Good morning, ladies and gentlemen. Today is May 16, 2024. My name is Reinis Fischer, and I’m the CEO and founder of Terramatris Crypto Hedge Fund. In today’s video, we’re going to discuss happenings in our portfolio. I greet you all from Tbilis, my favorite spot at Axis Tower. Unfortunately, my friend Dino is a bit busy today, so I’m recording from a different location.

First, let me give you a brief overview of Terramatris and how we operate. Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. The fund is privately held and not publicly registered. It’s available for investment through Raydium, DeFi liquidity pools, and Jupiter. We also offer private investment opportunities. The fund is primarily operated from Tbilisi, Georgia.

Swap USDC for TerraM on Raydium

Disclaimer: Investments in stocks, funds, bonds, or cryptocurrencies are risky, and you could lose some or all of your money. Please do your own due diligence before investing in any kind of asset.

Now, let me briefly cover our trading strategy at Terramatris Crypto Hedge Fund. We primarily sell one-day-to-expire put options on Bitcoin. Additionally, we sell covered calls on already established positions like Ethereum and Solana. We are working to build enough of a Bitcoin portfolio to start selling covered calls. While we haven't yet reached our minimum, we hope to do so soon. All premiums are reinvested back into cryptocurrencies.

So far, we have selected a few cryptocurrencies which we consider valuable. These include Bitcoin, Ethereum, Stellar Lumens, USDC, Solana, and the Jupiter token. We are also exploring the concept of tokenizing real-world assets, which is something we are actively working on this week. Always remember, while exciting projects are intriguing, they can also be risky.

This week, we are working on an exciting new project involving trading options on real physical gold. We'll cover this more in detail in future videos. When we receive premiums, we reinvest them back into crypto, employing a dollar-cost averaging strategy. This is week 39 since the fund’s launch, and this week, we have chosen to invest in Bitcoin, the king of them all.

Risk Management: At Terramatris, the foremost consideration in our options trades is safety. We look for high-probability trades that are likely to expire worthless. If our established positions go against us, we roll them forward for a credit, meaning we buy them back and sell new ones. We might hedge with futures and use stop losses as well. Occasionally, we buy options with more than 45 days to expire as protection against sharp market declines.

Weekly Goals: This week, at Terramatris, we are targeting a minimum of $8 daily from options premiums. So far, so good, and we are reinvesting all earnings back into Bitcoin.

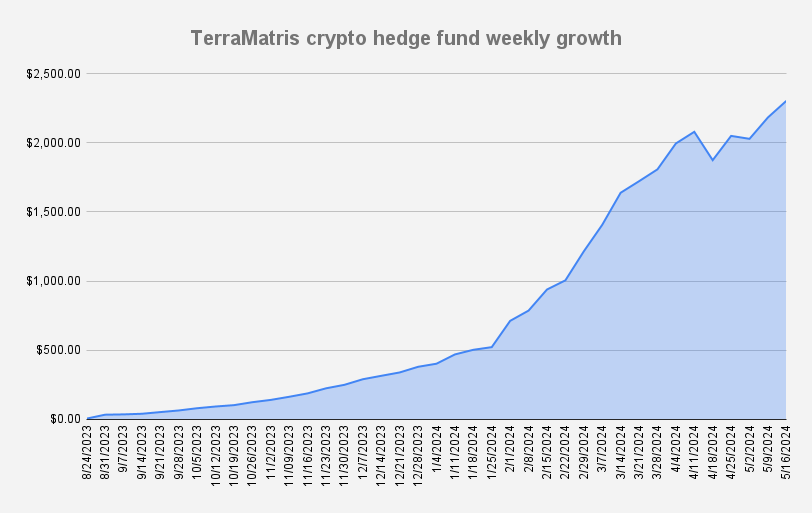

Weekly Results: Today, on May 16, 2024, Terramatris Crypto Hedge Fund has reached another all-time high, hitting $2,380. This represents a week-over-week growth of 5.49%, or $109 in dollar terms. We hope to reach the $2,500 milestone very soon. Over the past few weeks, we’ve been in a consolidation phase with one sharp decline, but we are now moving upward again. Since the fund’s inception, there have been only one or two weeks of decline, which we have already recovered from.

Current Trades: We currently have 0.07 Bitcoin put options with various strike prices and expiry dates. Tomorrow, on May 17, 2024, two Bitcoin put options (0.02 BTC each) are set to expire worthless, reducing our total trades under adjustment to 0.05 BTC. This is encouraging and indicates that we may soon return to a more aggressive trading strategy. For now, we are playing it safe and not opening unnecessary new trades, targeting $8 per day in premiums, down from our previous target of $15 per day.

Market Trends and Analysis: These are interesting times for trading Bitcoin. We focus on the 50- and 200-day moving averages and the relative strength index. Recently, Bitcoin surged to $65,000, testing resistance. The next move could either be a rally to $100,000 or a pullback to $57,000 or even $52,000. At Terramatris, we are cautious and hopeful for an upward adjustment in our positions.

Joining Terramatris Crypto Hedge Fund: There are several ways to join. The easiest and most straightforward method, though still quite technical, is to buy Terramatris tokens. There are 10,000 Terad tokens minted on the Solana blockchain. You need a Solana-powered wallet, like Phantom, and you can swap USDC for Terramatris tokens on Raydium or Jupiter networks. Currently, 344 Terramatris tokens are available at a starting price of $1.17 each. For larger investments, contact me on LinkedIn or leave a comment on YouTube.

Swap USDC for TerraM on Raydium

New Project Announcement: We are excited to introduce our new investment product: selling options on gold. This project involves the Meow Meow token, which will focus solely on investments in real physical gold. The token is not yet minted, but we aim to create a $1 million gold hedge fund, minting 1 million Meow Meow tokens, each tied to 1 USDC. The funds raised will be used for options trades on gold, with premiums reinvested in physical gold. More details will follow soon.

Thank you for watching, and see you next week!