Blog

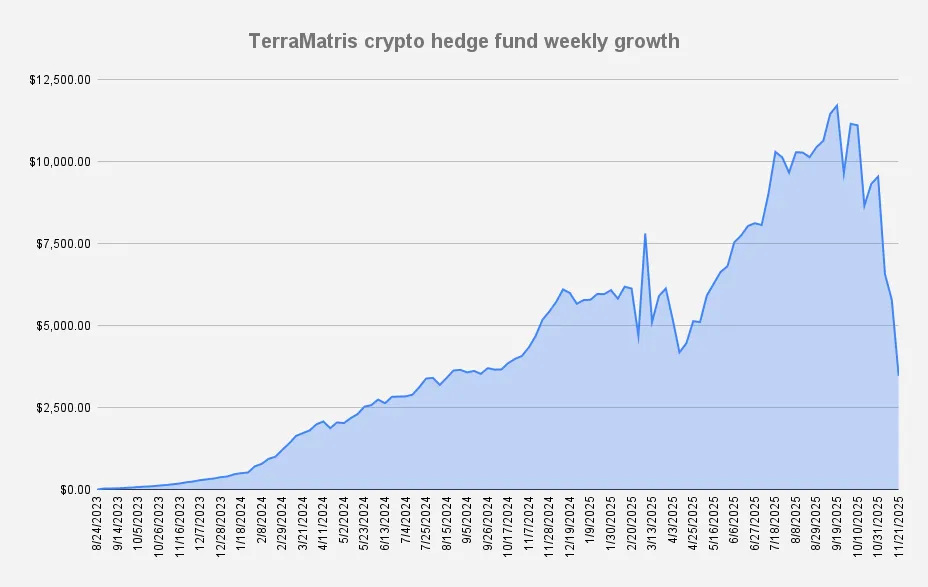

Ep 122: TerraM Multi-Asset Crypto Options Fund Down 24.86% WoW as ETH Weakness Persists

