Ep 117: Bitcoin Death Cross Worries Grow as TerraM Fund Drops Further

| Weekly updates | 28 seen

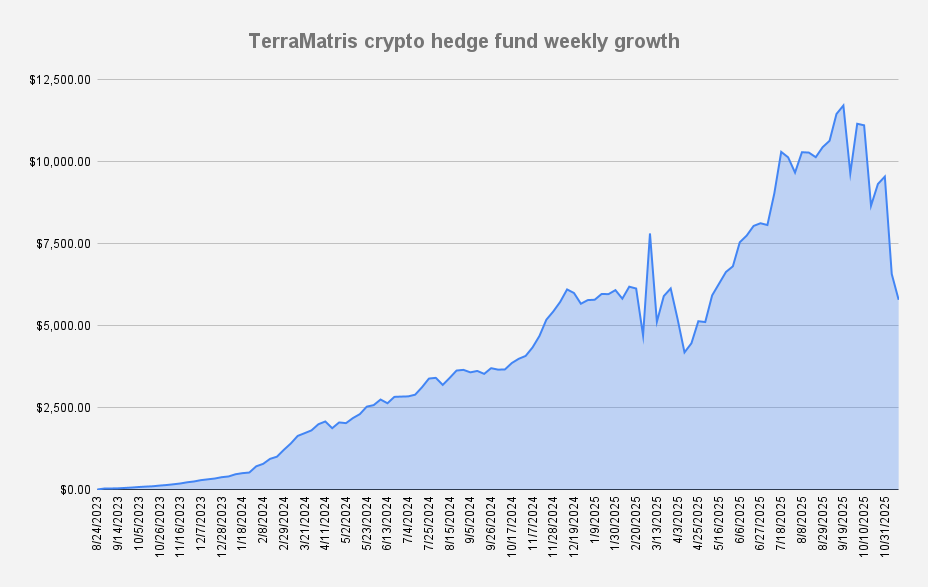

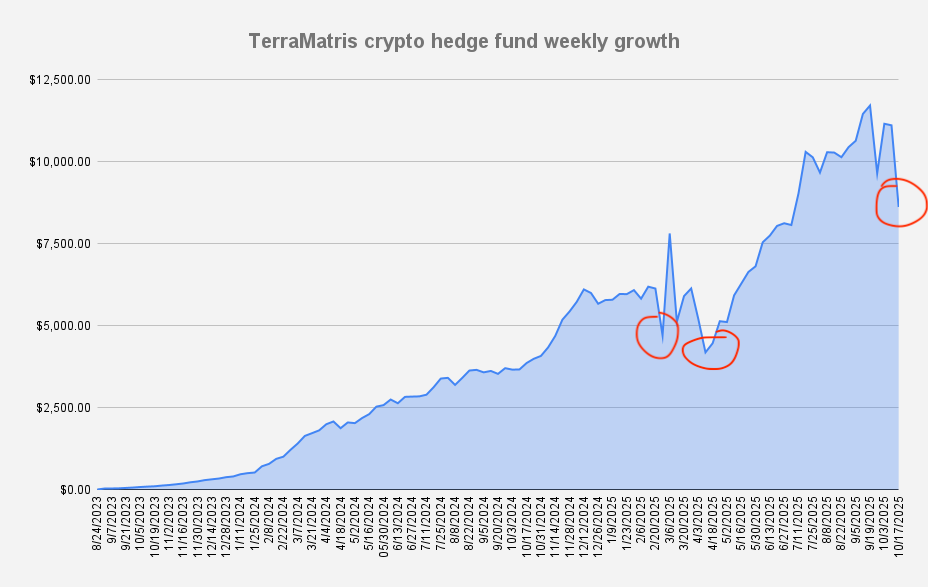

As of November 14, 2025, the value of the TerraM Multi-Asset Crypto Options Fund has declined by another -11.97%. Our drawdown has reached a new low of –50.58% in just a few weeks — a striking reminder of how quickly conditions can deteriorate. Even though most indicators are washed out and a recovery could be near, we remain cautious and do not rule out further downside. We still hope to be wrong.

There is one major event worrying us: a death cross on the Bitcoin chart. In fact, it’s not just potential it’s looking increasingly inevitable.

