Blog

Ep 109: TerraM Fund Weekly Report – Value at $11,719, +2.25% Weekly, +106% YTD

| Weekly updates | 34 seen

As of September 19, 2025, the TerraM crypto fund value stood at $11,719 what is an increase of +2.25% or +$257 in dollar terms when compared to the last week. Absolutely brilliant!

Last few weeks have been quite rewarding in crypto markets, with some type of consolidation forming.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our main TerraM fund is +106.33%. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options IncomeWe sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $160 from options premiums, translating to a 1.36% weekly return on capital. Our…

Why We Launched Solana Covered Call Growth Fund

| Funds | 124 seen

On September 4, 2025, Terramatris LLC officially launched its Solana Covered Call Growth Fund, a specialized investment vehicle designed to combine the growth potential of Solana (SOL) with disciplined income generation through covered call strategies. The fund began with an initial seed investment of $100 from TerraM and a net asset value (NAV) of 1.00, setting the foundation for future expansion.

Economics Behind the FundThe economic rationale of the fund is straightforward yet ambitious. By holding SOL tokens as the core asset, the fund is directly exposed to the appreciation potential of one of the fastest-growing blockchain ecosystems. At the same time, by systematically selling call options against these holdings, the fund generates additional yield, enhancing returns…

Ep 108: Fund Surges +7.69% This Week, Doubling Value in Under 9 Months

| Weekly updates | 47 seen

As of September 12, 2025, the Terramatris crypto hedge fund value stood at $11,461 what is an increase of +7.69% or +$818 in dollar terms when compared to the last week. Absolutely brilliant!

The week turned out better than expected, with bold moves - particularly in Solana. Most cryptocurrencies are trending higher, and to our surprise, the small position we began building in Plume just a few weeks ago is already up 40%.

As put sellers, we remain cautious, while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +101.79%. Absolutely remarkable - we’ve doubled the fund’s size in less than nine months. If the yearly pattern holds, we may be at the beginning of a run heading into Q4 2025. That said, we remain grounded and cautious.

Options…Episode 107 / Fund Grows 1.86% | New Solana Covered Call Fund & JUP Staking

| Weekly updates | 79 seen

As of September 5, 2025, the Terramatris crypto hedge fund value stood at $10,643 what is an increase of +1.86% or +$194 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

The past week started with some active moves — we even adjusted one ETH position by rolling it down and forward. However, as the days progressed, market activity slowed, and the week ended relatively calm, with little movement in crypto markets.

At this point, we might be entering a consolidation phase, setting the stage for a binary outcome — either the start of a bullish run or a sharp bearish attack.

As put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +87.38%.

Options Income…Jupiter (JUP): Why This Solana DeFi Token Caught Our Attention

| Investment ideas | 59 seen

At Terramatris, we believe in allocating small portions of our portfolio to projects with meaningful upside—a strategy that led us to JUP, the governance token of Jupiter, Solana’s leading DEX aggregator.

A Surprise Airdrop: A Door to ExplorationIn February 2024, we unexpectedly received JUP tokens via an airdrop in our Phantom wallet. This surprise grant sparked our curiosity. Since then, we’ve been steadily exploring Jupiter’s ecosystem—staking, voting, and observing its evolving DeFi utility—without letting excitement cloud our judgment.

What Is Jupiter—and Why It MattersJupiter is a decentralized exchange (DEX) aggregator on Solana, routing token swaps across over 20 liquidity sources like Raydium and Orca to find the best execution with low slippage It has grown…

Our Outlook on TON: Humble Investment Today, Moonshot Tomorrow?

| Investment ideas | 41 seen

At Terramatris, we regularly allocate a small portion of our fund to assets that we believe could have asymmetric upside potential — what we call moonshots. One of those tokens today is TON (The Open Network).

Our investment in TON is currently modest: at the time of writing, we hold just under 100 TON tokens, with a possible outlook to increase this allocation to 200–300 tokens in 2026. While this is a humble position compared to our core holdings, it reflects our conviction that TON has the potential to become a significant player in the crypto ecosystem.

There are a few key reasons why we believe in TON:

1. The Pavel Durov FactorAlthough Pavel Durov (the founder of Telegram and earlier, VKontakte) is not directly running TON — the project is now developed and…