| Weekly updates | 66 seen

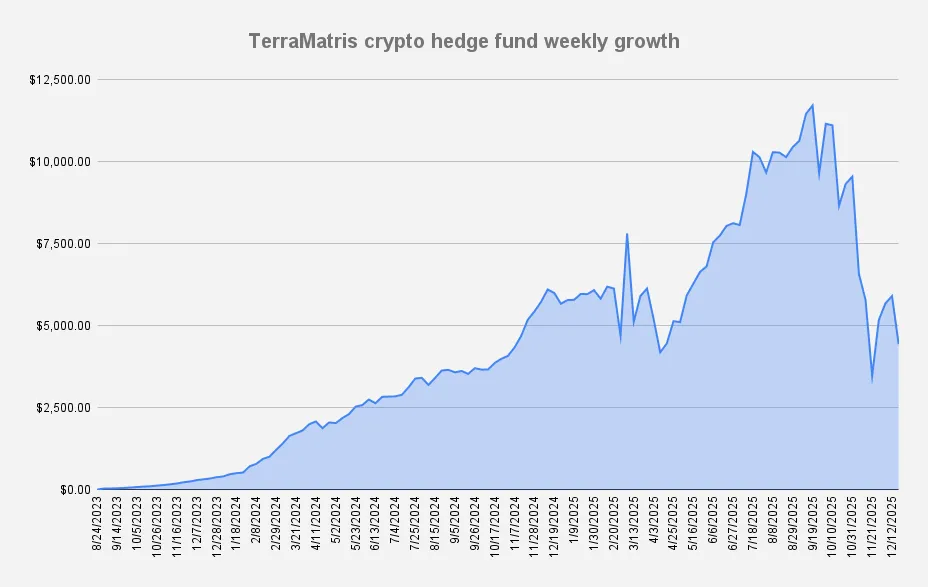

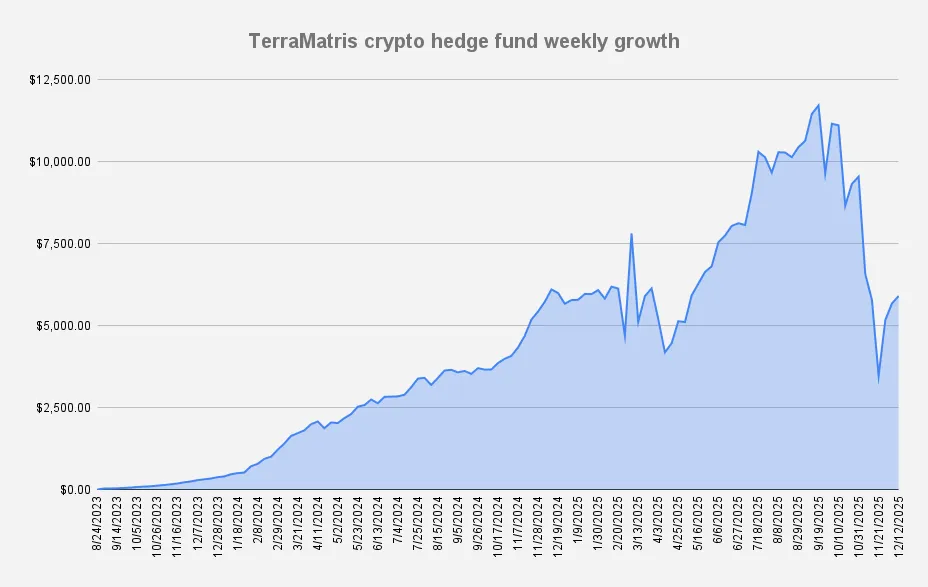

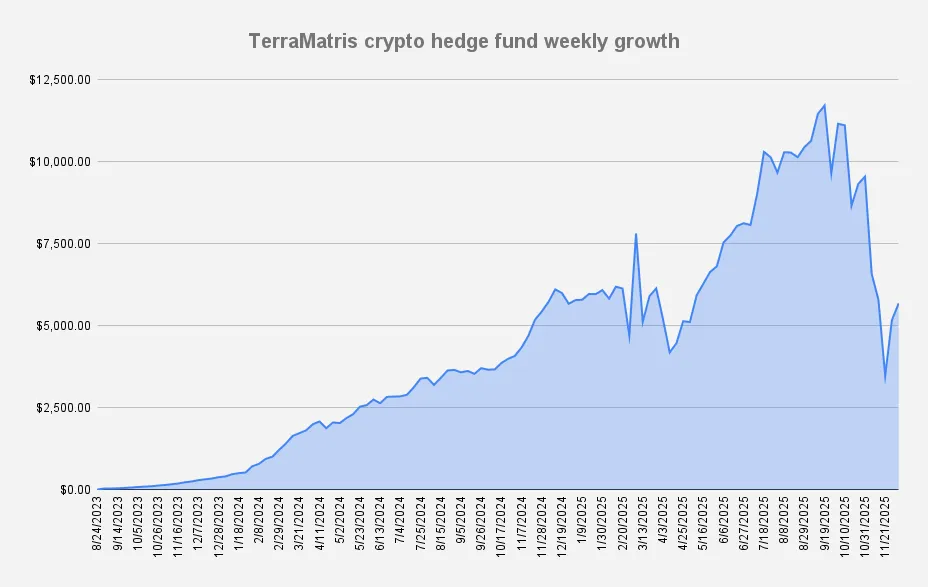

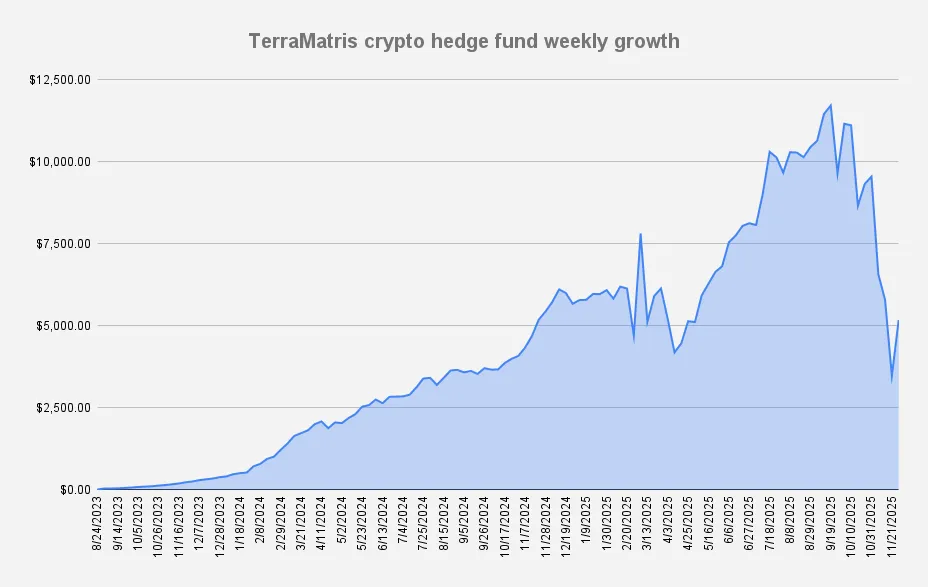

As of December 19, 2025, the TerraM Multi-Asset Crypto Options Fund is down (again) -24.86% week-over-week, discouraging result after brief relief for the past few weeks. Apparently the worst is not over. Unless momentum shifts, ETH likely revisits sub-$2,500 levels before any real recovery.

Overall drawdown is –62%. Year-to-date, the Fund is down –21.87%, underperforming Bitcoin (–6.97%) and ETH (–12.47%). This confirms our returns are still highly directional and closely correlated with the broader market—largely riding the wave, while aiming to add incremental income through our yield and options overlays. Leverage remains a double-edged sword: it can materially amplify gains in bull markets, but it also magnifies losses when the market turns against us.

…

Ep 121: Crypto Options Fund Up 3.94% $170 Premiums This Week

| Weekly updates | 96 seen

As of December 12, 2025, the TerraM Multi-Asset Crypto Options Fund is up +3.94% week-over-week, encouraging result after the steep drawdown just a few weeks ago.

Our overall drawdown stands at –49%, while YTD Fund value is up +3,98%, slightly outperforming Bitcoin (–1.29%) and ETH (–2.65%). This highlights that our returns remain highly directional and strongly correlated with the broader market - largely “riding the wave” while seeking to extract incremental income through our yield/option overlays.

Options IncomeThis week, the TerraM Multi-Asset Fund generated $170 in options premiums, what is impressive 2.87% weekly return on capital.

Over recent weeks we sold ATM covered calls below our break-even. This week we were challenged and had to roll up…

Ep 120: Rolling Up, Collecting Credit: TerraM Earns $231 Options Premium as Fund Jumps +9.87%

| Weekly updates | 167 seen

