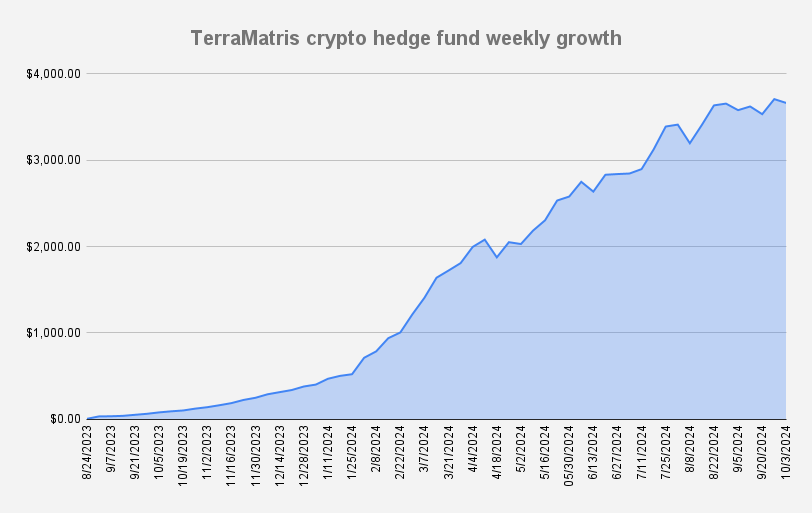

In this week's update, Reinis Fischer, CEO and founder of TerraMatris Crypto Hedge Fund, shares insights on how the fund performed amid a recent market selloff. Recorded on October 3rd, 2024, this report provides an overview of our strategy, trades, and how we managed risk throughout the week.

What is TerraMatris?

TerraMatris is a privately held crypto hedge fund, managed by Reinis Fischer, that operates out of Tbilisi, Georgia. The fund is not publicly registered but can be invested in through decentralized liquidity pools like Radium. Our primary strategy focuses on trading short-term put options on Bitcoin and Ethereum, while also holding long positions on Ethereum and Solana.

This Week’s Market Performance

It's been a challenging week, with the crypto market experiencing a selloff. As a result, the TerraMatris fund saw a decline of -1.21%, or $44.72 in dollar terms, bringing the fund's total value down to $3,661,52. Earlier in the week, we were much closer to $4K, but a late-week correction pushed us down.

Adjusting 1.5 ETH Put Options

Our primary focus this week was adjusting our 1.5 ETH put options. We regularly trade one-day expiration put options on both Bitcoin and Ethereum, collecting premiums and reinvesting back into crypto assets. However, given the market volatility, we had to roll out these ETH options to avoid further losses. Our strategy also includes selling covered calls on already established positions and, when necessary, using futures as a hedge.

Long Positions and Crypto Investments

We currently hold long positions in key cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). As part of our strategy, we’re dollar-cost averaging (DCA) into a diversified basket of crypto assets including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stellar Lumens (XLM)

- Solana (SOL)

- USDC (a stablecoin)

- Jupiter Token

- PXG (Digital Gold)

This week, we focused on increasing our investments in Bitcoin, PXG, and TokenFI

Risk Management at TerraMatris

At TerraMatris, we employ a strict risk management strategy. While we aim for high-probability trades, when markets move against us, we roll our options forward for credit. Sometimes, we hedge with futures contracts, though we didn’t do so this week due to our aggressive selling of Ethereum.

In situations where trades go significantly against us, we might also use stop losses to limit potential downside. Despite the challenges this week, our risk management protocols are in place to mitigate losses and prepare for market recoveries.

Weekly Goals and Moving Forward

Every week, we set clear investment goals for the fund. This week, we aimed for a %15 daily investment target, focusing on Bitcoin, PXG (digital gold), and TokenFi token. We believe in the long-term potential of these assets and continue to build positions despite short-term volatility.

Conclusion

It’s been a tough week, but we remain focused on our strategy. The market selloff has tested our portfolio, but with tactical adjustments like rolling ETH put options and maintaining diversified holdings, we are poised to navigate future volatility.

Stay tuned for more updates from TerraMatris Crypto Hedge Fund!

Swap on Raydium (Solana supported wallet required)