Good Morning, Ladies and Gentlemen!

My name is Reinis Fischer, and I am the CEO and Founder of TerraMatris Crypto Hedge Fund. Today is May 23rd, 2024, and I am excited to present our weekly video update, covering the latest developments in our crypto hedge fund portfolio.

TerraMatris is a private crypto investment fund managed by myself, Reinis Fischer. The fund is privately held and not publicly registered, but it is available over Raydium, implying a liquidity pool. The fund is primarily operated from Tbilisi, Georgia, although our assets are held on various exchanges globally.

Investing in stocks, funds, bonds, or cryptocurrencies carries risks, and you could lose some or all of your money. Please conduct your own due diligence before investing in any asset. This video is not a recommendation to invest in TerraMatris or any other investment.

Trading Strategy

At TerraMatris, we primarily trade one-day-to-expiry put options on Bitcoin and sell covered calls on our established positions. Currently, we have covered calls on assets like Solana. Our strategy involves rolling up covered calls, which we find effective, although we avoid rolling naked calls.

While trading options, we reinvest the premiums back into our crypto portfolio. This strategy has helped us build a robust portfolio, which includes Bitcoin, Ethereum, Stellar Lumens, USDC stablecoin, Solana, Jupiter coin, and our latest addition, PAXG (tokenized gold). This diversification is part of our dollar-cost averaging approach.

Weekly Performance

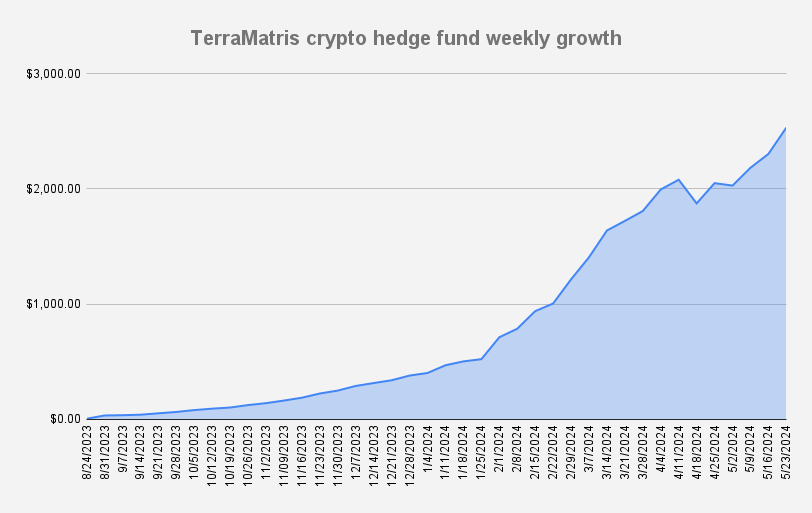

This week, our fund has reached a new all-time high of $2,532.61, marking a nearly 9% growth from the previous week. We are thrilled with this progress and are aiming to reach the $3,000 mark in the coming months.

Trade Adjustments

No trade adjustments were made this week. However, two of our Bitcoin put options expired worthless last week, reducing our exposure to 0.05 Bitcoin put options. These options are set to expire on May 31st, with strike prices around $65,000. Given Bitcoin's current trading price, we anticipate they will expire worthless.

Market Analysis

Bitcoin has recently broken above its resistance around $69,000-$70,000, testing previous highs. It currently trades at approximately $69,900, remaining above its 50-day and 200-day moving averages. We remain cautious, considering potential pullbacks to $66,000 or even $61,000, while acknowledging the possibility of further upward movement to $100,000.

Native TerraM Token

Our native TerraM token is available on the Solana blockchain. There are 10,000 tokens in total, and you can swap USDC for TerraM tokens on Raydium or Jupiter. Currently, 344 TerraM tokens are available for investment at a starting price of $1.17 each.

Swap USDC for TerraM on Raydium

Gold Fund Exploration

We are exploring the possibility of launching a separate gold fund, trading options on gold futures. This initiative is still in the theoretical stage, but we are already investing in physical gold, recognizing its value as a hedge against uncertainty.

That wraps up our update for this week. If you have any comments or questions, feel free to reach out. You can contact me on LinkedIn, YouTube, my personal blog, or the TerraMatris website.