Fund Overview:

Fund Name: TerraMatris Crypto Hedge Fund

Inception Date: August 22, 2023

Fund Structure: Closed Hedge Fund / Defi / TerraM token

Domicile: Georgia

Fund Manager: Reinis Fischer

AUM: $3,900

Minimum Investment: $10,000

Management Fee: 0%

Performance Fee: 50%

Liquidity: Monthly (30 days' notice)

Lock-up Period: 12 Months

Investment Strategy: Long/Short, Options Trading, Futures

Investment Objective:

Terramatris is a quantitative crypto research and investment hedge fund specializing in put selling on Bitcoin and Ethereum. Founded in 2023 by Reinis Fischer, our fund is dedicated to capitalizing on strategic opportunities within the cryptocurrency.

The fund operates in a hybrid mode utilizing the decentralized exchange (DEX) platform Raydium Automated Market Maker (AMM), while maintaining a private ownership structure. Although not currently registered publicly under any specific jurisdiction, our operational base primarily resides in Tbilisi, Georgia.

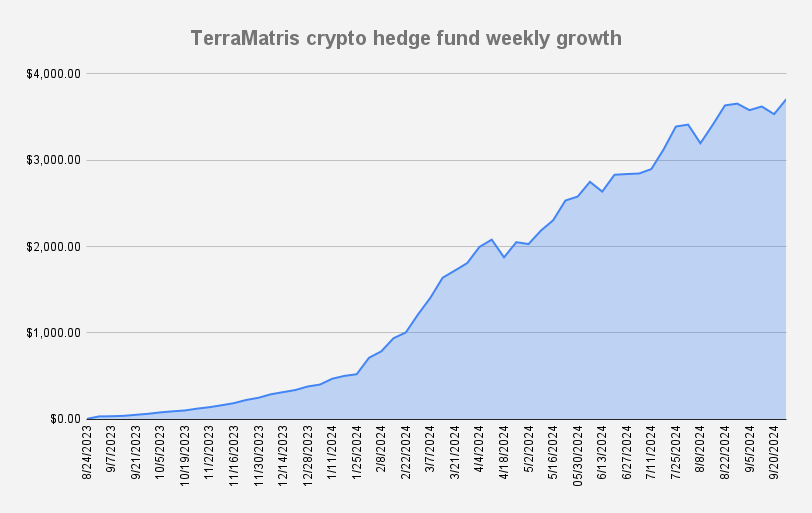

Performance Overview (as of October 1, 2024):

Period | Fund Return | Benchmark (BTC) | |

Year-to-date (YTD) | +890% | +42.77% | |

1 Month | +6.93% | +7.76% | |

3 Months | +32.93% | +7.79% | |

6 Months | +98.37% | -6% | |

Benchmark: Bitcoin (BTC) Price

Top Holdings (as of October 1, 2024):

Asset | Exposure (%) |

Bitcoin (BTC) | 4.5% |

Ethereum (ETH) | 6% |

Solana (SOL) | 8.5% |

Stablecoins (USDT) | 47% |

Other Crypto Assets | 34% |

Strategy Breakdown:

- At our fund, we specialize in trading options with cryptocurrencies and reinvesting the premiums into a diversified portfolio of crypto assets (buying spot crypto). Currently, we are focused on expanding our crypto holdings by selling put options on Bitcoin, with occasional trades involving Ethereum and Solana. Additionally, we employ a strategy of selling covered calls on already established positions like Ethereum, Solana or TON.

- We occasionally engage in selling covered calls on long perpetual futures and perform carry trades on cryptocurrencies, benefiting from the collection of funding fees from various crypto assets.

- This strategic approach allows us to steadily grow our crypto portfolio while effectively managing risk and capitalizing on market opportunities.

Risk Management:

TerraMatris employs a robust risk management framework to control drawdowns and volatility:

- Position Sizing: We limit position sizes to ensure diversified exposure and reduce overall portfolio risk.

- Stop Loss & Trigger Orders: Automated orders to minimize losses in case of adverse market movements.

- Options Hedging: Use of options to hedge against extreme downside risks, especially during periods of high market volatility.

Market Outlook:

We maintain a cautiously optimistic outlook on the cryptocurrency market. While market volatility remains elevated, we see strong potential for growth in key assets like Bitcoin, Ethereum, and Solana, especially as institutional adoption continues to rise. However, we remain hedged to protect against market downturns, with a particular focus on managing short-term volatility and market risks.

Contact Information:

For more details or inquiries, please contact:

Reinis Fischer

CEO & Fund Manager, TerraMatris

Email: reinis.fischer@terramatris.eu

Website: https://www.terramatris.eu