Terramatris is a private crypto investment hedge fund started back in August, 2023, by me. The fund is privately held and is not publicly registered under any specific jurisdiction. Though, its available to participate in the fund via Raydium liquidity pool by swapping USDC against TerraM.

In the end of the month, we managed to grow our portfolio by quite impressive 29%. No new investments were attracted to the fund, but I started to network with fellow fund managers and potential investors over Linkedin. We are still having just 2 private customers, for whom we earned $229.45 (+$88.55)in the month of May (before our cut of 20%)

We trade options with crypto while reinvesting premiums back into different crypto assets. At the moment we are growing our crypto portfolio by selling put options on Bitcoin. Also we are selling covered calls on ETH and SOL. Our position size is rather humble, but growing. We hope to start selling covered calls on BTC anytime soon.

Learn more how to invest in TerraMatris crypto hedge fund and grow with us

During the month of May, there were no purchases for TerraM tokens on the Raydium liquidity pool, and the tokens price remained stable at $1.17 while putting our tokens market cap at around $11,800. Rest of the growth comes from the options trading, crypto gains, management fees and from funding fees on carry trades.

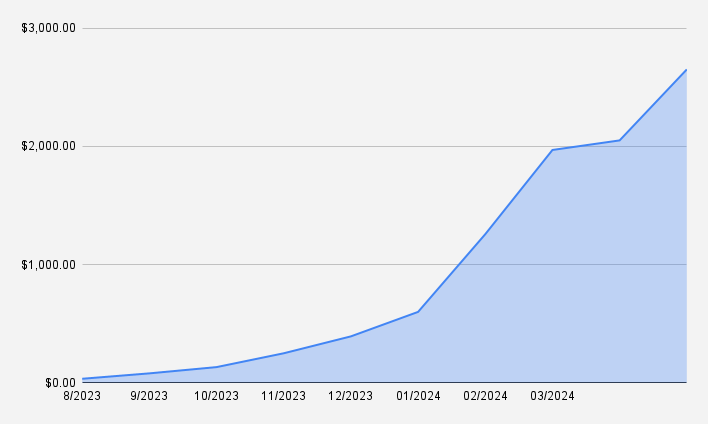

In May 2024 we were able to grow our crypto hedge fund to $2,651.17. The total fund's growth during the month was $600.45, which is about $19.37 daily.

Terramatris crypto hedge fund grows not only from options trades and crypto appreciation, it also grows from funding fees on carry trades, management and also performance fees. We look on this income as quite safe, and market neutral. In May 2024, 63.53 were made from market neutral trades. And that's awesome

Month over month we recorded 29.28% growth, and thats awesome. We would love to see 20% monthly gains every month, but we also understand that it is not very suistanable in the long term.

YTD our fund is up 574% which is just mind blowing, especially if compared to Bitcoin (+54.64%) or SP500 (10.39%)

Options trades and premium

In total we made 23 options trades last month, collecting $506.80 in options premium mostly from 1DTE options trades on Bitcoin. Also we sold few covered calls on ETH and SOL. At the end of the month there were no trades in recovery.

Carry Trade with XRP

We made additional $6.7 from funding fees on carry trade with XRP. From the capital invested in this carry trade ($1,000) that would give about 0.67% monthly yield.That is a decent result, but we have decided to stop working with carry trades in the month of June, closing all our exsiting positions and focusing on growing fund from put options.

Management Fee and Performance fee

We booked $45.89 performance fee from mamaging our private custome funds at the end of the month. All fees are reinvested back into TerraM token

TerraM token

In total there are 344 TerraM tokens available for Swapping against USDC.

You can participate in TerraMatris crypto hedge fund by owning TerraM coin.

Each TerraM token corresponds to a 1/10,000th share in the fund, allowing investors to gain exposure to a diversified range of assets and strategies. This not only spreads risk but also offers a chance to benefit from the fund's performance.

A Step-by-Step Guide to Buying TerraM Tokens via Raydium AMM

Goals for June 2024

For the month of May 2024, I would be delighted to see funds value grow to at least $3,000.

Learn more how to invest in TerraMatris crypto hedge fund and grow with us