Good Morning, Ladies and Gentlemen!

My name is Reinis Fischer, CEO and Founder of Terramatris, a private crypto hedge fund. Today is August 8th, 2024, and I'm here to share an update on the happenings in our crypto portfolio over the past week. But before we dive into the details, let me briefly introduce you to Terramatris and what we do.

What is Terramatris?

Terramatris is a private crypto investment hedge fund, managed by me, Reinis Fischer. The fund is privately held and not publicly registered, but it’s available for investment via a decentralized Radium liquidity pool through our TerraM token. Our operations are primarily based in Tbilisi, Georgia, but this week I’m reporting from the beautiful coastal town of Omiš, Croatia, nestled along the Adriatic Sea.

Quick Disclaimer: Investments in stocks, funds, bonds, or cryptocurrencies are risky. You could lose some or all of your money. Please conduct your own due diligence before investing in any kind of asset, including TerraM tokens.

Our Trading Strategy

At Terramatris, we employ a specific trading strategy focused on options trading. We primarily sell one-day-to-expiry put options on Bitcoin, alongside covered calls on established positions. Currently, our established positions include Ethereum and Solana. The premiums we collect are reinvested back into cryptocurrency, utilizing a select basket of coins, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stellar Lumens (XLM)

- USDC (USD Coin)

- Solana (SOL)

- Jupiter Token (JUP)

- PXG (Tokenized Gold)

- Toncoin (TON)

By reinvesting premiums daily, we follow a dollar-cost averaging strategy, gradually building up our portfolio.

Week 51: A Challenging Week

This week marks the 51st week since the inception of Terramatris, and it’s been an eventful one. I was en route to Split, Croatia, when the crypto market experienced a significant crash. Bitcoin plummeted from $57,000 to $51,000 during my flight, underscoring the importance of risk management in options trading.

Risk Management at Terramatris

When opening trades, we target high-probability options with a delta under -0.05, aiming for them to expire worthless. If a trade gets challenged, we roll forward for credit, hedge with futures, or, if necessary, take a stop loss. Sometimes, we also buy long put options with over 45 days to expiry.

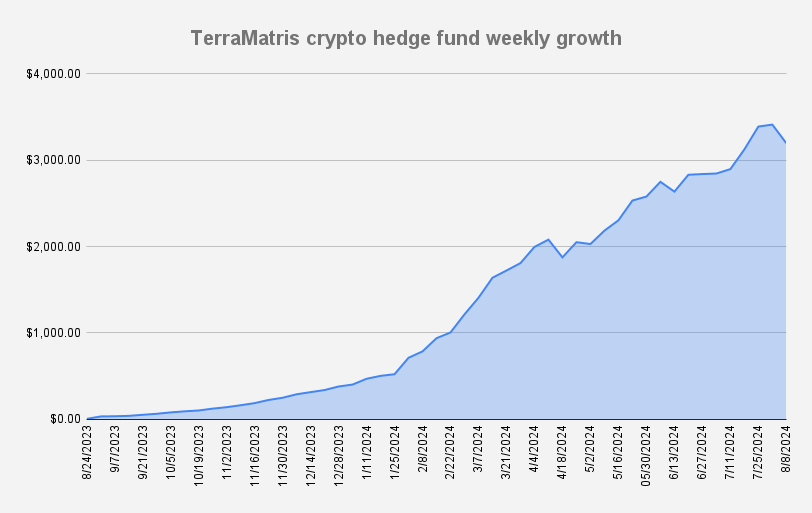

This week was particularly tough in managing risk. Given the significant market drop, our fund experienced a week-over-week decline of over 6%, with our portfolio value standing at $3,195,64 as of today, reflecting a loss of more than $215.

Weekly Goals and Adjustments

Our goal this week was to invest at least $10 daily in Bitcoin and Toncoin. However, due to the market conditions, we paused opening new put trades and focused on adjusting our existing positions. One of the key adjustments involved rolling forward a Bitcoin put option with a strike price of $57,000, which we had opened when Bitcoin was trading at $61,000. The sudden drop to $51,000 necessitated quick action to manage our risk exposure.

Market Trends and Technical Analysis

Currently, Bitcoin is trending below its 200-day moving average, which is a concerning sign. We are closely watching for a potential death cross on the one-day chart, which could trigger further sell-offs, potentially driving the price down to $48,000 or even lower. While we remain optimistic, we are prepared for continued volatility and will be cautious with new trades until the market stabilizes.

TerraM Token and Investment Opportunities

If you’re interested in investing in the Terramatris fund, you can do so via our TerraM token, available on the Radium liquidity pool. There are 10,000 tokens in total, with 374 currently available at a starting price of $1.55 per token. Due to market conditions, we decided to pause our buyback this week, but we anticipate resuming once the market stabilizes.

Swap on Raydium (Solana supported wallet required)

For those looking for a more personalized approach, direct investments into the fund are also possible, with a minimum investment of $10,000.

Final Thoughts

This week has been a tough one for our portfolio, with significant market volatility challenging our trading strategy. However, we remain committed to our long-term vision and are confident in our ability to navigate these turbulent waters. As we approach the one-year anniversary of Terramatris, we continue to focus on disciplined risk management and strategic investment.

Thank you for your continued support, and I look forward to sharing more updates with you next week.

Reinis Fischer

CEO & Founder, Terramatris