Good morning, ladies and gentlemen. My name is Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund. Today is August 29, 2024, and I’m excited to share the latest developments within TerraMatris Crypto Hedge Fund, as well as significant happenings in the broader cryptocurrency landscape. Let’s dive in.

About TerraMatris Crypto Hedge Fund

For those new to our community, TerraMatris is a private crypto investment hedge fund managed by me, Reinis Fischer. TerraMatris is privately held and not publicly registered, making it exclusively available for investment through our decentralized liquidity pool on Raydium.

Our fund primarily operates from Tbilisi, Georgia. As always, please note that investment in stocks, funds, bonds, or cryptocurrencies carries inherent risks. We encourage you to conduct your own due diligence before investing in any asset.

Our Trading Strategy

At TerraMatris, our trading strategy is both sophisticated and strategic. We primarily engage in selling one-day to expiry put options on Bitcoin. Additionally, we sell covered calls on our established positions, which currently include Ethereum and Solana. The premiums received from these options are reinvested back into the crypto market, allowing us to maintain a select basket of cryptocurrencies. Our current investments include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stellar Lumens (XLM)

- USD Coin (USDC)

- Solana (SOL)

- Jupiter Token (JUP)

- PXG

- Ton Token (TON)

We also hold minor positions in other coins such as USDT, but our core focus remains on the aforementioned assets. Our dollar-cost averaging strategy ensures consistent investment regardless of market fluctuations, a practice we have successfully maintained for over a year.

Risk Management: A Pillar of TerraMatris

Effective risk management is crucial for any successful hedge fund. At TerraMatris, we employ several strategies to mitigate potential losses:

- High-Probability Options Trades: We target options with a Delta under -0.10, increasing the likelihood of trades expiring worthless.

- Rolling Forward Positions: If our positions are challenged, we roll them forward for additional credit.

- Futures Hedging: We hedge our positions using futures contracts to offset potential losses.

- Stop Losses: Implementing stop losses on both our options and futures contracts helps protect our investments from significant downturns.

Hedging with Futures

Hedging with futures is a key component of our risk management strategy. We employ two primary methods:

- Long Bitcoin Perpetual Futures: If Bitcoin’s price drops significantly, we buy long Bitcoin futures to mitigate losses from put options.

- Trigger-Based Market Orders: When placing new options trades, we add a protective short futures trade at a strike price approximately $1,000 below our current option strike price. This approach helps offset potential losses if Bitcoin experiences a sharp decline.

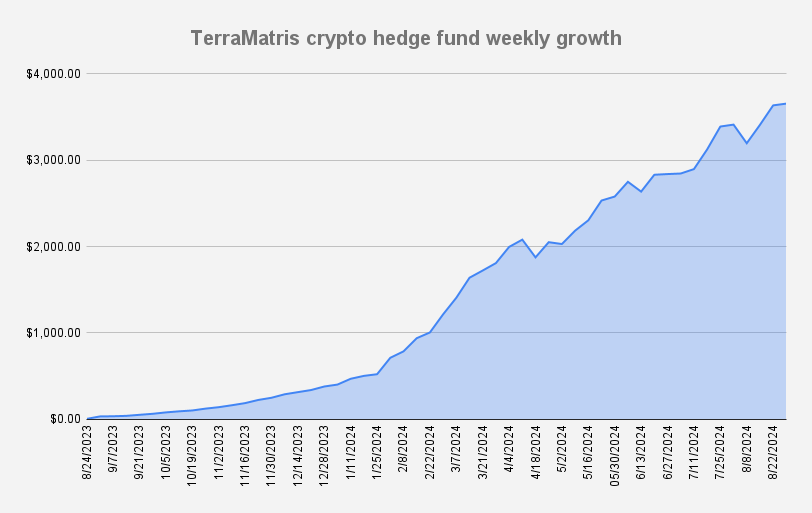

Over the past year, TerraMatris has successfully navigated several steep market drops, consistently recovering and maintaining the fund’s value. Implementing comprehensive hedging strategies has the potential to significantly enhance the fund’s performance.

Weekly Goals and Performance

This week, TerraMatris focused on investing a minimum of $12.50 daily. While premium earnings were modest, approximately $20 per week, our strategic adjustments have kept us in a strong position. The recent market crash in early August required us to roll forward some trades to the December expiry, but we remain well-capitalized and continue to invest in select cryptocurrencies:

- Ethereum (ETH): $5 per ETH

- Solana (SOL): $5 per SOL

- Ton Token (TON): $2.50 per TON

Despite market volatility, TerraMatris reached an all-time high of $3,654.39 on August 29, 2024, demonstrating our resilience and strategic prowess. Our short hedges have effectively offset losses, ensuring a positive end to the week.

TerraM Token: Empowering Our Community

TerraM Token is a unique opportunity for investors to participate in our fund. With a total of 10,000 TerraM tokens minted on the Solana blockchain, investors can swap USDC for TerraM tokens via Radium’s automated market maker. Currently, 374 TerraM tokens are available on the market, starting at $155 per token. To ensure minimal slippage, we offer over-the-counter or private capped purchases of up to 200 tokens at a fixed price of $155 each.

We are actively buying back TerraM tokens from the liquidity pool, which supports the token’s price and benefits our investors. Alternatively, direct investment into our fund is possible with a minimum commitment of $10,000, although we are primarily focused on attracting TerraM token holders.

Market Trends and Technical Analysis

Bitcoin is currently trading below its 200-day moving average, presenting both challenges and opportunities. Potential resistance levels could push Bitcoin back to $62,000, although further declines to $49,000 remain a possibility. Our analysis remains optimistic, anticipating a rebound towards $62,000 in the near future.

TerraMatris continues to demonstrate robust performance through strategic trading and effective risk management. Our commitment to innovation and investor success drives us to explore new opportunities and refine our strategies continually.

If you have any questions or would like to learn more about TerraMatris and TerraM Token, please reach out via our YouTube channel, personal blog, or the TerraMatris website. We welcome your inquiries and are here to support your investment journey.

Thank you for being part of the TerraMatris community. Stay tuned for more updates, and together, we aim to achieve new heights in the crypto market.

See you next week, and let's aim to crack that $4K milestone!