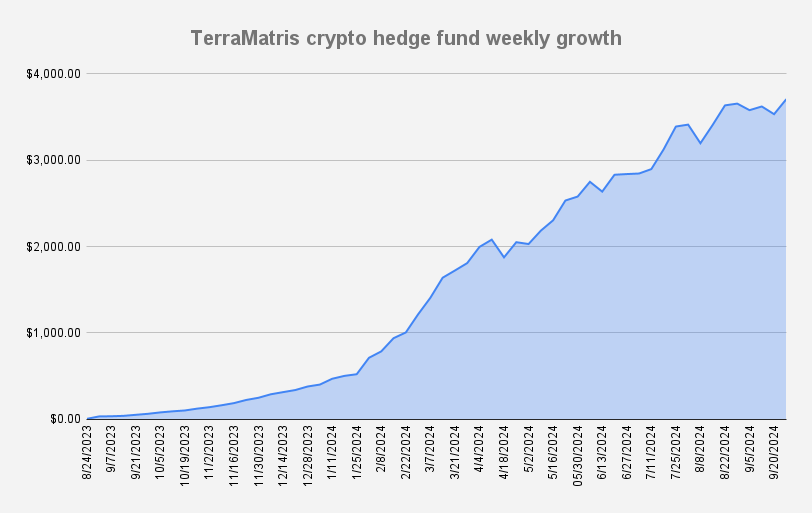

Greetings from TerraMatris! I'm Reinis Fischer, CEO and Founder of TerraMatris Crypto Hedge Fund, bringing you the latest updates. Today, I'm thrilled to announce that our fund has reached another all-time high on September 26, 2024, after weeks of strategic trading, growing by 4.53% this week. We've taken a more aggressive approach, particularly with ETH put selling, while continuing to invest in Ethereum (ETH), Solana (SOL), and Toncoin (TON). I’ll also discuss the upcoming TON Hackathon in Tbilisi this October, an event I'm excited to attend and explore more about the TON ecosystem.

TerraMatris Fund Overview:

For those new to TerraMatris, we are a private, decentralized crypto hedge fund primarily operated from Tbilisi, Georgia. While the fund isn't publicly registered, it's available for investment through Raydium’s decentralized liquidity pool. Managed with a risk-aware approach, we focus on selling 1DTE (1 Day to Expiry) put options on Bitcoin and other major cryptocurrencies. Additionally, we sell covered calls on established positions, providing consistent income and long-term growth.

Strategy Update: Aggressive ETH Put Selling

This week, we employed an aggressive put-selling strategy, specifically targeting Ethereum. Our typical strategy focuses on high-probability trades with a Delta of -0.10, but this week, we pushed the boundaries, increasing our risk profile to Delta -0.25. This was a calculated move based on our confidence in current market conditions.

The result? A new all-time high for the fund, reaching $3,706 on September 26, 2024, a 4.93% week-over-week growth, adding $174.99 to the portfolio. While we’re pleased with this result, aggressive strategies like this require a deep understanding of risk management, which is at the core of everything we do.

Weekly Investments: ETH, SOL, and TON

In addition to option trades, we continued our strategy of dollar-cost averaging (DCA) into key assets, including Ethereum (ETH), Solana (SOL), and Toncoin (TON). These cryptocurrencies form part of a diversified basket we believe in for the long term.

- Ethereum (ETH): With ETH testing resistance levels and showing strong potential for growth, we doubled down on put selling and spot investments.

- Solana (SOL): Solana remains one of our key holdings, particularly after reaching out to the Solana Foundation for potential collaborations. Their grant programs present exciting opportunities for future growth.

- Toncoin (TON): We’ve recently increased our exposure to TON ahead of the TON Hackathon in Tbilisi this October. As we continue to explore this promising blockchain project, we look forward to understanding more about its fundamentals and seeing how it fits into our portfolio.

Tbilisi TON Hackathon – October 2024

We are particularly excited about the TON Hackathon coming to Tbilisi next month. This event promises to bring together developers, traders, and enthusiasts to explore and innovate within the TON blockchain. While TerraMatris excels at technical and market analysis, we look forward to deepening our understanding of the TON ecosystem, specifically its fundamentals. If you’re in Tbilisi, this is an excellent opportunity to meet, exchange ideas, and collaborate.

Risk Management and Strategy Refinement

At TerraMatris, risk management is the cornerstone of our strategy. As we aim for consistent returns, we continuously monitor our trades and adjust positions when necessary. This week, our increased risk exposure was mitigated by careful position sizing and rolling trades for credit if needed. We also employ hedging strategies using futures contracts, ensuring that even in volatile markets, we remain well-positioned to protect our portfolio.

TerraMatris Term Token and Solana Blockchain Integration

As part of our fund's decentralized nature, investors can participate through our TerraMatris Terram Token, built on the Solana blockchain. Currently, 10,000 tokens are available, with 374 tokens circulating. We actively buy back our own tokens, increasing the price for early holders and offering potential for long-term gains. You can swap USDC for Terram tokens on Raydium or consider over-the-counter (OTC) transactions for a more tailored investment approach.

Swap on Raydium (Solana supported wallet required)

Join Us on Our Journey

We’ve recently raised our entry level for business partners to $100,000, targeting investors in Georgia and beyond. If you're interested in exploring business partnerships or investing directly in the TerraMatris fund, we’d love to discuss how we can work together to achieve long-term growth.

Closing Thoughts:

It’s been an incredible week for TerraMatris, with significant growth, exciting investments in ETH, SOL, and TON, and new opportunities on the horizon with the TON Hackathon in Tbilisi. As always, we remain committed to prudent risk management while pushing the envelope on strategic trades.

Stay tuned for more updates as we continue to innovate and grow our fund. If you’re interested in learning more about crypto options trading, TON developments, or partnering with us, feel free to reach out!

Thank you for watching, and see you next week!