Bitcoin's volatility presents unique opportunities for traders looking to generate passive income through derivatives strategies. One such approach is selling covered calls on Bitcoin perpetual futures contracts. This strategy allows investors to collect premium income while maintaining exposure to Bitcoin's price movements.

In this article, we'll explore our recent covered call trade on Bitcoin perpetual futures, the potential benefits of this strategy, and how it can be a valuable addition to a long-term investment portfolio.

Our Trade Setup: A Step-by-Step Breakdown

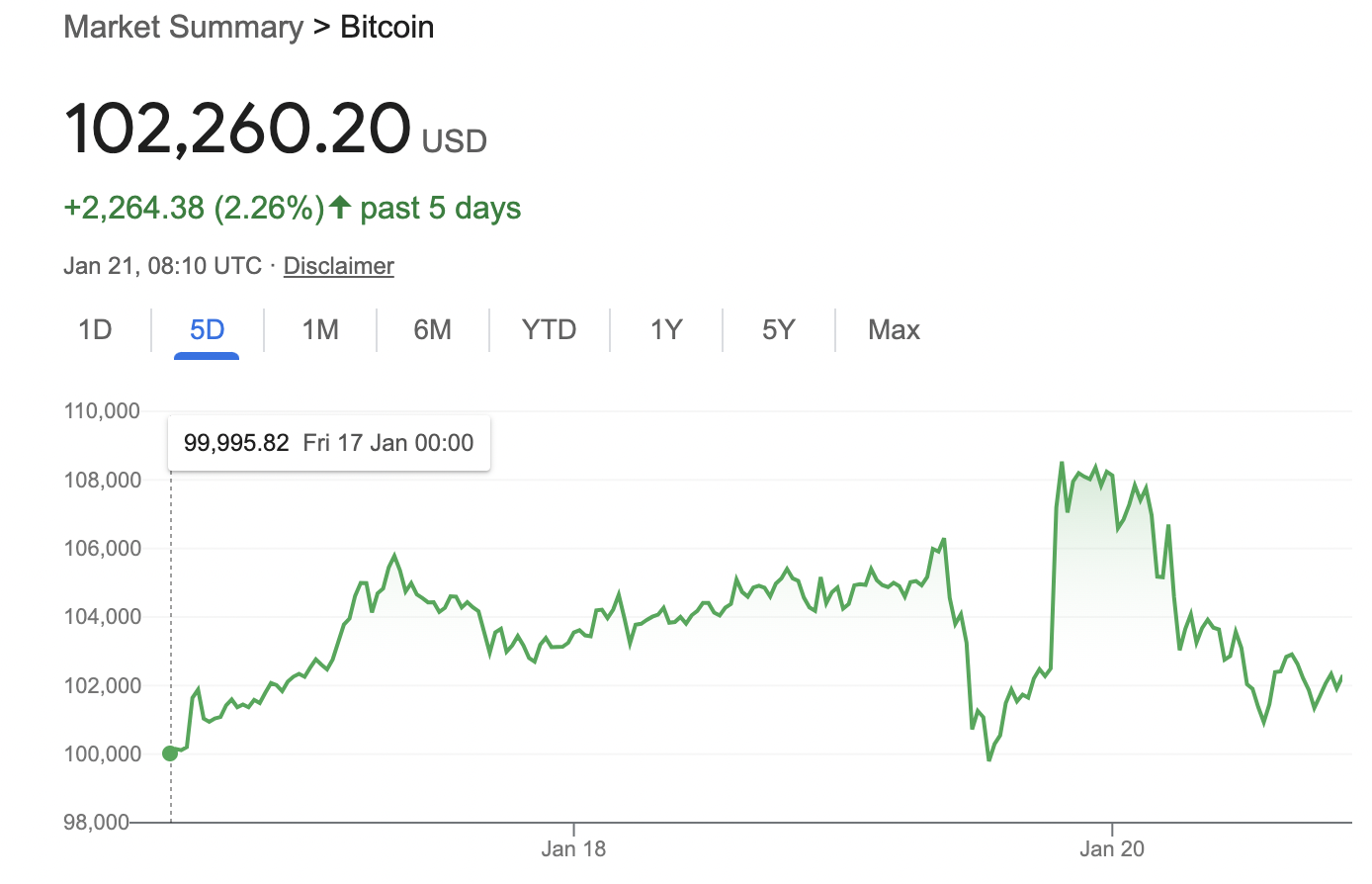

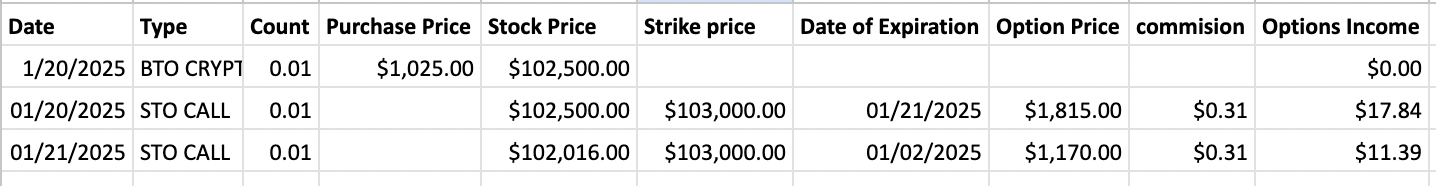

On January 20, 2025, we executed a covered call strategy by purchasing 0.01 BTC perpetual futures at a price of $102,500 per Bitcoin. Simultaneously, we sold a 1-day-to-expiry (1DTE) 0.01 BTC call option with a strike price of $103,000, collecting a premium of $1,800 per Bitcoin.

As the first day concluded, our call option expired worthless, allowing us to retain the entire premium. We then sold another 1DTE call option, collecting an additional $1,170 per Bitcoin, effectively lowering our breakeven price to $99,576.

Our goal is to continue selling short-term call options on this position for as long as market conditions allow. This consistent premium collection can help offset potential drawdowns while generating passive income.

Our max profit: $34.34 or 3.35% potential income return in 2 days. Max profit is realized in case Bitcoin trades above $103,000 on the expiry date (January 22, 2025) and we close the long perpetual futures contract.

The Rationale Behind Covered Calls on Bitcoin Perpetual Futures

- Generating Consistent Income: Selling call options allows us to collect premiums regularly, helping to reduce our cost basis and improve profitability.

- Mitigating Volatility: Bitcoin's price swings can be extreme, and covered calls provide a cushion by generating income, even if the price remains stagnant.

- Lowering Break-even Levels: As illustrated in our trade, the additional income from selling calls helps lower our effective break-even price.

