Good morning, ladies and gentlemen. My name is Reinis Fischer, and I am the CEO and founder of Terramatris Crypto Hedge Fund. Today is June 6th, 2024. I am joined by my friend Dino in the background, and together we are recording this screencast to update you on the recent happenings in our crypto hedge fund. By "our," I mean yours and mine—you and me. Let's begin.

Before we dive in, let me give you a quick overview of what the Terramatris Crypto Hedge Fund is. Terramatris is a private crypto investment hedge fund managed by me, Reinis Fischer. The fund is privately held and not publicly registered, so it is available for investment through the Raydium decentralized liquidity pool. You can swap USDC for our native TERRAM token. The fund is primarily operated from Georgia.

Disclaimer: Investments in stocks, funds, and cryptocurrencies carry risks. You could lose some or all of your money. Please do your own due diligence before investing in any kind of asset.

Now, let me explain our trading strategy at Terramatris.

Here at Terramatris, we mostly sell one-day-to-expiry equity options on Bitcoin. Additionally, we might sell covered calls on already established positions, such as Ethereum. All the premium earned is reinvested back into crypto. So far, we have chosen a few select coins, including Bitcoin, Ethereum, USDC (a stablecoin), Solana, Jupiter Token, and PAXG (tokenized gold).

Risk Management: At Terramatris, risk management is paramount. As put sellers, we look for high-probability options trades—meaning trades that are likely to expire worthless. If our trades get challenged, we look to roll forward for credit. We might hedge with futures contracts, such as shorting perpetual futures, to limit our losses from put options. In extreme market conditions, we might use stop losses and buy long put options with more than 45 days to expire as an extra layer of safety.

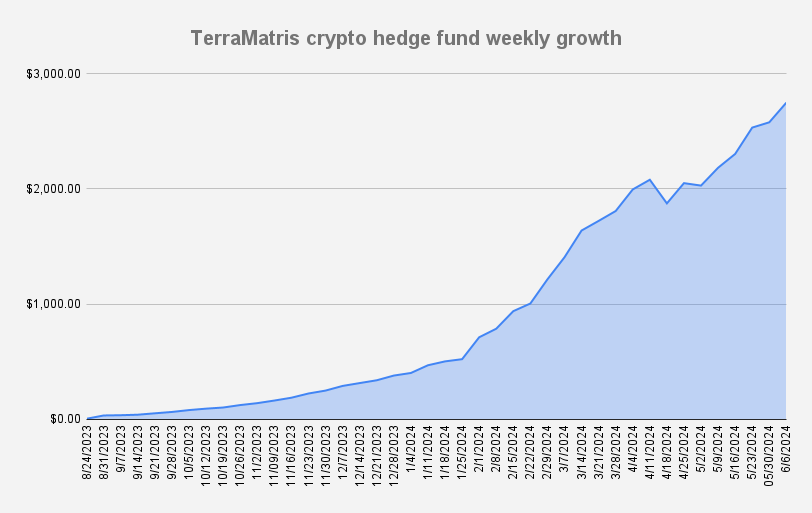

Weekly Goals: Every week, we set goals for our daily premium. This week, we targeted a minimum of $11 daily from options premiums, reinvesting this premium back into Bitcoin and PAXG. Let's see how we did this week. Today, on June 6th, 2024, we reached another all-time high of $2,749, representing a week-over-week growth of more than 6%, which is a great result. In dollar terms, we added more than $170 to our crypto hedge fund.

Since our inception in August 2023, we've almost reached $3,000. If market conditions remain stable, we expect to hit this milestone in June. However, market conditions can change, and we're not guaranteeing we'll reach $3,000 soon.

Trade Adjustments: We don't have any trade adjustments at the moment and are quite happy with our portfolio. In May, we were concerned about a few put options on Bitcoin, but they all worked out well.

Market Trends and Technical Analysis: Currently, Bitcoin is very bullish, trading above its 200-day moving average. We are aware of potential pullbacks to $65,000 or even $57,000, which corresponds to its 50-day and 200-day moving averages, respectively. If Bitcoin pulls back to $57,000, we will be very cautious about the market's next move. It could drop further to around $40,000, but we're not predicting this will happen. We remain cautious and look for opportunities where the price should not go, rather than predicting exact price movements.

52 Weeks Bitcoin 10x Leverage Challenge: A few weeks ago, we started the "52 Weeks Bitcoin 10x Leverage Challenge," where we buy 0.001 Bitcoin every week, forming a Bitcoin dollar-cost average price. Once we have enough Bitcoin, we will start selling call options on it. After 52 weeks, we aim to hold Bitcoin with an average dollar-cost price and expect to make a profit, although the outcome is uncertain. During this period, we will sell call options against the futures contract.

LinkedIn Networking: Recently, I was very active on LinkedIn, reaching out to my connections about our fund. We had about 10 Google Meet calls with various individuals, including crypto blockchain developers, investors, and quant traders. While we haven't raised any additional funds yet, the networking experience was invaluable, and I plan to revisit fundraising in a few months.

TERRAM Token: If you're not interested in making a large capital investment in the Terramatris Crypto Hedge Fund, you can still grow with us via our native TERRAM token. There are 10,000 tokens minted on the Solana blockchain. You can swap USDC for TERRAM on the Raydium liquidity pool. At the moment, there are 344 TERRAM tokens available. The starting price for one TERRAM token is $1.17. For larger investments, you can contact me directly to purchase up to 200 TERRAM tokens privately.

Invest with TerraMatris crypto hedge fund

Participating in our fund is straightforward: either make a direct investment in the hedge fund or acquire TERRAM tokens. Both ways are great for growth. If you're interested, please drop a comment, connect on LinkedIn, or fill out the form on our website.

That’s all for this week. Thank you for watching, and see you next time!