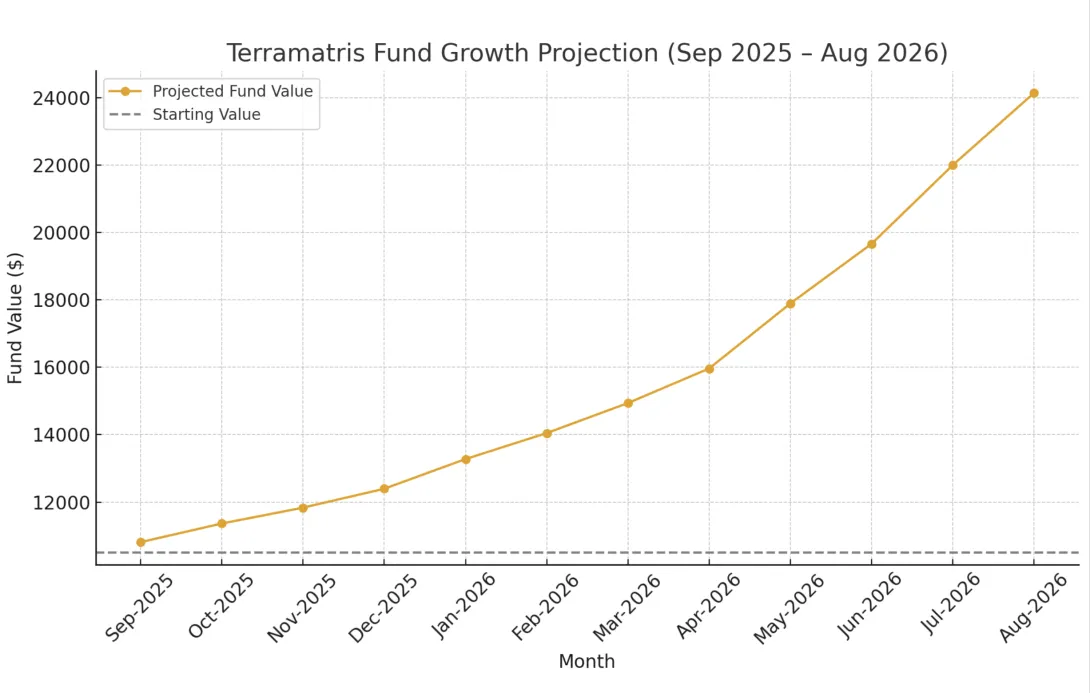

Wishful Thinking, Statistics, and Modeling: Where Could Terramatris Fund Be in September 2026?

| Research | 56 seen

On September 2, 2025, the Terramatris crypto hedge fund stands at $10,500. Out of this, roughly $3,500 is low-interest debt, which we are steadily repaying at a rate of $300–450 per month. If nothing changes, we expect to be debt-free by April 2026. Importantly, there is no real pressure to return these funds quickly; and if market conditions turn against us, we believe we could borrow back on similar terms without risk to the core strategy.

This puts Terramatris in a comfortable position: a five-figure portfolio, a clear debt-repayment path, and a robust options premium strategy that has been delivering consistent weekly returns.

The Options Premium EngineOur core edge comes from selling weekly options—primarily covered calls and short puts.

Base case (regular weeks): $…Why We Decided to Invest in Trump Coin

| Investment ideas | 47 seen

As part of our ongoing exploration of asymmetric opportunities in the crypto markets, we have decided to make a small, opportunistic bet on Trump Coin ($TRUMP). This position will not replace or alter our core holdings in Bitcoin, Ethereum, and Solana, but will instead be structured as a side challenge using a disciplined, incremental approach.

The 52-Week ChallengeWe will allocate to Trump Coin gradually over the course of one year. Starting with $1 in week one, increasing by $1 each subsequent week, and continuing through week 52, this strategy will total $1,378 in contributions if completed.

Initial funding: Early weeks will be financed from our existing cash balances.Later weeks: We may allocate a portion of weekly options premiums into Trump Coin, depending on market…TerraM Token Buyback and Liquidity Policy for 2025–2026

| TerraM token development | 56 seen

The TerraM token derives its value from the earnings generated by the Terramatris Fund. As the fund grows, a portion of that growth is systematically directed toward strengthening token liquidity. This structure is designed to provide existing token holders with improved price stability and reduced transaction slippage.

Liquidity Management PlanLiquidity is central to the long-term functioning of TerraM. Our structured plan includes:

Allocation Rule: For every $1,000 in net fund growth, $200 areadded to the Raydium liquidity pool through the TerraM:USDC pair.Objective: Increase the pool share from the current 4.10% of tokens to 6–7% over the next growth cycle.Expected Impact: By expanding liquidity, we aim to reduce slippage for token holders and support a more orderly…Episode 106 / Ethereum Nears $5K as Terramatris Fund Surges +83.97% YTD

| Weekly updates | 157 seen

As of August 29, 2025, the Terramatris crypto hedge fund value stood at $10,448 what is an increase of +3.02% or +$306 in dollar terms when compared to the last week. Also we have set another all time high. Awesome!

Just like the previous week, this one was also marked by significant volatility. Ethereum (our bread and butter) surged to nearly $5,000 — a new all-time high — before pulling back to $4,360at the time of writing. We believe that if ETH breaks above $5,000, another major rally could follow — perhaps toward $7,000? That’s just speculation, of course. Nevertheless, as put sellers, we always remain cautious while maintaining an opportunistic outlook.

YTD our crypto hedge fund is +83.97%.

Current Long Perpetual Futures (USDT Settled)1.6 ETH – Break-even: $4…