Blog

Episode 106 / Ethereum Nears $5K as Terramatris Fund Surges +83.97% YTD

| Weekly updates | 157 seen

As of August 29, 2025, the Terramatris crypto hedge fund value stood at $10,448 what is an increase of +3.02% or +$306 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

Just like the previous week, this one was also marked by significant volatility. Ethereum (our bread and butter) surged to nearly $5,000 — a new all-time high — before pulling back to $4,360at the time of writing. We believe that if ETH breaks above $5,000, another major rally could follow — perhaps toward $7,000? That’s just speculation, of course. Nevertheless, as put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +83.97%.

Current Long Perpetual Futures (USDT Settled)1.6 ETH – Break-even: $4…Trading Covered Calls on XRP with Deribit

| Crypto Options | 139 seen

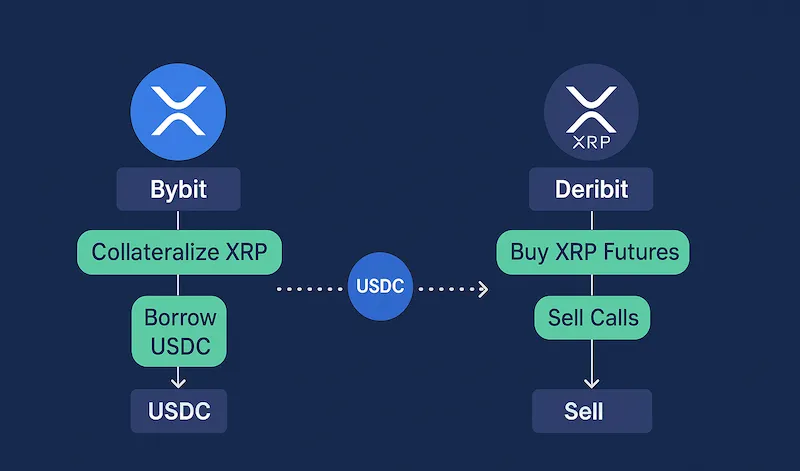

At Terramatris we are always exploring new ways to structure option strategies around crypto assets. One of the more interesting challenges we’ve faced recently is figuring out how to trade covered calls on XRP.

Our favorite trading platform, Bybit, unfortunately does not yet offer XRP options. That left us looking for alternatives, and naturally, Deribit became our next candidate. Deribit does offer XRP options, but as always, the devil is in the details.

The Challenge: Collateral Rules on DeribitDeribit lists XRP options, but they are settled in USDC. At the time of writing, there is no way to post XRP directly as collateral for call selling. This complicates things because in a “classic” covered call setup, you’d hold the underlying asset (XRP in this case) and sell…

Episode 105 / ETH Volatility, Options Income of $170, and New Plume Position

| Weekly updates | 135 seen

As of August 22, 2025, the Terramatris crypto hedge fund value stood at $10,142 what is a decrease of -1.37% or -$140 in dollar terms when compared to the last week.

The past week has been quite turbulent, with Ethereum fluctuating between 4,600 and 4,000. At one point, we even considered hedging by shorting part of our position with perpetual contracts, but ultimately decided against it. The week ended on a positive note, as all of our weekly options expired worthless. The decline in portfolio value mainly came from the depreciation of our long-term holdings.

Despite negative performance in crypto markets we are still just a few hundred dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

…Managing Risk: Rolling Forward and Hedging With Trigger-Based Shorts

| Crypto Options | 31 seen

In the past week, one of our ETH option positions came under pressure. We were short 1.7 ETH put contracts with a 4100 strike expiring on August 22. With ETH price action weakening, the trade started to look challenged.

At Terramatris, our primary focus is risk management. Collecting option premium is attractive, but holding onto a position that feels unsafe can quickly turn into a liability. We therefore took a hard look at our choices:

Roll forward to a later expiry to keep premium income flowing.Hedge with futures to neutralize delta risk.Combination strategies, blending both approaches.Why It Felt UnsafeNear-dated puts carry high gamma risk. If ETH sold off aggressively before expiry, our margin exposure would spike, forcing reactive hedging at poor prices. That is not…

Episode 104 / Wyoming LLC Launch, Ethereum Rally & $137 Weekly Income

| Weekly updates | 83 seen

As of August 15, 2025, the Terramatris crypto hedge fund value stood at $10,283 what is a decrease of -0.11% or -$10 in dollar terms when compared to the last week. As we had some small business expenses last week (Registered agent service fee – Wyoming LLC incorporation), for which we used part of our fund’s capital, we still consider it another stellar week.