- Capitalizing on Range-Bound Markets: If Bitcoin trades within a predictable range, this strategy can be highly effective in capturing returns from option premiums.

Potential Adjustments and Long-Term Outlook

Should Bitcoin experience a significant decline, we are prepared to convert our perpetual futures position into spot BTC, effectively increasing our total holdings to 0.02 BTC. This move would allow us to maintain long-term exposure to Bitcoin, leveraging the current dip to accumulate more of the asset.

Looking forward, some optimistic forecasts suggest that Bitcoin could reach $13 million per BTC within the next 20 years. With this perspective in mind, today's covered call strategy serves as a small yet important step toward maximizing long-term value while generating short-term income.

Key Takeaways for Investors

- Covered calls provide a steady income stream: By selling call options, traders can collect regular premiums and lower their risk exposure.

- Adaptability is key: Being prepared to convert perpetual futures to spot positions can enhance long-term portfolio growth.

- Long-term vision matters: Combining short-term income with a long-term bullish outlook creates a balanced investment strategy.

- Risk management is crucial: Understanding potential downside scenarios ensures that traders are well-positioned to respond to market shifts.

Conclusion

Selling covered calls on Bitcoin perpetual futures is a strategic way to generate passive income while maintaining exposure to Bitcoin's long-term growth potential. Our recent trades demonstrate how consistent premium collection can reduce costs and enhance profitability over time.

At Terramatris, we believe in the power of combining short-term strategies with long-term conviction. By continuing to sell calls strategically and being prepared for market fluctuations, we position ourselves to capitalize on Bitcoin's future trajectory while managing risk effectively.

Stay tuned for more updates on our trading journey and insights into the evolving crypto derivatives market.