A death cross occurs when the 50-day moving average falls below the 200-day moving average. This signal typically reflects a long-term shift from bullish to bearish momentum. Historically, it doesn’t always trigger an immediate selloff, but it often marks periods of extended weakness, slow recoveries, or deeper downside. The mechanics are simple: the faster-moving average (50-day) reacts quickly to recent price declines, while the slower one (200-day) represents the broader trend. When the short-term line crosses below the long-term line, it signals that recent price action has deteriorated enough to drag the overall trend down with it.

While markets can sometimes bottom shortly before or after a death cross, the pattern itself highlights deteriorating momentum and the risk of further drawdowns — exactly why it remains a key concern for us right now.

We’re not making price predictions, but a move toward 84,000 for Bitcoin seems increasingly plausible. Again, we hope we’re wrong.

Our open-ended Solana Covered Call Growth Fund also followed downtren, declining by another -5.04%, with the NAV per unit now at $0.77. Although Solana retraced more than 15%, the fund operates without leverage, so the drawdown poses no structural risk — we simply ride out the market move.

Our native TerraM token was without changes, thats encouraging, few bot traders and long term holders there.

Options Income

We sell weekly options every Friday, which is why this update is published at the end of the week.

This week, the TerraM Multi-Asset Fund generated $188 in options premiums, what is impressive 3.24% weekly return on capital.

For the sake of transparency, the higher options income comes with certain trade-offs. We sold covered calls below our break-even levels. This means that if the market experiences a strong rally, we may forgo part of the upside potential.

Trades and Adjustments (USDT Settled / Weekly)

- 1.29 ETH – Break-even: $4,113 | Long calls: $3,200 (0.69), $3,800 (0.2) $4,200 (0.4) | Short put: $3,800 (0.1)

- 13 SOL – Break-even: $203.93 | Long calls: $150

- 0.02 BTC – Break-even: $112,995 | Long calls: $101,500

Crypto Algo Trading and Machine Learning: Options Probability Bot

Last week we spent time writing Python code and building machine-learning–driven algo trading bots. It’s both fun and useful — it keeps us sharp while giving us an edge in understanding market behavior. We also launched our first fully functional 1DTE SOL trading bot. Functional doesn’t mean profitable, and that’s the part we’re working on now: extending the system with machine-learning models to identify higher-probability setups.

In parallel, we continued developing our options-trading signal engine, which we distribute through a separate newsletter.

Most importantly, we made solid progress fine-tuning our Options Probability AI Bot. It’s proving especially helpful for novice traders who are still learning how to assess risk and probability. Without further preamble, here are a few signals the bot picked up for last week’s expiry:

The options market remains unusually skewed toward elevated out-of-the-money premiums, especially on BTC covered calls and short ETH puts with just six days to expiry. This kind of pricing typically reflects a mix of high implied volatility and cautious positioning ahead of near-term catalysts. The distribution of strikes suggests traders are willing to sell upside risk while collecting modest returns on deeply OTM downside exposure.

If you’d like to follow our weekly updates on fund performance, market analysis, and development progress, you can subscribe to our newsletter.

This report is for informational and educational purposes only and does not constitute financial advice or an invitation to invest.

Crypto Options Prediction Bot — Inside Our Next-Gen AI Trading Engine

| Crypto Options | 19 seen

At Terramatris, we’ve spent years exploring the intersection of quantitative finance, machine learning, and blockchain markets.

Our latest internal project - Crypto Options Prediction Bot - represents a major leap in how AI can analyze and rank crypto options across Deribit in real time.

Unlike retail “signal” bots, our bot doesn’t guess. it learns, measures, and scores every BTC and ETH options contract based on statistical probabilities, expected returns, and volatility dynamics.

- Fetches live Deribit options data for BTC and ETH every week.

- Filters all contracts with Friday expiries — matching standard options cycles.

- Uses machine learning models to estimate:

- The probability an option expires out-of-the-money (P(OTM))

- Its expected return (%)

- Liquidity and volatility conditions

- Market regime indicators like implied-volatility rank

These inputs are combined into a composite scoring system that ranks the most statistically favorable opportunities — for both option sellers and buyers.

