Good morning, ladies and gentlemen. My name is Reinis Fischer, and I'm the CEO and founder of TerraMatris Crypto Hedge Fund. Today, on April 25, 2024, I'm recording this video from the lobby at Axis Tower in Tbilisi. It's a bustling morning here, with many people around, making it a vibrant and tourist-friendly city. If you're ever in town and would like to connect, this is a great meeting place.

Axis Tower, where I conduct most of my meetings, also boasts an excellent gym. But enough about that—let's dive into the world of crypto and discuss Terramatris, our private crypto investment hedge fund.

Terramatris is a private crypto investment hedge fund managed by me. It's not publicly registered in any jurisdiction, making it available for investment through various channels, including Decentrazide Finance. Investors can acquire TerraM tokens, the native token for our hedge fund, either through Raydium liquidity pool or Jupiter aggregator.

Before delving into our trading strategy, I must emphasize the disclaimer that investments in stocks, funds, bonds, or cryptos carry risks, and investors could lose some or all of their money. It's crucial to conduct thorough due diligence before investing in any asset.

Trading Strategy

Our primary trading strategy at Terramatris revolves around selling one-day-to-expire put options on Bitcoin while reinvesting the premium back into cryptocurrencies. We've primarily focused on Bitcoin, Ethereum, Stellar Lumens, USDC stablecoin, Solana, and Jupiter.

However, we're considering narrowing down our investments to three major coins: Bitcoin, Ethereum, and Solana. These coins offer excellent opportunities for selling both put and call options, which aligns with our investment approach.

Risk Management

Managing risk is paramount in our trading endeavors. We seek high-probability options trades with a high chance of expiring worthless or out of the money. When trades go against us, we adjust them by rolling forward for credit or incorporating stop losses and buying long put options as protection.

Weekly Results and Market Analysis

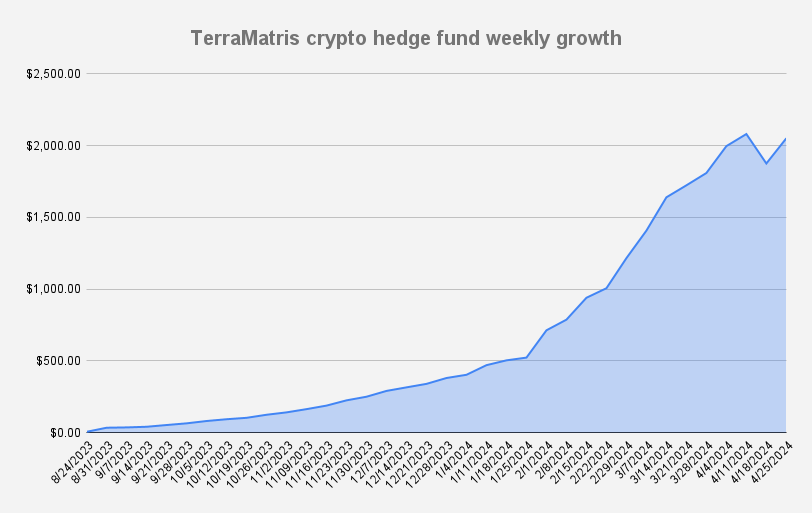

As of April 25, 2024, our fund has reached almost an all-time high, with a week-over-week growth of 9.37%. This recovery follows a correction mode from the previous week, where we experienced losses. Our recovery has been aided by various factors, including Coinbase rewards and an additional purchase of TerraM tokens.

In terms of market trends and analysis, we've observed Bitcoin trading below its 50-day moving average, indicating a correction or consolidation phase. While there's speculation about potential price movements, we're cautious about possible pullbacks to key support levels, such as $51,000 or even $50,000.

TerraM Token and Trade Adjustments

TerraM tokens are minted on the Solana blockchain and can be acquired through various platforms. We recently distributed a token airdrop to existing token holders, offering 10% additional tokens. Trade adjustments, particularly on Bitcoin put options, have been a focus, as we navigate market fluctuations and strive to maintain a balanced portfolio.

In conclusion, navigating the crypto market requires a combination of strategic insight, risk management, and adaptability. While challenges persist, opportunities abound for those who approach trading with diligence and foresight. As we continue to refine our strategies at Teramatris, we remain committed to safe and informed trading practices.

Thank you for watching, and feel free to reach out with any questions or comments. Until next time, trade safe and stay informed. Goodbye.