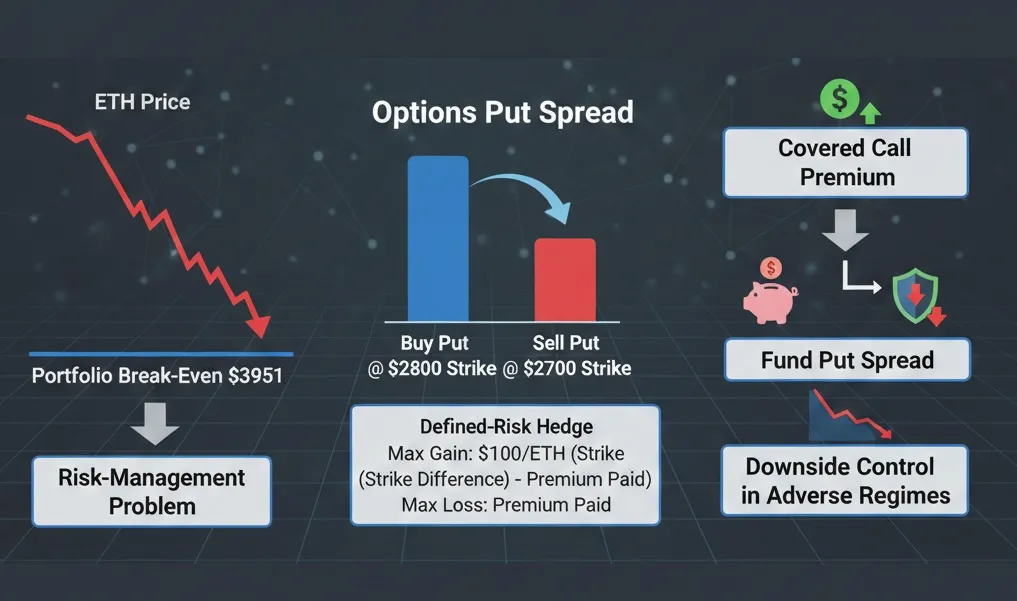

When markets move below our average entry, we treat the situation as a risk-management problem, not a prediction problem. At that point, the priority is simple: avoid turning a manageable drawdown into a deeper one. One of the tools we use for that purpose is the put spread.

To make the logic concrete, here is a real-style example.

On December 18, 2025, Terramatris was holding 2.8 ETH with a portfolio break-even price of $3,951. As part of our systematic income approach, we regularly sell weekly covered calls to generate premium and work our break-even lower over time. This can be rational in stable or gradually recovering markets. But after a deeper-than-expected drop, it became clear that covered calls alone are not enough: they help reduce basis, yet they do not protect against continued downside. When the market keeps sliding, premium selling without protection can become a slow grind—collecting income while the underlying continues to inflict damage.

That is why we explored an additional layer of downside control: the put spread.

A put spread is a defined-risk hedge built with two options of the same expiry. We buy a put at a higher strike (closer to the current price) and sell a put at a lower strike. The sold put reduces the cost of the hedge, but it also caps the maximum protection. This is intentional. We are not trying to buy unlimited crash insurance every week—we are trying to control downside in a specific range at a cost that can be justified and repeated.

Here is a clean illustration.

Suppose ETH is trading around the high-2,000s after the drop. We can buy the 2,800 put and sell the 2,700 put with the same expiry. If ETH stays above 2,800 into expiry, both options expire worthless and the spread loses the premium paid. If ETH falls below 2,800 but stays above 2,700, the hedge gains value dollar-for-dollar as price drops through that 100-dollar zone. If ETH falls below 2,700, the hedge reaches its maximum payoff: the difference between strikes, which is $100 per ETH, minus the premium paid. If ETH falls to 2,500, the hedge does not pay more than that $100 per ETH width.

That’s the trade: cheaper protection, but capped.

Why do this instead of buying a naked put? Because repeatedly buying naked puts is often expensive and inefficient, especially in volatile conditions. They decay quickly, and the cost can overwhelm the income earned from covered calls. Put spreads are more efficient: they let us purchase protection where we need it most without continuously paying for protection we may not need. This approach is common in professional options books because it makes hedging measurable, budgetable, and repeatable.

At Terramatris we use put spreads when the market is below our break-even and the dominant risk is further downside. In this regime, selling covered calls can still be rational: it harvests time decay and helps reduce basis over time. But once the market shifts into a sharper downtrend, we want to avoid the scenario where a manageable drawdown becomes significantly worse. The put spread is the counterweight: it limits the damage a further leg down can do while we continue running the income strategy.

We also prefer to finance this hedge from premium earned by selling covered calls, particularly when those calls are sold below break-even. The logic is straightforward. When price is below our average entry, we are not in a “maximize upside” environment—we are in a “prevent further downside” environment. Using part of the covered-call income to pay for protection turns the approach into a disciplined risk overlay rather than a one-way premium sale. In practice, this behaves like a collar-style framework: premium comes in, and a portion of it is redirected toward risk control.

This does not guarantee a quick return to break-even, and it is not designed to. The purpose of the hedge is not to profit; it is to reduce the probability of a large, permanent loss while we work the position. A put spread is not crash insurance. If the market breaks significantly below the lower strike, the hedge stops increasing in value. That is why sizing, strike selection, and hedge horizon matter. If we are concerned about a deeper move, we adjust the structure—by widening the spread, moving strikes, extending duration, or combining the spread with cheaper tail protection—always with the goal of keeping risk defined without letting hedging costs consume the entire strategy.

The bottom line is that this is a professional way to stay operational in adverse regimes. When price is below break-even, our edge comes from discipline: collecting premium where it makes sense, and spending part of that premium to reduce the chance of further downside doing disproportionate damage. Put spreads let us cap downside in a targeted range, at a predictable cost, while we continue working toward break-even rather than betting everything on a single market outcome.