Morning, ladies and gentlemen! My name is Reinis Fischer, and today is October 10th, 2024. I'm in my favorite spot, the Axis Tower in Tbilisi, and it's time for our weekly review of happenings in the crypto world. Let me start by giving you an overview of what TerraMatris is and what we’re doing here.

TerraMatris is a quantitative DeFi hedge fund that focuses on advanced options trading strategies, particularly put options, to maximize growth while minimizing risk in the cryptocurrency market. It’s available for investment through Raydium, using the TerraM token, which is powered by the Solana blockchain. The fund operates primarily in Georgia.

Disclaimer: Investments in stocks, funds, or other assets carry risks. Please do your due diligence before investing. This is not financial advice.

At TerraMatris, we primarily trade 1-day-to-expiry (1DTE) put options on Bitcoin and Ethereum. Additionally, we sell covered calls on established positions. We have small exposure to Ethereum and Solana, and as we collect premiums from these trades, we reinvest them back into crypto. We've developed a basket of coins that we consider good investments, which include Bitcoin, Ethereum, Stellar Lumens (XLM), Jupiter Token, and PAXG.

Our strategy revolves around dollar-cost averaging (DCA), where we consistently invest regardless of market conditions. This is our 60th week since the start of the fund, and this week, we’ve been investing in Ethereum, Solana, and TON. TON is an intriguing project, and I hope to cover it more in the future.

Risk Management

Risk management is at the core of our operations. When entering trades, we focus on high-quality options trades, particularly those likely to expire worthless. If a trade becomes challenged, we aim to roll it forward for a credit, meaning we close the current position and open a new one at a lower strike price to squeeze out more premium. In addition, we sometimes hedge with futures and employ stop-loss strategies if the market moves unexpectedly.

Weekly Goals

Every Thursday, we set new weekly goals. This week, our main objective was to invest at least $15 daily across three coins: Ethereum, Solana, and TON. We’ve been utilizing our cash reserves to fund these investments, as one of our trades went against us. While waiting for that trade to recover, we’ve continued to spend cash and add to our crypto holdings.

Weekly Results

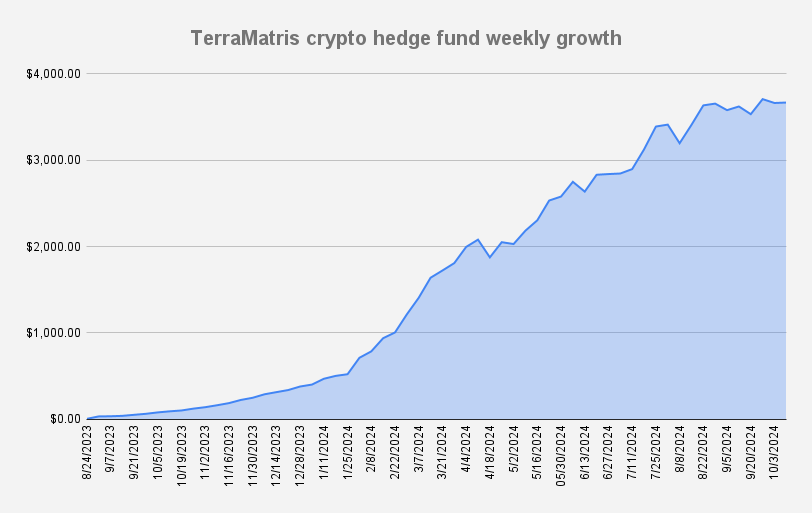

As of October 10, 2024, the TerraMatris fund has grown to $3,666.79, reflecting a small but respectable week-over-week growth of 0.14%. At one point, we were up 3-4%, but a recent market dip lowered our gains. Nevertheless, the fact that we’ve managed to grow during such a volatile week is a great sign.

Current Options Positions

We currently hold a 1.1 short position on Ethereum with a strike price of $2,550, set to expire tomorrow (October 11). Since Ethereum is trading around $2,400, we’ll likely need to adjust this trade. My plan is to roll the position to a later expiry date, lower the strike price to $2,400, and reduce our exposure slightly.

We’ve been closely monitoring Ethereum, which is currently trading below its 50- and 200-day moving averages. Although this is a bearish signal, we’re hopeful for a pullback to $2,500, which would align with the 50-day moving average. However, we’re prepared for further downside risk, which is why we’re cautious about opening new positions.

TerraM Token Overview

Speaking of investments, let’s talk about how you can get exposure to TerraMatris through the TerraM token. The TerraM token represents ownership in the TerraMatris hedge fund, offering a stake in its growth and performance. Powered by the Solana blockchain, this token ensures secure and transparent ownership. It’s easy to swap USDC for TerraM tokens using Raydium, a decentralized platform.

Swap on Raydium (Solana supported wallet required)

If you’re interested, feel free to reach out for more information or help with an over-the-counter (OTC) trade, especially if you’re looking to invest larger amounts and want to avoid slippage on Raydium.

Networking and Fundraising

Recently, I’ve been very active in networking and promoting the TerraMatris fund. I’ve connected with hedge funds, Web3 developers, institutional investors, and private angel investors. If we’ve recently spoken, thank you for reaching out—it’s been an exciting time!

Thank you for joining me today. I hope to see you next week as we continue our crypto journey!