Good morning, ladies and gentlemen. My name is Reinis Fischer, CEO and founder of Terramatris Crypto Hedge Fund. Today is June 20, 2024, and I’m recording our weekly recap of happenings in Terramatris Crypto Hedge Fund from Tbilisi Axis Tower. You might sea my friend Dino in the background. With that said, let’s begin.

Let me give you a brief overview of Terramatris. We are a private crypto investment hedge fund managed by me, Reinis Fischer. Our fund is privately held and not publicly registered, though it is available for investment via the Raydium decentralized liquidity pool. The fund operates primarily from Tbilisi, Georgia, with assets held on both decentralized and centralized exchanges.

Disclaimer: Investments in stocks, funds, bonds, or cryptocurrencies are risky, and you could lose some or all of your money. Do your own due diligence before investing in any kind of asset or trading strategy.

At Terramatris, we primarily trade one-day to expiration put options on Bitcoin. Additionally, we sell covered calls on already established positions. So far, we have been selling calls on Ethereum and Solana, and the premiums received from these put options are reinvested back into crypto. Our basket of coins includes Bitcoin, Ethereum, Stellar Lumens, USDC (stablecoin), Solana, Jupiter Token, and PAXG (tokenized gold). This forms our dollar-cost averaging strategy, allowing us to maintain a decent buying price.

As we reach week 44 since the fund's launch, we’ve consistently invested in Ethereum and Stellar Lumens. Our risk management strategies are straightforward. When entering trades, we look for high probability trades likely to expire worthless, meaning we trade put options with a delta around -0.10. If a trade goes against us, we consider rolling forward for credit, buying back our losing position, and selling a new position at a lower strike price. Additionally, we might hedge with futures if we anticipate a significant market drop, entering a short position using a future perpetual contract. We also employ stop losses and buy long put options with more than 45 days to expiration to protect against steep market crashes.

Weekly Goals: Every week, we set ambitious goals. This week, we targeted a minimum of $13 daily from options premiums, reinvesting this back into Ethereum and Stellar Lumens. So far, most of our trades have been successful, expiring worthless and allowing our premiums to grow.

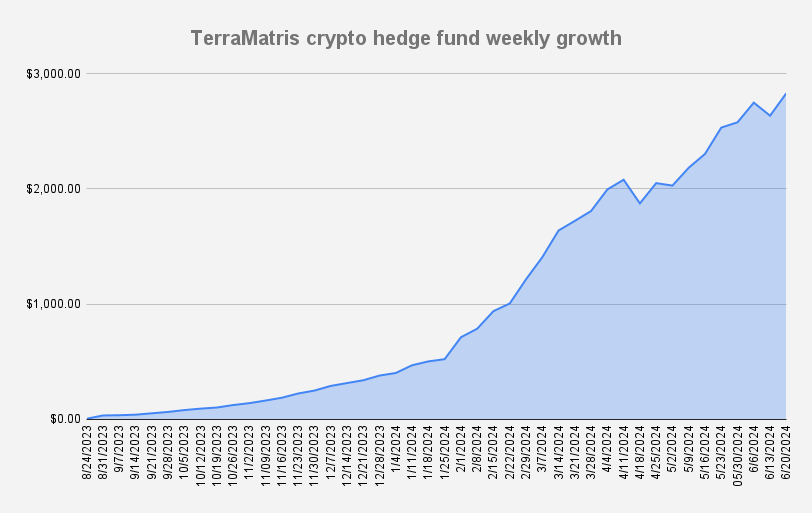

Weekly Results: On June 20, 2024, we reached an all-time high of $2,831, representing a week-over-week growth of more than 7%. This growth of $195 was partly due to a private sale of 200 Terram tokens to a private investor, conducted over Facebook. This sale contributed to our overall growth, despite a market correction that affected our altcoin holdings like Jupiter and Solana. Without this additional investment, we would have faced a negative week.

Market Trends and Technical Analysis: Looking at the Bitcoin chart, Bitcoin is currently trading a bit under its 50-day moving average. We're in a testing zone with a high chance of a pullback. I expect Bitcoin to first drop to $61,000 and potentially to $57,000, which is still above the 200-day moving average. If the support at $50,000 doesn’t hold, we may see a drop to $41,000. This volatility influences our one-day expiration put options trading strategy.

Additional Activities: We recently added to our 52-week Bitcoin future leverage account, purchasing 0.001 Bitcoin weekly, planning to start selling call options using a covered call strategy. Despite the market correction, our average buy price remains at $68,000, with Bitcoin currently priced around $65,000.

LinkedIn Fundraising: We’ve been passively fundraising on LinkedIn, receiving commitments of at least $10,000 from potential investors. One spot remains for additional private investors.

Token Sale and Buyback Initiative: We sold 200 Terram tokens, making us very happy. To give back to our DeFi community, we’re launching a buyback initiative, buying back our own tokens from the liquidity pool to increase the price for current token holders. As the fund reaches $3,000, we’ll start this buyback, aiming to drive the token price to around $1.40-$1.50 in the coming weeks.

Terram Token Details: There are 10,000 Terram tokens available on the Solana blockchain, which can be swapped for USDC on Radium or Jupiter. If you want to purchase more than what's available in the liquidity pool, or at a better price, you can contact me directly for an over-the-counter sale.

Personal Note: Last weekend, I participated in a 10K race in Tbilisi, finishing in just over two hours. Despite not being my best performance, it was a great analogy for the rollercoaster nature of crypto markets. I met other hedge fund managers during the race, and although I wasn’t the fastest, it was a valuable experience.

That's it for this week's recap. It's been a good week for Terramatris and our token. See you soon!