we notice that Bitcoin might be losing momentum and could drop in the coming weeks. We will discuss this in more detail in the next slides.

Regarding Bitcoin trade adjustments, we have been adjusting a few Bitcoin put options since mid-April. As of today, May 31st, 2024, all of those adjusted options are expiring worthless, leaving us with no more trade adjustments at the end of the day, which is excellent news.

At the beginning of May, some hedge fund managers were pessimistic about Bitcoin, but May turned out to be a good month for Bitcoin and our Terramatris Crypto Hedge Fund.

Now, let's discuss different market trends and analyses. Looking at the Bitcoin one-day chart, we see a bullish market as Bitcoin tries to stay above its 50- and 200-day moving averages. However, we see a possible pullback to $65,000 or even $61,000.

We are more bullish but prepared for the worst. We consider technicals while constructing our options trades.

Bitcoin 52 weeks challenge

Last week, we decided to launch a 52-week Bitcoin futures challenge, investing in 0.01 Bitcoin weekly using 10% leverage on long vertical futures.

We aim to sell a call option on Bitcoin long futures after ten weeks, achieving a dollar-cost-average price and maintaining enough margin cushion.

This week, we bought our first batch of Bitcoin at around $67,000. Depending on next week's price, we will continue buying to achieve an average price. This will help us maintain control over our trades. We will discuss this more in future updates. Additionally, I've been fundraising on LinkedIn, connecting with many people from the crypto and trading industries, which has resulted in some interesting discussions and potential partnerships.

Fundraising over LinkedIn

I've been using LinkedIn to share details about our fund's performance, and this week, I sent out a message highlighting our 540% performance increase. This has generated interest from potential investors, and I've had several meetings set up. We are looking for a minimum $10,000 investment in our hedge fund. You can invest directly with us or through our native TerraM token on Raydium or Jupiter networks.

There are 364 TerraM tokens available for investment, with a starting price of $1.17 per token. If you're interested in investing more than what's available in the liquidity pool, we offer direct investments in the TerraM token, capped at 200 tokens per investor to ensure equal opportunities for everyone.

That's all for this week's update. If you have any questions or would like to learn more or schedule a call with me, feel free to reach out. Thank you for watching, and see you next week.