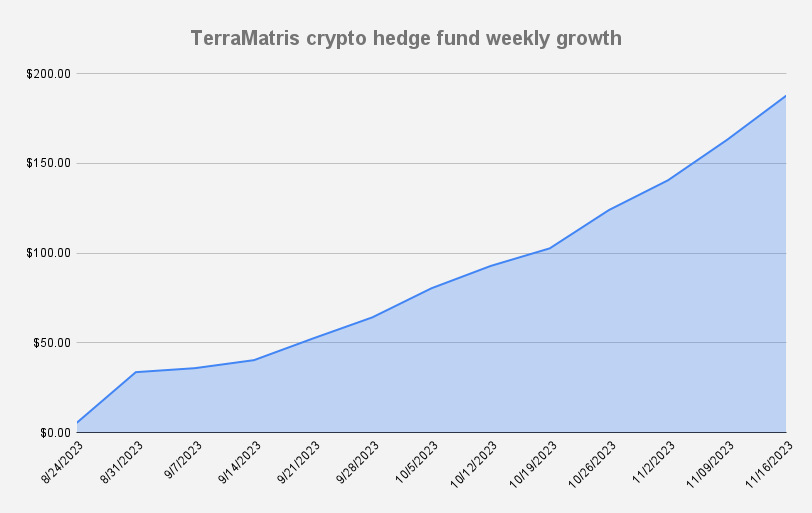

On August 22, 2023, TerraMatris Crypto Hedge Fund began its venture into the dynamic world of cryptocurrency trading, with a distinctive focus on options to propel portfolio growth.

As we reflect on our journey thus far, the close of 2023 saw us strategically selling 1 Day to Expiry (DTE) put options on Ethereum and Bitcoin. A pivotal move, as the premiums garnered were promptly reinvested back into the crypto market. The initial results are promising, laying the foundation for what lies ahead.

Looking to the future, TerraMatris has set an audacious goal – to increase the total fund value more than tenfold.

As of November 15, 2023, with the fund's current value standing at $180, our sights are set on an impressive $4,146 by the close of December 2024.

This equates to growing our funds by more than 23 times in the next 13 months. The noteworthy aspect? We aim to achieve this remarkable feat independently, relying on our expertise and strategic approach to navigate the complex crypto landscape.

At present, our daily trading strategy involves actively managing 1-2% of the total fund value, providing us with a dynamic and hands-on approach to capitalize on short-term market movements.

Starting January 2024, TerraMatris is embarking on an ambitious growth plan, aiming to increase the fund's value by a minimum of $5 daily, with incremental growth of $1 each subsequent month. By the close of December 2024, the objective is to achieve an impressive daily growth of $16. This ambitious plan signifies our commitment to controlled and sustainable growth.

Here is a glimpse into our planned growth, outlining the monthly progression of daily premiums:

| Monthly | Total | Daily Premium | |

| January 2024 | $155.00 | $459.05 | $5.00 |

| February 2024 | $168.00 | $627.05 | $6.00 |

| March 2024 | $217.00 | $844.05 | $7.00 |

| April 2024 | $240.00 | $1,084.05 | $8.00 |

| May 2024 | $279.00 | $1,363.05 | $9.00 |

| June 2024 | $300.00 | $1,663.05 | $10.00 |

| July 2024 | $341.00 | $2,004.05 | $11.00 |

| August 2024 | $372.00 | $2,376.05 | $12.00 |

| September 2024 | $390.00 | $2,766.05 | $13.00 |

| October 2024 | $434.00 | $3,200.05 | $14.00 |

| November 2024 | $450.00 | $3,650.05 | $15.00 |

| December 2024 | $496.00 | $4,146.05 | $16.00 |

As of the moment we are considering trading a 1 Day to Expiry (1DTE) put option valued at $5 on Ethereum (ETH) with a delta under 0.1, our margin collateral requirement stands at approximately $640. In contrast, to engage in the sale of an identical put option at a premium of $16, the margin collateral needed increases to approximately $2,000. This difference in margin requirements underscores the importance of careful consideration and strategic planning in our options trading endeavors.

It will be interesting to see, how our plans will evolve and how the fund will grow. In the case of attracting a few strategic investors, we should talk completely about other numbers, but right now we are focusing on organic growth.

If you are interested in learning more or participating in the fund (minimum investment $10,000) - feel free to write me an email to reinis.fischer {at} terramatris.eu or connect on LinkedIn