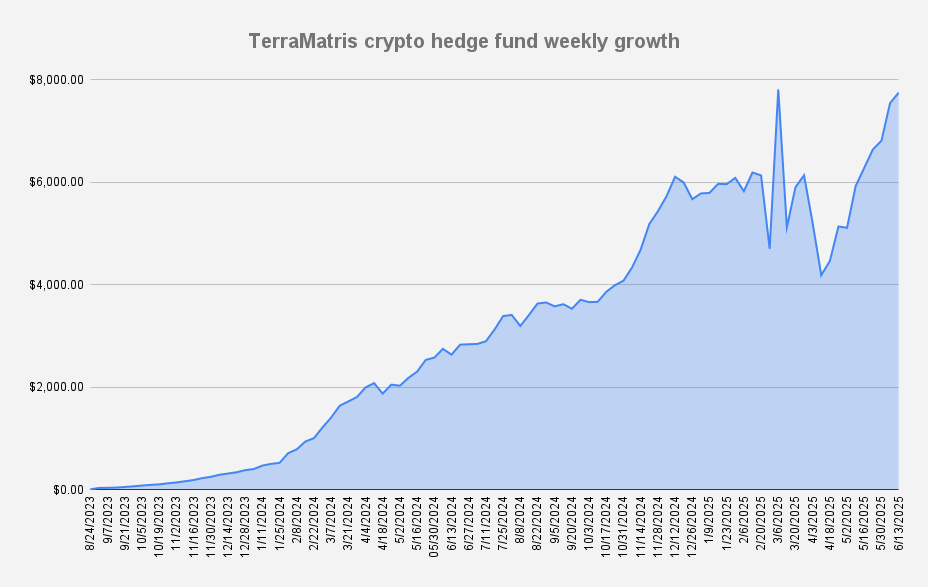

As of June 13, 2025, the Terramatris crypto hedge fund value stood at $7,750 showing yet another weekly growth of +2.71% or +$204 in dollar terms.

Just like the previous week, our fund’s value remained well above $8,000 for most of the time. However, a slip occurred once again, and at the time of writing this article, we’ve fallen below that threshold.

Despite the growth, we are still -0.82% below our all-time high of $7,811 (recorded on March 6, 2025), while the fund's year-to-date performance is +36.46%

Current Long Perpetual Futures (USDT Settled)

- 0.02 BTC – Break-even: $115,367 | Short puts: $96,000

- 1.9 ETH – Break-even: $3,143 | Short puts: $2,300

- 5 SOL – Break-even: $167.64| Long calls: $156

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, in total, we earned $143.63 from options premiums, translating to a 1.85% weekly return on capital. Our target is anything above 1%, so we're satisfied with this result.

TerraM Token Update

The TerraM token remains stable at $2.60, with little price movement in recent weeks.

We're focused on improving liquidity, but no major buybacks or liquidity increases are planned until the fund reaches at least $8,000 in value. Although we're approaching the next buyback, which could slightly improve liquidity and potentially raise the token price by around 10 to 13 cents.

Outreach campaign over LinkedIn

This week, we launched a targeted LinkedIn outreach campaign focused on DeFi, Web3, and crypto investors. We curated a high-potential contact list and reached out to 10 qualified individuals per day, sending warm-up messages to introduce our work and expand awareness of the TerraM fund.

The primary goal is to build credibility and authority within the crypto investment space. A secondary objective is to explore direct or OTC deals involving our fund’s TerraM tokens.

By the end of the week, our CEO had established 130 (+18)LinkedIn connections, while our official company page remained at just 4 followers—a clear signal of the personal nature of early engagement versus brand awareness.

The goal of this outreach campaign is to spark interest, build strategic partnerships, and potentially attract new investments.

If this resonates with you, feel free to connect with us on LinkedIn—we’re always open to meaningful conversations.

This update is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.