As the CEO of TerraMatris Crypto Hedge Fund, I’m always on the lookout for advanced trading strategies that not only capitalize on market opportunities but also protect against unforeseen risks.

In this article, I’m going to walk you through a sophisticated approach that combines options and futures to hedge your positions effectively. We’ll dive into a specific trade scenario involving Bitcoin, exploring how to manage potential risks, especially in volatile market conditions.

The Setup: Selling Bitcoin Puts with 1DTE

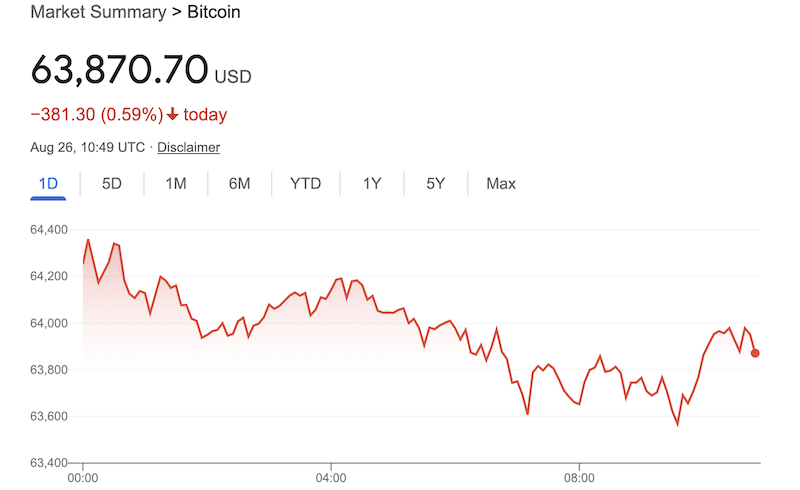

On August 26, 2024, Bitcoin was trading at $63,800. As a trader with a keen eye on short-term opportunities, I identified a compelling setup by selling a put option on Bitcoin with a strike price of $61,000, set to expire the next day. This trade offered a premium of $25 (or $0.25 for 0.01 BTC) and had a delta of -0.05, indicating a low probability that the option would be in the money at expiry.

Given Bitcoin’s current price, the likelihood of the put option expiring worthless seemed high. However, I’m always mindful of the potential for black swan events—those unexpected, significant market moves that can wreak havoc on seemingly safe trades. To hedge against this, I decided to incorporate futures into my strategy.

The Hedge: Using Futures for Risk Management

To safeguard against a sudden downturn, I set up an automated market order to short double the size of my options position (0.02 BTC) if Bitcoin hit the $61,000 trigger price. The logic here was simple: if Bitcoin dropped to $61,000 or lower, my futures hedge would kick in, potentially offsetting the losses from the put option.

This strategy, in theory, could be considered a zero-risk play. If Bitcoin stays above $61,000, the put option expires worthless, and I keep the premium. If it drops below $61,000, the short futures position should cover the loss, allowing me to exit the trade without a major dent in my portfolio.

What Could Go Wrong? The Risks of This Strategy

While this approach appears solid on paper, real-world trading is rarely so straightforward. There are a few critical risks to be aware of:

- Market Orders and Slippage:

- In a sharp selloff, there’s no guarantee that my market order to short futures would be filled exactly at $61,000. It could be executed at a lower price, which would reduce the effectiveness of the hedge.

- Price Oscillations:

- Markets often exhibit oscillatory behavior, and Bitcoin is no stranger to this. If my trade gets triggered at $61,000, but the price quickly recovers to $63,000, my short futures position could turn from a hedge into a liability.

- Stop Loss Considerations:

- To mitigate the risk of a rapid recovery, I would set a stop loss on the futures position. For example, if the trade moved 5% against me, the stop loss would close the position, capping potential losses.

Scenario Analysis 1: A Steep Market Selloff

Let’s first consider a scenario where Bitcoin drops to $55,000:

- Put Option Loss: The put option would be deep in the money, leading to a maximum loss of $60 ([$61,000 - $55,000] x 0.01 BTC), minus the $0.25 premium received.

- Futures Hedge Gain: The futures hedge would generate a gain of $120 ([$61,000 - $55,000] x 0.02 BTC).

- Net Result: The futures hedge offsets the option loss, leaving me with a net gain of $60.25 ($120 - $60 + $0.25 premium).

Scenario Analysis 2: Price Drops to $60,000 and Quickly Recovers to $62,000

Now, let’s examine a scenario where Bitcoin drops to $60,000, triggering my futures hedge, but then quickly recovers to $62,000:

- Put Option Outcome: If Bitcoin recovers above $61,000 by expiry, the put option expires worthless, and I keep the full $0.25 premium.

- Futures Hedge Loss: The recovery to $62,000 means my short futures position would incur a loss of $20 ([$61,000 - $62,000] x 0.02 BTC).

- Net Result Without Stop Loss: The net result would be a loss of $19.75 ($20 futures loss minus $0.25 premium).

- Net Result With Stop Loss: With a stop loss set at a 1% move against me, the position would be closed around $61,610, limiting the futures loss to $1,220 and the overall loss to $24.4.

Conclusion: Navigating the Complexities of Hedging

Hedging options with futures is a powerful tool in a trader’s arsenal, especially in volatile markets like Bitcoin. However, as these scenarios demonstrate, the strategy requires careful management to avoid turning a hedge into an additional risk. By setting stop losses and being prepared for potential slippage and price oscillations, I can better navigate the complexities of this approach.

While this strategy aims to protect against extreme market moves, it’s essential to remain vigilant and adaptable. In the fast-paced world of cryptocurrency trading, even the best-laid plans can be challenged by the unpredictable nature of the markets.