We are still just a few dollars shy of our all-time high recorded earlier this summer—an encouraging sign of the fund’s resilience and upward momentum.

YTD our crypto hedge fund is +81.06%.

Current Long Perpetual Futures (USDT Settled)1.7 ETH – Break-even: $4,697 | Short puts: $4,10013 SOL – Break-even: $199.38 | short puts: $180This week saw another strong rally for Ethereum, climbing from $3,900 to $4,…

Episode 103 / Crypto Hedge Fund Update: $10,294 Value, SOL Strategy Shift, and TerraM Airdrop

| Weekly updates | 61 seen

Greetings from Thessaloniki, Greece

This week, the Terramatris team has traveled to beautiful Thessaloniki to celebrate a special occasion—our CEO’s 40th birthday!

With fresh sea breezes, delicious local cuisine, and surprisingly excellent bulk wine, this coastal city has proven to be a true hidden gem in the heart of Europe. Thessaloniki offers a perfect balance between modern energy and historic charm, and it’s been the ideal backdrop for both celebration and exploration.

As we've immersed ourselves in the culture, we've also taken note of the local financial landscape. Interestingly, we’ve come across several brokerage names during our time here, suggesting that crypto investing and digital asset funds are gaining traction in Greece.

That said:…

Episode 102 / Options Premiums Hit $125 This Week – 1.29% Weekly Return for Crypto Fund

| Weekly updates | 37 seen

As of August 1, 2025, the Terramatris crypto hedge fund value has dropped to $9,673 what is a decrease of -4.59% or -$465 in dollar terms when compared to the last week. Considering we returned more than $500 in loan capital last week, the performance remains encouraging.

YTD our crypto hedge fund is +70.31%.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $124,002 | Short puts: $108,0001.7 ETH – Break-even: $3,954| Short puts: $3,3005 SOL – Break-even: $163.27 | short puts: $168As long as SOL stays above 168 by next Friday's expiry we will be break even on this position, thus freeing up funds for other options trades. Awesome.

We sell weekly options every Friday, which is why this update is published at the end of the week.

…Episode 101 / Crypto Fund Hits Record Options Premium Week with $418 Earned

| Weekly updates | 36 seen

As of July 25, 2025, the Terramatris crypto hedge fund value was $10,138 what is a slight decrease of -1.61% or -$166 in dollar terms when compared to the last week. A healthy pullback after few strong weeks. YTD our crypto hedge fund is +78.50%. Awesome!

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $125,277 | Short puts: $109,0001.7 ETH – Break-even: $3,448 | Short puts: $3,3005 SOL – Break-even: $173.87 | short puts: $170We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $418 from options premiums, translating to a 4.12% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

This has been our best-performing week…

Episode 100 / $10K Achieved! Terramatris Crypto Fund Celebrates Week 100 with Strong Gains

| Weekly updates | 32 seen

Welcome to Episode 100 – A Historic Milestone!

On this special 100th episode dated July 18, 2025, we’re thrilled to announce that the Terramatris Crypto Hedge Fund has reached a major milestone: $10,304 total fund value, breaking the $10K barrier for the first time ever!

This week alone, we posted a strong +14.04% gain, or +$1,268 in dollar terms. Absolutely awesome!

It took us exactly 100 weeks to grow to $10,000, and while the first ten grand was a grind, we’re optimistic the next $10K won’t take nearly as long. In fact, we’re aiming to double the fund’s value within a year — and all this without adding any outside capital.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $128,767 | Short puts: $112,0001.8 ETH – Break-even: $4,013 | Short…Episode 99 / Terramatris Crypto Fund Weekly Report: +$963 Growth, ETH Rally, and New Synthetic Covered Calls

| Weekly updates | 26 seen

As of July 11, 2025, the Terramatris crypto hedge fund value has grown to $9,036 showing very strong weekly growth of +11.93% or +$963 in dollar terms. Week after week, we continue breaking milestones — and this week, we’ve set a new all-time high. Absolutely awesome! As we’ve just crushed several of our key milestones, another TerraM token buyback and liquidity boost is now in the pipeline.

Current Long Perpetual Futures (USDT Settled)0.02 BTC – Break-even: $129,070 | Short puts: $112,0001.8 ETH – Break-even: $3,448 | Short puts: $2,7005 SOL – Break-even: $165.86 | Long calls: $156We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $155.47 from options premiums, translating to a 1.72%…