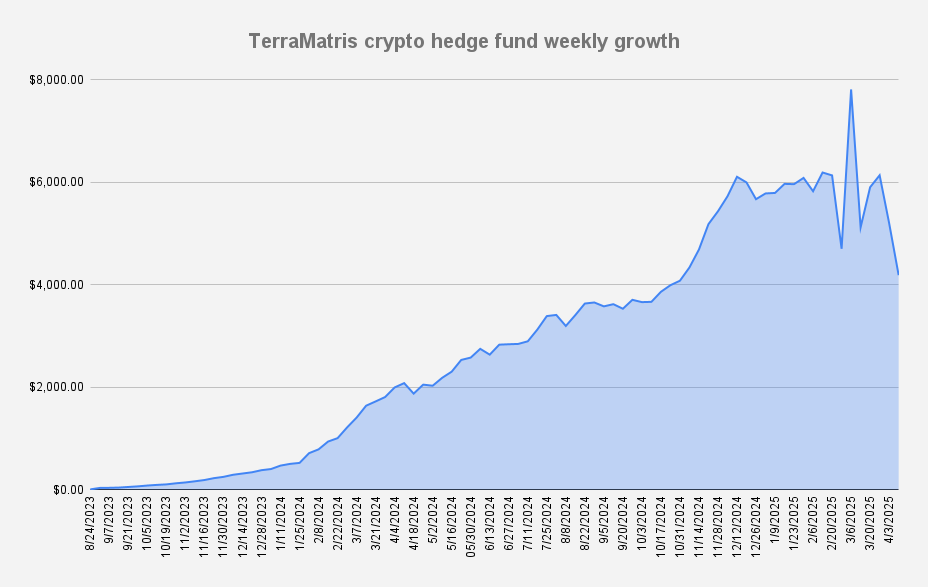

As of April 11, 2025, the fund’s value has declined to $4,187.39, marking a -19.52% drop week-over-week, equivalent to a -$1,015 decrease in dollar terms. This marks the second consecutive week of losses, further highlighting the ongoing instability in the broader market.

We now stand -44.03% below our all-time high of $7,811, recorded on March 6, 2025, a sobering reminder of the persistent volatility that continues to shape the current macroeconomic landscape. YTD crypto hedge fund has dropped to -26.28%

This week’s downturn was largely driven by escalating geopolitical tensions, most notably the newly imposed tariff wars announced by President Trump. The market reacted sharply, with Ethereum—our most heavily impacted position - falling below the critical $1,500 mark, sparking a wave of forced liquidations and panic-driven selling.

While ETH has since recovered slightly above this threshold, the turbulence left a visible mark on our portfolio’s performance.

Ethereum has been bleeding heavily, and a retest of the $1,000 level is not off the table.

Whether we get there largely depends on Bitcoin's next moves. If Bitcoin fails to hold support at $75,000, there’s a high probability it will continue to slide toward $68,000. Adding to the bearish sentiment, Bitcoin has formed a death cross on its 50/200-day moving averages — a classic indicator of potential downward momentum.

Despite viewing this as a healthy market correction, the reality is tough: we’re holding Bitcoin purchased at levels above $108,000. At this stage, there’s little we can do besides holding our bags, selling covered calls against our positions, and waiting for a recovery.

Trade Adjustments

A few weeks ago, we restructured our deep in-the-money ETH put options into covered calls on long perpetual futures to optimize risk, enhance capital efficiency, and reduce downside exposure. This adjustment has proven effective as the market begins to stabilize.

Current positions in long perpetual futures (settled in USDC):

- 0.02 BTC (break-even: $106,577) lowered by -$2,153 | strike $84,000 / $78,000 (short)

- 2.1 ETH (break-even: $2,589) lowered by -$111 | strike $1,450 (short)

- 5 SOL (break-even: $159.06) lowered by -$2.97 | strike $124

Over the past several weeks (and even months), we've been generating options premium primarily through trade adjustments rather than initiating new positions. Despite the challenging circumstances and the underperformance of our existing holdings, we still managed to collect $183.4 in premium this week from these ongoing adjustments—a modest but meaningful contribution under the circumstances.

Converting these positions to spot crypto would require $8,363.74 in cash—an impractical sum given our constraints. By using long perpetual futures, we need only a fraction of that, though funding fees remain a burden.

With current strike prices and options premiums there is still about $2,929 funds to be recovered to break even our suffered positions. One of the short term goals is to sell weekly call options to offset the loses and generate cash, which later can be used to purchase actual spot crypto. As while in the recovery mode we are not buying any additional spot crypto as we don't have enough cash / and we don't want to use margin. Cash is KING!

No new capital has been injected into the fund, and liquidity remains a top priority.

TerraM Token Update

The TerraM token continues to demonstrate resilience, outperforming much of the broader crypto market, but thats mostly attributed that there are just a few TerraM token holders and seems most are interested in long term growth, which is great!

- Current TerraM Price: $2.60 (unchanged week-over-week)

We are committed to improving liquidity for TerraM, but given current market conditions, we do not anticipate a significant liquidity increase or another buyback until the total fund value reaches $8,000.

The crypto fund endured another difficult week, shedding 19.5% and deepening YTD losses to over 26%. Ethereum's sharp drop and Bitcoin’s looming technical breakdown are keeping markets unstable. Strategic options restructuring has helped marginally lower break-evens and generate small cash inflows. TerraM remains stable, but all eyes are now on liquidity, premium collection via weekly calls, and careful portfolio management until recovery conditions improve.

This update is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.