How It Works

The bot connects to the Deribit API, fetching full BTC and ETH options chains up to 365 days ahead. Raw data is processed and normalized - calculating spreads, deltas, implied volatility, and distance from the money. A custom scoring algorithm blends risk, reward, and liquidity to highlight the most promising contracts. Weekly results are stored locally building a historical dataset for future model retraining.

Our algo trading bot currently runs on our internal machines, air-gapped from external systems. It is not connected to exchanges or wallets, and does not execute trades -it simply produces data-driven insights for internal analysis.

Each Friday at 08:00 UTC, the bot automatically:

- Fetches new Deribit data

- Scores all contracts

- Saves the top results to an internal archive

The system helps our research team identify weekly patterns and optimize strategies — especially for covered calls and short puts.

Over the next few months, we will continue gathering and analyzing weekly data. Once sufficient history is built, we’ll begin internal testing for on-chain execution and closed-loop learning.

Public rollout isn’t planned before late 2026, as our focus remains accuracy, stability, and compliance.

We’re open to partnerships, research collaborations, and institutional pilot discussions. If you’re building in the crypto options or quantitative analytics space, let’s talk.

How to Repair a Deep-in-the-Money Covered Call in Crypto

| Crypto Options | 43 seen

Covered calls are among the most reliable tools for extracting yield in volatile markets. Still, when prices fall sharply, even disciplined positions face pressure. The decision then shifts from profit maximization to risk control and capital efficiency.

In this article, we’ll walk through practical ways to repair a broken covered call, especially when the underlying asset has crashed and the position is deep in the money.

At Terramatris, we primarily trade crypto options, so the examples focus on assets like Ethereum — but the same principles apply to traditional stock covered calls as well.

1. Rolling Down the Call

When the underlying declines, the short call’s value drops. Buying it back and reselling at a lower strike increases income but sacrifices potential upside if prices recover. It’s a quick income fix, not a long-term solution.

2. Ratio Rolling (Adding Lower Calls)

Selling an additional lower strike call can speed up premium recovery but doubles exposure if the market reverses. It’s a tactic that rewards precision timing and disciplined risk sizing.

3. Closing and Re-Entering via Short Puts

Closing the covered call and pivoting to short puts allows traders to maintain premium flow while resetting exposure lower. It’s often cleaner when volatility remains high and directional conviction is low.

At Terramatris, we operate under a simple principle: Income first, precision later.

We’re comfortable selling aggressive calls below breakeven to maintain premium inflow — but only when risk/reward justifies it. Our breakeven on ETH is roughly $4,250, and we’re currently evaluating selling short-term calls with $3,600–$3,800 strikes while the market stabilizes around $3,200–$3,300.

This approach acknowledges near-term downside risk while extracting yield from elevated implied volatility. If the market recovers and ETH closes above the strike:

- Assignment at $3,600–$3,800 would effectively realize a controlled loss versus our original $4,250 entry.

- From there, we’d re-enter exposure via short puts, likely around $3,000–$3,200, collecting premium while positioning to rebuild ownership at a better cost basis.

This keeps the capital working without forcing early exits or reactive hedges.

When ETH plunged from ~$4,100 to $3,200, our 1 ETH covered call was deep underwater relative to the initial entry. Rather than panic-selling, we analyzed the probability curve:

- At-the-money IV was above 80%, creating strong short premium opportunities.

- Selling 1-week calls around $3,600–$3,700 would yield roughly $38–$56 per contract, translating to a 1–1.5% return on notional for a single week.

That’s sufficient to reduce the effective cost basis toward $4,200 even if price drifts sideways. If assigned, the follow-up short put cycle continues the yield chain without margin strain.

We’ve long maintained that leverage is a double-edged sword. It amplifies gains in quiet markets but can destroy capital during volatility spikes.

As the Terramatris portfolio grows, our objective is clear:

- Keep leverage lower, ideally under 1.2× net exposure.

- Prioritize liquidity and optionality over absolute yield.

- Let compounded option income grow the portfolio organically, rather than force size with borrowed capital.

Reducing leverage allows us to survive drawdowns intact — which, in option writing, is the real competitive edge.

