Greetings, fellow crypto enthusiasts! I'm Reinis Fischer, CEO and founder of Terramatris Crypto Hedge Fund, and I'm thrilled to be back in Georgia after my recent travels in Greece. Today, I want to share our latest insights, strategies, and results in the dynamic world of crypto trading.

Terramatris Crypto Hedge Fund Overview

For those unfamiliar, Terramatris Crypto Hedge Fund is a private crypto investment fund operating under my management. Founded and based in Georgia. Terramatris is not publicly registered, offering a unique opportunity for private investment.

A quick disclaimer: All investments carry risks, whether in stocks, funds, bonds, or cryptos. It's essential to conduct thorough due diligence before diving into any asset, including our beloved TerraM token.

Trading Strategy at Terramatris

Our trading strategy revolves around selling one-day-to-expire put options on Bitcoin and Ethereum. This involves collecting premiums and reinvesting them back into the crypto market. Currently, our chosen cryptocurrencies for investment include Bitcoin, Ethereum, Stellar Lumens, USDC stable coin, and Solana.

We embrace the concept of dollar-cost averaging, investing daily, Monday to Sunday, taking advantage of the crypto market's continuous availability.

Weekly Investment Highlights

As of this week, we've reached week 23 of our trading journey. Our focus has been on investing in Solana and USDC stable coins. Some might wonder about counting USDC as an investment, but indeed, we view it as such. Despite being a stable coin, it provides opportunities for generating passive income through staking.

Risk Management at Terramatris

Proper risk management is the backbone of any successful hedge fund or trading strategy. At Terramatris, we adhere to four core principles:

- High Probability Expiry Trades: We seek trades with a 90-95% probability of expiring worthless.

- Low Deltas on Puts: We aim for low deltas on our put options.

- Hedging with Futures: In certain situations, we may hedge with futures to mitigate risk.

- Long-Term Put Options: We buy longer-term expiry put options as insurance against significant market crashes.

Weekly Goals and Achievements

Each week, we set ambitious goals. This week, our target was a minimum of $6,5 daily from options premiums, which we plan to reinvest in Solana and USDC coin.

Weekly Results and Challenges

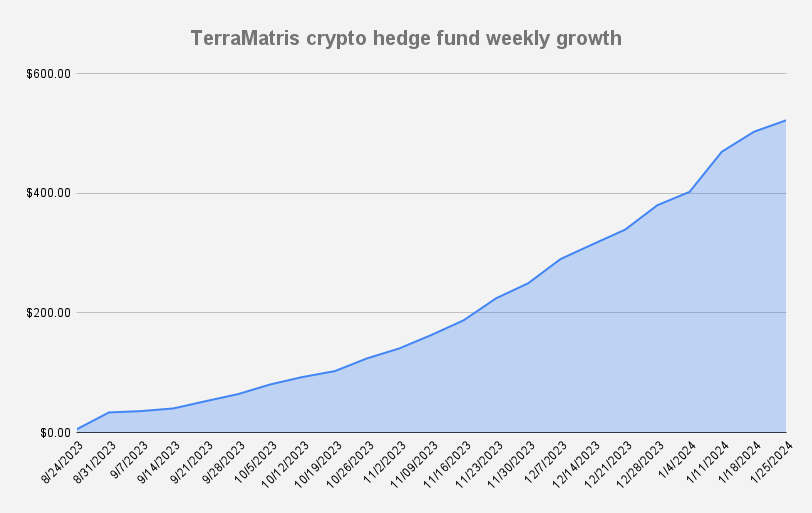

Excitingly, we've achieved another all-time high on January 25, 2024, reaching $522.25. Despite the market challenges, including a pullback in Bitcoin from $46,000 to $40,000, we've managed a week-over-week growth of 3.8%. This demonstrates the resilience of our strategies even in challenging market conditions.

Trade Adjustments and Lessons Learned

This week presented us with the need for trade adjustments. After several weeks without adjustments, we rolled forward and down 0.15 Bitcoin contracts with a strike price of $40,000, downsizing the position to 0.09 Bitcoins. This adaptive strategy allowed us to navigate market fluctuations effectively.

Market Trends and Analysis

In terms of market trends, Bitcoin has experienced an expected pullback under $40,000. Our analysis suggests a potential test of $38,000, with a chance of bouncing back to $42,000 before a potential further decline to $34,000. Our risk-aware approach involves studying charts, conducting technical analysis, and staying updated on news and developments, such as the recently approved Bitcoin ETF.

Milestones and Future Endeavors

Notably, we've reached a fund growth of $500 USDC. We continue to deposit additional TerraM tokens into the Raydium liquidity pool, bringing our total to 163 tokens.

In conclusion, despite the challenges and market uncertainties, our strategies have proven resilient, achieving consistent growth. Stay tuned for more updates on our exciting crypto journey at Terramatris Crypto Hedge Fund!