Good morning, ladies and gentlemen. My name is Reinis Fischer. Today is June 14, 2024, and I'm recording this video for Terramatris, covering happenings in the last week. I usually record these videos on Thursdays, but today is Friday. The data recorded in this video covers one week until yesterday, Thursday, June 13, 2024. I'm here in AXIS Tower, and you might see my friend Dino in the background. Let's begin.

If you don't know what Terramatris is, let me give you a brief overview. Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. The fund is privately held and not publicly registered, so it's available for investment over Raydium liquidity pool. The fund is mostly operated from Tbilisi, Georgia.

Remember, investments in stocks, funds, bonds, or cryptos are risky, and you could lose some or all of your money. Do your own due diligence before investing in any kind of asset, including Terramatris.

That said, let me briefly cover our trading strategy here at Terramatris.

We mostly trade one-day-to-expiry put options on Bitcoin. Additionally, we sell covered calls on already established positions. So far, we have established positions on Ethereum and Solana. All the premium we receive is reinvested back into crypto itself. We have a select pool of crypto coins, including Bitcoin, Ethereum, Stellar Lumens, USDC, Solana, Jupiter Token, and PAXG, but we are looking to narrow it down and stick only with Bitcoin, Ethereum, and Solana. Additionally, we might keep holding tokenized gold (PAXG), but that's something we're going to work out in the coming weeks and months.

With this approach, we are averaging our prices, which makes a nice average weighted price. Every week, we choose one or a few coins or tokens to invest in. This has been week 43, and this week we have been investing in Solana and Token Fi. When placing those put option trades, we look for high-probability options trades that are likely to expire worthless. One of our risk management strategies, in case the market goes against us, is to buy back those put options and roll them forward for a credit. Additionally, we might hedge with futures, something we haven't done yet, but we might consider it. We also consider using stop losses if the market goes completely against us, but with proper risk management, we don't seriously consider using stop losses at this stage.

How well have we managed so far? The crypto hedge fund might buy more than 45-day-to-expiry long put options, giving us a cushion of protection in case of a market correction. These long put options will add value to protect us.

Weekly goals: every week, we set ambitious goals for the fund. This week, we targeted a minimum of $12 daily from options premium while reinvesting all this premium into Solana and Token Fi. Currently, we have established covered gold positions with Solana, and we hope to double our Solana holdings soon. This will allow us to set more goals with Solana.

Token Fi is a real-world asset token, which we are bullish on in the long term. We see this as a great entry point into real-world asset tokenization. Speaking of that, this week, I met with some of our investors at Terramatris and received an interesting offer involving the Terram token, which I will talk about in a moment.

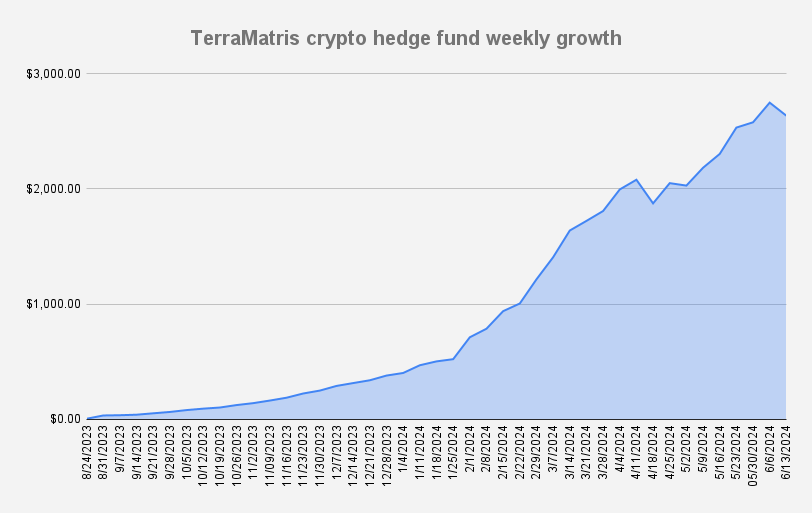

Weekly results: this week, the Terramatris crypto hedge fund reached $2,635.77 on June 13, 2024, which represents a week-over-week decrease of more than -4% or in dollar terms, -$113.35. This is the third week since the establishment of this fund when there has been a drop. However, we are not very concerned because we have a well-managed portfolio, and it seems more like a correction. I am not sure where the market is heading, something we will discuss in one of the next slides when we overlook what’s happening with Bitcoin.

So far, it's quite good. We don't have any losing positions; it's just the crypto market movements. There were no trade adjustments this week. During the week, we had a trade adjustment as Bitcoin pulled back from $69,000 to $67,000. Some of our positions went underwater, but we made more than our daily $12 premium this week.

Let’s see what’s happening in the market with Bitcoin. We are still bullish as it trades above its 50- and 200-day moving averages. However, we are sitting on its last 50-day moving average from a technical trading perspective. There is a possible bounce up from here, but we are also looking for a possible pullback to $65,000 and potentially to the 200-day moving average at $57,000, which aligns with a previous drop. It's important to be careful when placing trades and not over-leverage.

Other activities: we started a 52-week Bitcoin challenge with perpetual contracts using leverage. Every week, we buy 0.001 Bitcoin futures and leverage them. Once we have enough value of Bitcoin, we will sell call options on that contract. I have also been fundraising on LinkedIn and interacting with potential investors. We are looking for one spot for a minimum $10K investment in our fund.

This week, I met with one of our top investors and got an interesting offer to buy real estate in Tbilisi, Georgia, using leverage and also using Terramatris to finance and refinance. Real estate is not something we are very excited about, especially now with the market prices, but we are open to such deals.

If you have any questions about how Terramatris could help in financing a real estate purchase, don't hesitate to contact me to learn more. There are two ways to potentially invest with us: either through a direct investment, which we negotiate, or on your own with the Terram token.

There are 10,000 tokens available on the Solana blockchain, and it's possible to swap USDC for Terram on Radium. For that, you will need a Solana-supported wallet, such as Phantom. Currently, there are 344 Terram tokens available on the Raydium liquidity pool with a starting price of $1.17 per token. If you want to acquire more than what is available on the liquidity pool, contact me, and we can make a deal.

To summarize, this has been a cautious week with Bitcoin pulling back and our portfolio decreasing slightly in value. Despite these challenges, we are well-managed with no trade adjustments and are continuing to grow.

Thank you for watching, and see you soon.