Welcome to the first weekly newsletter from Terramatris Research, where we highlight potential trade candidates discovered by our in-house options scanner at scanner.terramatris.eu.

Each week, our screening engine evaluates crypto options across BTC, ETH, and selected altcoins to identify premium-selling setups with favorable risk-to-reward and a statistically high chance of expiring worthless.

In this inaugural edition, we focus on simple option-selling strategies:

Cash-secured puts – for traders comfortable owning the underlying at a discount.

Covered calls – for those already holding the asset and seeking to earn additional yield.

We do not recommend selling naked call options under any circumstances, and we strongly discourage the use of significant leverage. If you choose to apply leverage, keep it minimal — think 1.1 ×, not 5 ×. The objective here is steady, compounding premium income, not gambling on volatility spikes.

Without further ado, here are this week’s trade ideas our scanner flagged as potentially profitable, high-probability candidates for expiration without value.

Trade Recommendations – Week of November 7, 2025

This week’s Terramatris Options Scanner identified several high-probability premium-selling setups with attractive implied volatility and strong probabilities of expiring worthless.

We focus only on short-premium strategies — selling puts and covered calls — that align with our conservative, income-oriented approach. All probabilities are derived from real-time Deribit option data; values such as delta, IV, and mark price are included for reference.

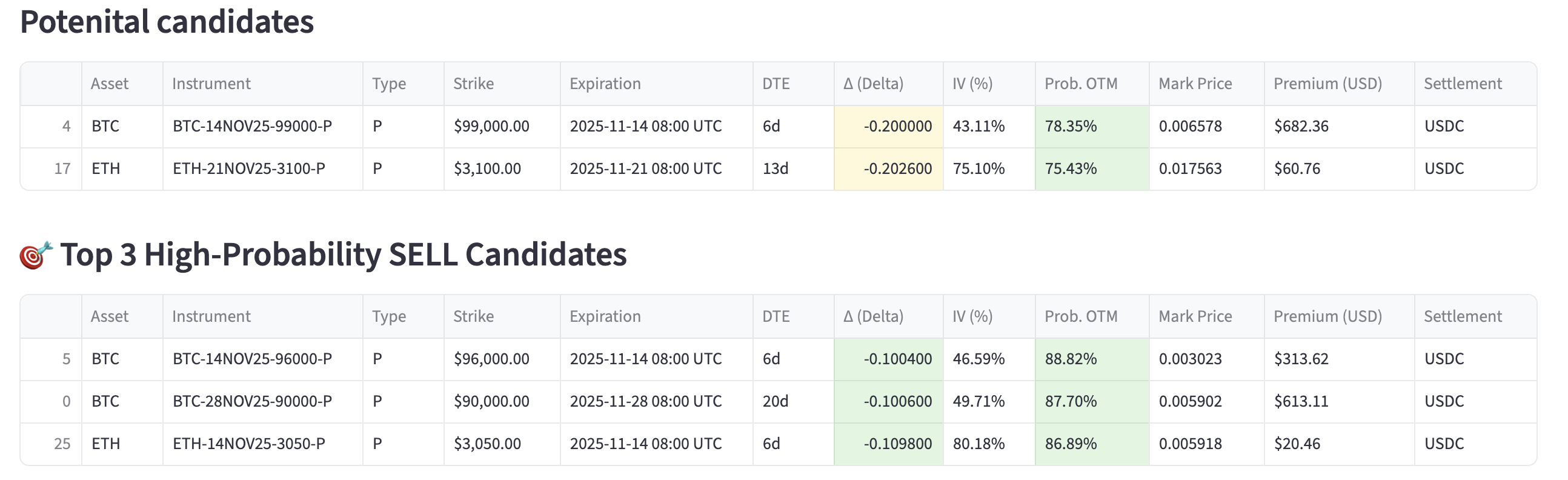

Cash secured puts

All listed trades show probabilities of expiring OTM above 75 %, indicating favorable odds for option sellers.

BTC’s short-dated puts offer tighter spreads and lower margin requirements, while ETH continues to price in elevated volatility, rewarding premium collectors who manage risk carefully.

We recommend sticking with cash-secured puts and covered calls, avoiding naked positions. Use small size relative to total capital — think 1–5 % risk per leg, no leverage, and be prepared to take assignment if prices drop.

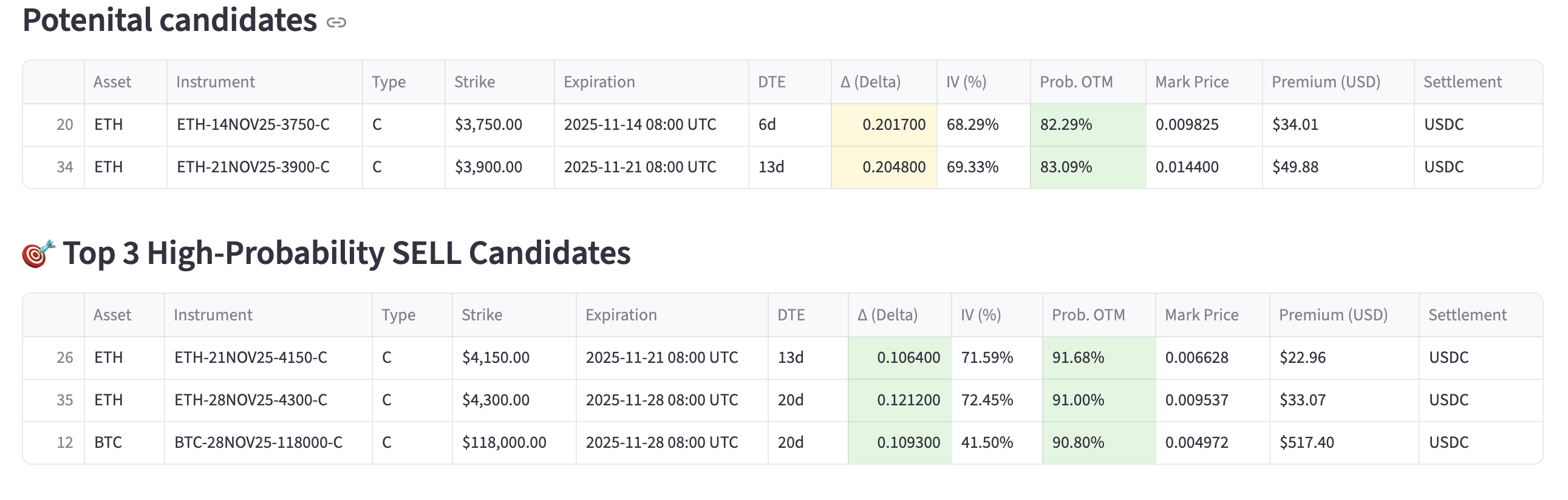

Covered calls

All the listed positions have probabilities of expiring out-of-the-money above 80 %, making them strong candidates for covered-call premium collection rather than naked call sales.

ETH remains the richer volatility target, offering better call-selling yields.

BTC premiums are lower in relative terms but stable and suitable for conservative covered-call exposure.

All trades carry high OTM probabilities (> 90 % on the top picks).

The focus remains on covered calls only — avoid naked call exposure, especially with IV above 70 %.

As always, use small allocation per leg (≈ 5 % of portfolio) and avoid leverage.

Next week, we’ll review the outcomes of these trades and, if needed, adjust the parameters of our options scanner to better align with evolving market volatility.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Crypto Options newsletter