As of December 5, 2025, the TerraM Multi-Asset Crypto Options Fund is up +9.87% week-over-week, giving as a hope that the worst is behind us, and we should focus on growth.

Our overall drawdown has now improved to –51%, a meaningful recovery, though still well below the fund’s mid-September all-time high. Year-to-date, we are up +0.04%, slightly outperforming Bitcoin (–1.63%) and modestly outperforming ETH (–5.32%). This highlights that our returns remain highly directional and strongly correlated with the broader market—largely “riding the wave” while seeking to extract incremental income through our yield/option overlays.

Options IncomeThis week, the TerraM Multi-Asset Fund generated $231 in options premiums, what is impressive 4% weekly return on capital. …

Crypto Meetup in Palolem Beach, Goa – Traders, Builders & Investors Welcome

| Events | 52 seen

Join us for an informal, high-quality crypto meetup right on Palolem Beach, South Goa. This gathering brings together traders, builders, researchers, and open-minded enthusiasts for a focused discussion on real market strategies and emerging opportunities.

When: Thursday, December 25 12:00 PM - 2:00 PM (GMT+5:30)Where: Palolem Beach, GoaTopics on the table

Crypto options trading (practical strategies, risk frameworks, yield ideas)DeFi staking/yields and what currently worksBitcoin, Ethereum, Solana market outlooksAnalysis of promising altcoins with real potentialOpen discussion: what’s worth watching in 2026?Format

Straightforward conversations, shared insights, and a few Kingfishers in between.

Who’s welcome

Anyone serious about crypto: traders…

Ep 119: Weekly Update: +48.85% Rebound, Drawdown Recovery, and Options Income Surge

| Weekly updates | 147 seen

As of November 28, 2025, the TerraM Multi-Asset Crypto Options Fund is up +48.85% week-over-week, marking our strongest weekly gain to date. However, this surge is largely a retracement following last week’s –40% drawdown, rather than new growth.

