Greetings, fellow enthusiasts! I'm Reinis Fischer, CEO and Founder of Terramatris crypto hedge fund, bringing you our weekly update live from the bustling city of Athens, Greece. Today is January 18, 2024, and I'm excited to share the latest developments with you.

For those new to Terramatris, it's a private crypto investment hedge fund managed by yours truly. While the fund is primarily operated from the beautiful city of Tbilisi, Georgia, I occasionally manage it from various locations during my global travels. Terramatris is not publicly registered, but you can invest in it through the Raydium decentralized liquidity pool, swapping USDC for TerraM tokens.

Before we jump in, a quick reminder: investments carry risks, whether in stocks, funds, or cryptos. Always tread carefully, conduct your due diligence, and be mindful of the potential to lose some or all of your money.

At Terramatris, our trading philosophy revolves around daily put options on Bitcoin and Ethereum, with a recent focus on the ever-volatile Bitcoin market.

Risk management is the heartbeat of Terramatris. We seek high-probability options trades, always prepared to adapt. Whether rolling forward for credit, hedging with futures, or setting stop losses, our approach is rooted in protecting against market crashes. Weekly goals are our compass, and this week, it's all about aiming for a $6 daily options premium, with every penny reinvested back into the exciting world of cryptos.

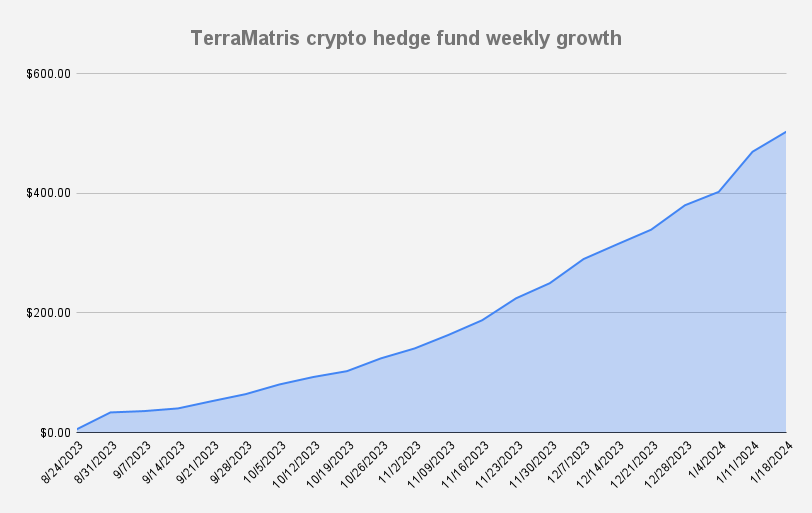

Fast forward to January 18, 2024, and we've hit an all-time high—$503! A stellar 7% week-over-week growth in dollar terms. What's even more exhilarating? No trade adjustments this week! Our strategy of rolling forward for credit and letting trades expire worthless has proven to be a winning formula, making me genuinely excited about the future of Terramatris.

Despite Bitcoin's recent fluctuations, hovering around $42,800, we've navigated the waves successfully. Ethereum, too, has held its ground at $2,500. My cautious optimism sees Bitcoin potentially hitting $68,000 in the next two to three months—an inner feeling, not a guaranteed prediction.

Georgia Incorporation and Crypto-Friendly Ecosystem:

Ever considered incorporating a hedge fund in Georgia? I have, and here's why: low crypto license costs (under $2,000), a tech-friendly environment, and the option to operate under special economic zones. While not a tax haven, Georgia's corporate tax at around 15% and dividend tax at 5% still make it an attractive prospect worth exploring.

Now, let's talk numbers—specifically, raising 1 million. It might sound audacious, but imagine leveraging 10% for active daily put option trading while keeping 90% as reserves for protection. The result? A potential daily premium of $690 or over 20,000 monthly, representing a significant percentage without actually purchasing the coins outright.

As I contemplate the incorporation structure in Georgia and the prospects of raising 1 million, one thing remains constant—Terramatris is growing. From its current standing at $503, the journey has been a steady climb, often reaching 5% or 10% weekly growth. Committed to organic growth and open to external injections, Terramatris is an ever-evolving story.