It's Reinis Fischer, CEO, and Founder of TerraMatris crypto hedge fund, bringing you the latest insights into our portfolio and trading strategy. Today marks the 15th week since the inception of TerraMatris, and I'm thrilled to share our progress with you.

For those new to TerraMatris, we are a private crypto investment hedge fund based in Tbilisi, Georgia. Operating privately and not publicly registered, our focus is on managing risk in the dynamic world of cryptocurrency.

A quick disclaimer before we delve into details: investments in stocks, funds, bonds, or cryptos involve risks, and due diligence is crucial before any investment decision.

Our trading strategy centers around selling one-day-to-expiry put options on Ethereum and Bitcoin, reinvesting the premiums back into crypto assets. We primarily stick to four coins: Bitcoin, Ethereum, Stellar (XLM), and USDC. This approach follows the Dollar-Cost Averaging (DCA) buying strategy, providing stability to our investment.

Managing risk is paramount in our approach. In case our options face challenges, we employ a straightforward strategy – rolling forward or down, preferably for a credit. Our goal is to avoid complex options positions that require extensive management. Additionally, with the use of stop losses and potential hedging with futures, we aim to safeguard our positions.

For this week, our target was $3 from options premiums, reinvested in USDC. I'm delighted to share that we exceeded our goal, reaching $4 in a single trade today. While we have ambitious plans, we prioritize a cautious approach to avoid overusing leverage.

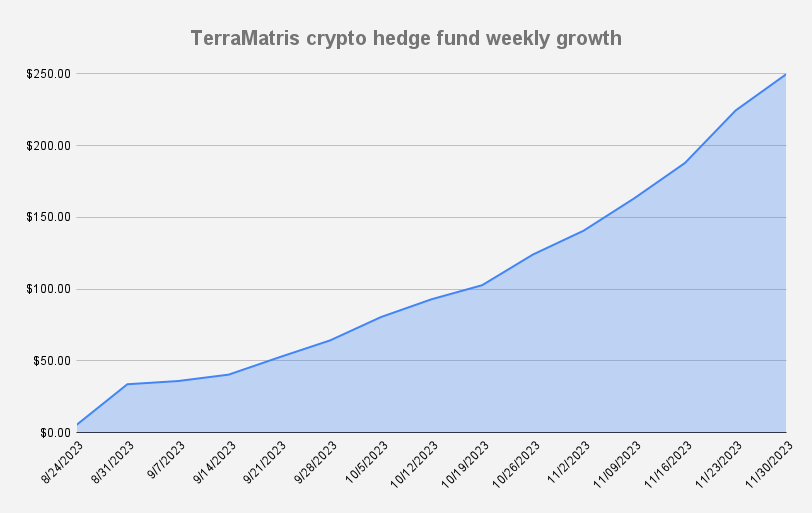

This week has been stellar, reaching another all-time high at almost $250 on November 30, 2023. Our week-over-week growth stands at an impressive 11.28%, resulting in an additional $25 in profits. While we aspire for larger gains, consistent growth and risk management remain our focus.

Observing recent market trends, both Bitcoin and Ethereum have shown bullish signs, trading above their 50 and 200-day moving averages. While we remain vigilant for potential pullbacks, our trading decisions align with technical indicators and market dynamics.

Our TerraMatris token, running on the Sol blockchain, continues to provide an avenue for direct participation in the fund. With 10,000 tokens available, the current average price on the Radium liquidity pool is $1.08. No significant changes occurred last week, but if you have questions or want to learn more, feel free to explore TerraMatris tokens.

Swap USDC for TerraM on Raydium

In summary, it's been a fantastic week for TerraMatris. We appreciate your continued support and look forward to what the coming weeks will bring. If you have any questions or thoughts, don't hesitate to reach out. Thank you for being part of the TerraMatris journey, and here's to more success in the weeks ahead. Happy investing!