Strategies

TerraM Multi-Asset Crypto Options Fund

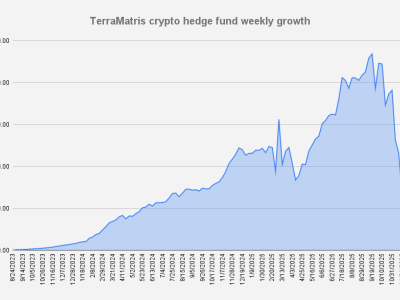

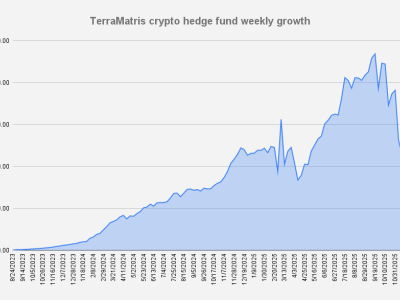

TerraM Multi-Asset Crypto Options Fund is a closed-end strategy managed by Terramatris LLC, focusing on generating consistent income through systematic options trading on Bitcoin, Ethereum, and Solana.The fund employs disciplined, rules-based selling of cash-secured puts and covered calls, reinvesting collected premiums into underlying spot positions to steadily compound long-term exposure.

Solana Covered Call Growth Fund (SolCCG)

The Terramatris Solana Covered Call Fund (“SolCCG”) is an open-end private investment fund designed to generate consistent income through systematic option premium collection on spot Solana (SOL) holdings. The strategy combines direct ownership of Solana with disciplined covered call writing to produce steady yield while compounding long-term growth in the underlying asset.

Blog

Ep 124: TerraM Multi-Asset Crypto Options Fund: +7.57% Weekly Gain to Start 2026

Greetings in 2026. The Terramatris team has traveled to the beautiful Palolem Beach in Goa, India, and with great excitement we are preparing the first weekly review of the new year. We wish everyone a strong and successful start to 2026.As of January 2, 2026, the TerraM Multi-Asset Crypto Options Fund is up +7.57% week-over-week, encouraging start of the new year. While the crypto market remains in a consolidation phase, still trying to decide its next move, last week was relatively calm, with most gains coming from expiring options positions.TerraM Multi-Assets Fund drawdown from all time…

Bull Put Spreads for Crypto Income

In crypto markets, being bullish does not necessarily mean expecting explosive upside. Most of the time, the more realistic assumption is that price will hold above a certain level. Bull put spreads are designed precisely for that environment.At Terramatris, we use bull put spreads as a structured, probability-driven way to generate income while keeping downside risk explicitly defined. This is not about prediction; it is about positioning.What Is a Bull Put Spread?A bull put spread is an options strategy that involves selling one put option and buying another put option at a lower strike…

Crypto Options

Ep 123: How TerraM Generated 5.4% Weekly Returns Using In-the-Money Covered Calls

As of December 26, 2025, the TerraM Multi-Asset Crypto Options Fund is up +13.77% week-over-week, encouraging result after previous weeks sharp drop. With only a few days left in 2025, crypto appears to be searching for a footing as it heads into 2026.TerraM Multi-Assets Fund drawdown from all time high back in September is –56%. While Year-to-date, our Fund is down –11.12%, underperforming Bitcoin (–4.57%) and ETH (–10.59%). Options IncomeThis week, the TerraM Multi-Asset Fund generated $276 in options premiums, what is impressive 5.4% weekly return on capital. The increase in options…

Weekly updates