Hello, my name is Reinis Fischer, CEO and Founder of the Terramatris Crypto Hedge Fund. Today is July 25th, 2024, and I’m excited to share the latest developments from our hedge fund.

Introduction to Terramatris

Terramatris is a private crypto investment hedge fund managed by me. It is privately held and not publicly registered, making it available for investment over decentralized automated market makers. Our fund operates primarily from Tbilisi, Georgia.

Disclaimer

Investments in stocks, funds, bonds, or cryptocurrencies carry risk. You could lose some or all of your money. Always perform your own due diligence before investing in any asset, including TerraMatris.

Trading Strategy at Terramatris

At Terramatris, our primary strategy involves selling puts on Bitcoin and Ethereum while also selling covered calls on our established positions. We maintain long positions in Ethereum and Solana and reinvest all premiums back into crypto assets. This week, we’ve chosen to invest in two tokens: TokenFi (TokenFi) and XLM (Stellar Lumens), as both have experienced significant price drops.

Weekly Trading Activity and Adjustments

Our focus this week has been on managing and adjusting trades to optimize our positions. We have:

- Short Bitcoin Puts: We are holding a short position of 0.04 BTC with a $60,000 strike expiring at the end of the year.

- Long Bitcoin Calls: We have 0.05 BTC long calls expiring tomorrow, July 26, 2024. With Bitcoin currently at $64,000, these calls are in the money, necessitating trade adjustments.

Risk Management

Our risk management strategy involves:

- Rolling Forward for Credit: If a trade goes against us, we buy back the put option and roll it forward, preferably at a lower strike price.

- Using Futures for Hedging: We occasionally hedge with futures, especially during significant market drops, like the recent Bitcoin dip to $54,000.

- Buying Long-term Options: We buy options with more than 45 days to expiry for added protection against market volatility.

Weekly Goals and Results

Our weekly goal is to generate a minimum of $10 daily from options premiums. Although we’ve been more observant this week due to market conditions, we’ve still made strategic trades and reinvested the premiums.

Market Trends and Technical Analysis

Currently, Bitcoin is trading above its 50 and 200-day moving averages, indicating a bullish trend. We use technical analysis to guide our trades, ensuring we make informed decisions.

Achievements

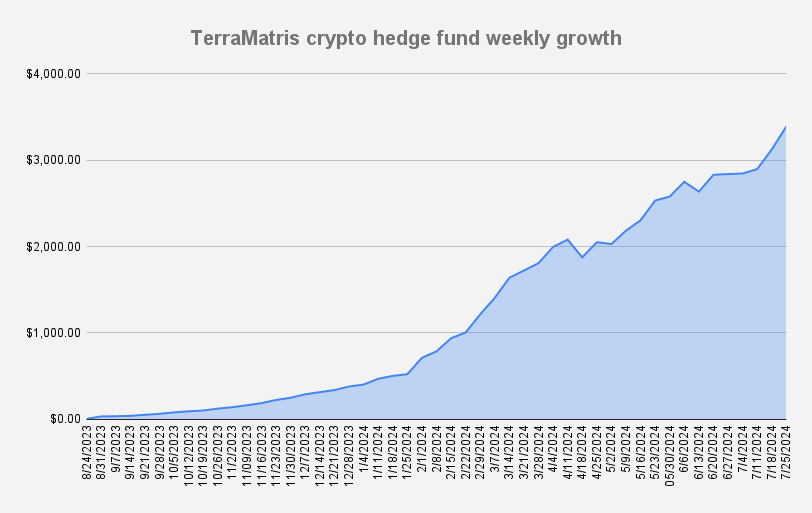

This week, we reached an all-time high of $3,389, an impressive 8% growth compared to last week. This marks a significant milestone as we approach our 50th week. Our journey from $1,000 to $3,000 has been marked by careful strategy and adjustments, and we’re optimistic about reaching $4,000 soon.

Conclusion

At Terramatris, we strive to remain market-neutral and pragmatic. We don’t expect Bitcoin to reach extreme highs or lows but prepare for various scenarios to ensure stability and growth. Our focus remains on strategic trading, risk management, and reinvestment of premiums to maximize our fund's potential.

Thank you for joining us in this update. Stay tuned for more insights and developments from Terramatris.

Note: For any investment advice, consult a financial advisor. The information provided here is for educational purposes only.