Terramatris is a private crypto investment hedge fund started back in August, 2023, by me. The fund is privately held and is not publicly registered under any specific jurisdiction. Though, its available to participate in the fund via Raydium liquidity pool by swapping USDC against TerraM.

Aptrilt started good, but turned out quite low in the end of the month. We got stuck with one of our put options trades on BTC, adn started to adjust, thus limiting new positions and decreasing premiums. In the end of the month, w managed to grow our portfolio by just 4.11%. Besides that we a larger injection for the hedge fund, from one of our investors investing additional USDC 3.200. We are still having 2 private customers, for whom we earned $140.9 (+$18.91 )in the month of April (before our cut of 20%)

We trade options with crypto while reinvesting premiums back into different crypto assets. At the moment we are growing our crypto portfolio by selling put options on Bitcoin. Also we are selling covered calls on ETH and SOL. Our position size is rather humble, but growing. We hope to start selling covered calls on BTC anytime soon.

Interested crypto investors can SWAP USDC for TerraM tokens on the Raydium Decentralized exchange.

During the month of April, there was 1 purchase for TerraM tokens on the Raydium liquidity pool, raising tokens price to $1.17 amd puting our tokens market cap at around $11,800. Rest of the growth comes from the options trading, crypto gains, management fees and from funding fees on carry trades.

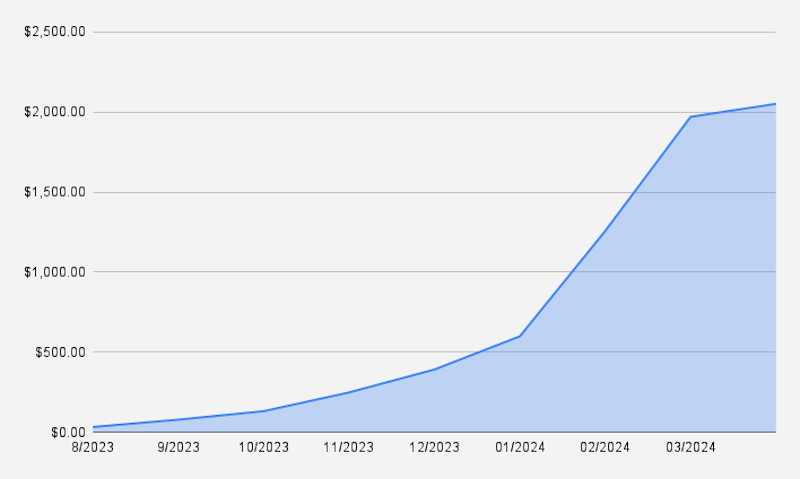

In April 2024 we were able to grow our crypto hedge fund to $2,050.72. The total fund's growth during the month was $80.94, which is about $2.7 daily.

Terramatris crypto hedge fund grows not only from options trades and crypto appreciation, it also grows from funding fees on carry trades, management and also performance fees. We look on this income as quite safe, and market neutral. In April $37,2 were made from market neutral trades. And that's awesome

Month over month we recorded 4.11% growth, now that doesn't seem a lot, if compared to the previous months, but as long as there is growth we are satisfied. I would like to see at least 20% monthly growth in the coming months

Options trades and premium

In total we made 46 options trades last month, collecting $255.10 in options premium mostly from 1DTE options trades on Bitcoin. Also we sold few covered calls on ETH and SOL. At the end of the month there were 0.07 BTC put options in recovery (trade adjustments)

Carry Trade with XRP

Additionally to income from options trades in the month of April we made additional $8.42 from funding fees on carry trade with XRP. From the capital invested in this carry trade ($800) that would give about 1.05% monthly yield. Awesome. We are quite satisfied with the returns form the carry trades and I'm looking to grow our carry trade portfolio ever month but by bit.

I invested additional 300 XRP in carry trade. Now holding 2000 XRP while shorting with the same amount XRP perpetual futures contract. In case we will be able to repeat 1.05 % funding fee return in May, we might be looking at about $10.05 additional income. Quite decent.

Management Fee and Performance fee

We booked $37.2 performance fee at the end of the month. All fees are reinvested back into TerraM token

TerraM token

In total there are 344 TerraM tokens available for Swapping against USDC.

You can participate in TerraMatris crypto hedge fund by owning TerraM coin.

Each TerraM token corresponds to a 1/10,000th share in the fund, allowing investors to gain exposure to a diversified range of assets and strategies. This not only spreads risk but also offers a chance to benefit from the fund's performance.

A Step-by-Step Guide to Buying TerraM Tokens via Raydium AMM

Goals for May 2024

For the month of May 2024, I would be delighted to see funds value grow to $2,200-$2,400

If you are interested in learning more or participating in the fund directly (minimum investment $10,000) - feel free to write me an email to reinis.fischer {at} terramatris.eu or connect on LinkedIn