Our overall drawdown has now improved to –55.87% - a meaningful recovery, though still far from the fund’s all-time high reached in mid-September. This past week offered welcome relief, and we hope the positive momentum continues, but we remain cautious and do not rule out the possibility of another sharp decline.

It has now been more than two years since we launched our crypto hedge fund, and while this is the steepest drawdown we have experienced, it is also the easiest to handle. Although leverage contributed to the size of the…

Ep 118: TerraM Fund Reports Record –40% Weekly Loss as Drawdown Reaches –70%

| Weekly updates | 97 seen

As of November 21, 2025, the TerraM Multi-Asset Crypto Options Fund is down –40.00% week-over-week, marking our worst weekly result to date. The overall drawdown has deepened to –70.35%, placing the fund firmly in distressed territory. The crypto bear market has hit us hard, and leverage remains the primary problem. Core positions are still intact, but another week of similar magnitude could put us at serious risk without additional external capital.

Last week’s outlook turned out correct: BTC slipped toward the previously noted $84,000 level. While we’re not issuing price predictions, a short-term bounce — potentially a long-anticipated Santa rally — is still possible. Conversely, a push down toward $75,000 cannot be dismissed. Technical patterns typically revert, making a…

Ep 117: Bitcoin Death Cross Worries Grow as TerraM Fund Drops Further

| Weekly updates | 68 seen

As of November 14, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by another -11.97%. Our drawdown has reached a new low of –50.58% in just a few weeks — a striking reminder of how quickly conditions can deteriorate. Even though most indicators are washed out and a recovery could be near, we remain cautious and do not rule out further downside. We still hope to be wrong.

There is one major event worrying us: a death cross on the Bitcoin chart. In fact, it’s not just potential it’s looking increasingly inevitable.

A death cross occurs when the 50-day moving average falls below the 200-day moving average. This signal typically reflects a long-term shift from bullish to bearish momentum. Historically, it doesn’t always trigger an immediate…

Crypto Options Prediction Bot — Inside Our Next-Gen AI Trading Engine

| Crypto Options | 67 seen

At Terramatris, we’ve spent years exploring the intersection of quantitative finance, machine learning, and blockchain markets.

Our latest internal project - Crypto Options Prediction Bot - represents a major leap in how AI can analyze and rank crypto options across Deribit in real time.

Unlike retail “signal” bots, our bot doesn’t guess. it learns, measures, and scores every BTC and ETH options contract based on statistical probabilities, expected returns, and volatility dynamics.

Fetches live Deribit options data for BTC and ETH every week.Filters all contracts with Friday expiries — matching standard options cycles.Uses machine learning models to estimate:The probability an option expires out-of-the-money (P(OTM))Its expected return (%)Liquidity and volatility…Ep 116: Volatile Week in Crypto: TerraM Fund Drops 31%, Solana Fund Down 8%

| Weekly updates | 24 seen

As of November 7, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by -31.12%. While this may appear to be our worst week-over-week result, it is not unprecedented — on March 13, 2025, the fund experienced an even steeper drop of -34%.

Let’s hope it stays that way, as there’s no reason to challenge that record. The current decline stems from a broad weakening in the crypto market and the fact that several positions remain leveraged.

We’ve been actively reducing leverage over the past few weeks, and despite the market stress, the fundamentals remain intact. There are no margin calls, just an exceptionally tense view on the charts.

Drawdown from the all-time high, recorded in mid-September, stands at -43%.

Our open-ended Solana Covered…

Ep 115: TerraM Multi-Asset Crypto Options Fund Gains +2.42% While Solana Covered Call Slips –1.52%

| Weekly updates | 34 seen

As of October 31, 2025, the TerraM Multi-Asset Crypto Options Fund achieved another week-over-week gain of +2.42%.

Meanwhile, the Solana Covered Call Growth Fund maintained its consistent performance, generating steady options income that was fully reinvested into SOL to strengthen the fund’s core long position. The NAV per unit closed at $0.88, reflecting a modest -1.52% weekly decline.

Activity around the TERRAM token increased notably this week, with the price stabilizing at $3.13 by week’s end. Trading bots have begun interacting with the token — a positive sign, as these algorithms are deploying real USDC. This suggests that TERRAM has reached sufficient liquidity and trading volume to attract automated market participants, signaling growing interest that may continue…