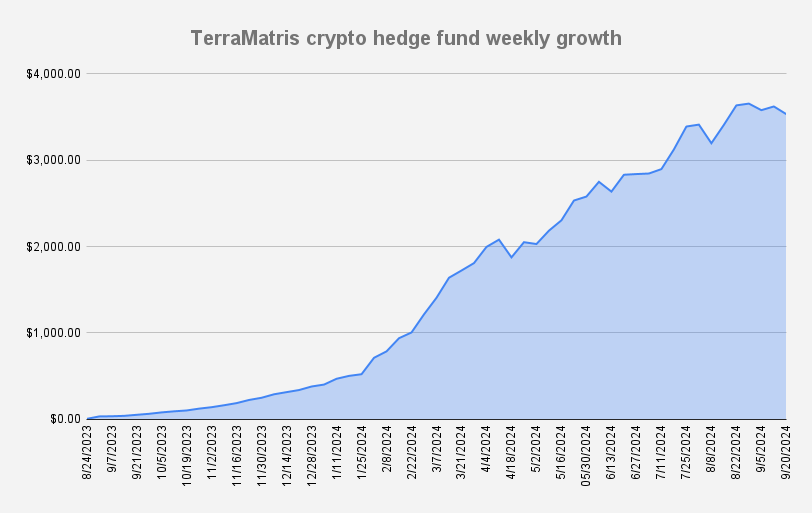

On September 19, 2024, we recorded this week's update from my favorite spot in Tbilisi, the Axis Tower. It has been quite a busy morning here, with many tourists around, but let’s dive into the latest happenings at Terramatris.

Terramatris is a private crypto hedge fund that I manage. The fund operates mostly out of Tbilisi, Georgia, and is available for investment through our Raydium Liquidity Pool. As a private, closed-end fund, we prioritize a robust trading strategy and meticulous risk management to grow our portfolio.

Trading Strategy

Our trading strategy is centered around simplicity and consistency. We primarily trade 1-day-to-expiry (1DTE) put options in Bitcoin. Additionally, we sell covered calls on our existing positions. Currently, we have covered calls on Solana and Ethereum, as well as a more advanced trade involving a covered call on a Bitcoin long perpetual futures contract. We regularly reinvest the premiums received from these options into select cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Stellar Lumens (XLM), Jupiter (JUP), and digital gold (PXG).

Risk Management

Risk management is the cornerstone of our fund. We strive to engage in high-probability trades that expire worthless, minimizing potential losses. In case of troubled positions, we prefer rolling forward for credit or using advanced trigger-based futures trades to hedge our positions. Cutting losses with stop-losses is also part of our strategy, ensuring that we exit bad positions promptly.

Weekly Goals

Each week, we set specific goals. This week, we aimed for a minimum daily investment of $10, allocated to Bitcoin, Jupiter, and Stellar Lumens. While we haven't always generated $10 daily from our options trades recently, we have been utilizing our cash reserves to meet this investment goal.

Weekly Results: -2.46% Loss

This week, the fund's value dropped by 2.46%, closing at $3,532 on September 19. The decrease was primarily due to an accounting error involving our Stellar Lumens (XLM) holdings. During a market sell-off in early August, we had to liquidate several long spot positions. In the process, we inadvertently overlooked 2,000 XLM tokens, which represented about $200. Adjusting for this error reflected the loss, although the market has seen positive movements with Bitcoin jumping over $60,000.

Current Options Positions

Our current options positions include a long call on Ethereum with a $2,500 strike price, expiring on September 19. We expect this call to expire worthless unless there's a steep rally. Additionally, we hold 0.2 short puts with a $2,300 strike, which are also expected to expire worthless. Moving forward, we plan to increase our options trade size to at least 1.3 ETH contracts.

Crypto Yield Fund from Rental Income

We recently started a crypto yield rental fund, utilizing rental income to sell cash-secured Ethereum put options with zero leverage. The fund began with $550 USDC and has already generated $5.13 (about a 0.92% gain) within a week. This strategy offers landlords a way to boost returns by reinvesting rental income into the crypto market.

Market Trends & Technical Analysis

Currently, Bitcoin is trading between its 50- and 200-day moving averages, indicating a consolidation phase. We are prepared for potential pullbacks or rallies, with a cautious approach focused on avoiding risk rather than seeking aggressive moves.

How to Invest in Terramatris

Terramatris is tokenized, with 10,000 tokens minted on the Solana blockchain. You can swap USDC for TerraM tokens on Raydium, requiring a Solana wallet like Phantom. We also offer direct investments in the fund with a minimum of $10,000. For those interested in learning more or investing, feel free to contact us directly.

Swap on Raydium (Solana supported wallet required)

Conclusion

Despite the accounting error this week, it has been a promising period for the crypto markets overall. We remain confident about the future and continue to fine-tune our strategies to ensure steady growth. Thank you for following our journey, and we look forward to updating you next week.