Covered call “repair” isn’t about recovering every lost dollar — it’s about managing premium flow and risk posture intelligently. At Terramatris, we remain patient. We’re evaluating short calls between $3,500–$3,600, not rushing to sell. If assignment occurs, we’ll pivot to short puts near $3,000–$3,200 to re-establish long exposure with lower basis and continued yield.

In volatile markets, survival and steady premium accumulation matter more than speed.

Solana Covered Call Growth Fund Performance - October 2025

| Funds | 27 seen

The Terramatris Solana Covered Calls Growth Fund completed its second full month of operations in October 2025. The Fund continued to follow its systematic covered call strategy on Solana (SOL), maintaining disciplined position management amid heightened crypto market volatility.

By the end of October, the Fund had 12,171 shares issued, bringing total Assets Under Management (AUM) to $10,831 based on a closing NAV of $0.89 per share. This represents a 95.6% increase in AUM from September’s level of $5,536.

Solana’s market price declined from $208 to $186 (-10.6%) over the month, while the Fund’s NAV decreased 4.3%, demonstrating relative resilience and approximately +6.3% outperformance versus the underlying asset.

The Fund remains open to new capital commitments until total AUM reaches $100,000. TerraM Fund, one of our core investors, continues biweekly contributions of $100, supporting consistent capital growth.

For full details on Fund activity, performance, and strategy outlook, please refer to the attached monthly report.

Poor Man’s Crypto Hedge Fund: Earning Income from Dogecoin Options on Bybit

| Crypto Options | 23 seen

After Bybit enabled options trading for Dogecoin (DOGE), we decided to include DOGE in the TerraM Multi-Asset Crypto Options Fund. Our favorite approach across assets remains consistent - selling put options to generate income and using that income to accumulate the underlying asset over time.

If assigned, we take delivery of the asset and sell covered calls. More often than not, we roll forward the position for a credit instead of letting the call get exercised, effectively compounding income while maintaining exposure.

On October 29, we opened our first DOGE position by selling:

- 1,000 DOGE put options

- Strike: $0.185

- Credit received: $0.019 per DOGE

- Expiry: October 31, 2025

By October 31, the strike was in the money, so we decided to take a proactive stance — rolling the position forward one week to the next expiry while lowering the strike price to $0.18 and earning an additional premium of $0.0058 per DOGE.

All collected premium is reinvested into spot DOGE, which is now part of our TerraM Multi-Asset fund.

- Spot DOGE holdings: 40 DOGE

- Short puts: 1,000 contracts (strike $0.18)

- Average buy price: $0.1895

- Break-even price: $0.1742

What happens next?

If, on expiry — November 7, 2025, DOGE remains above $0.18, our short put options will expire worthless, allowing us to keep the full premium and continue selling new weekly puts to generate consistent income.

If, however, DOGE trades below $0.18, we’ll evaluate two possible paths:

- Roll Out and Forward: Extend the position to a later expiry while keeping or slightly adjusting the strike price — ideally for an additional net credit, compounding the income stream.

- Take Assignment: Accept delivery, most likely in the form of a perpetual futures position, and transition to a covered call selling strategy to generate further yield.

This flexible approach allows us to adapt dynamically to market conditions while maintaining our primary goal — steady option income and strategic accumulation of DOGE within the TerraM Multi-Asset Crypto Options Fund.

After our first week with DOGE coin option we are looking at 3% income in 9 days

This marks the start of our “Poor Man’s Crypto Hedge Fund” series, where we’ll use DOGE as a fun and educational vehicle to demonstrate disciplined, option-based accumulation and yield generation in crypto markets.

As always, all DOGE income and positions are part of the TerraM Multi-Asset Crypto Options Fund, following the same risk-managed, income-compounding approach used with BTC, ETH, and SOL.

Why We Added MNT to Our Long-Term Investment Portfolio

| Investment ideas | 17 seen

At Terramatris, we’ve added a small position in Mantle (MNT) to our Multi-Asset Crypto Options Fund, following Bybit’s launch of MNT options. The move aligns perfectly with our focus on assets that support options trading — a key part of our long-term yield strategy.

We’re generally bullish on assets that we can build structured positions around — primarily BTC, ETH, and SOL — since these allow us to generate steady yield through systematic option selling. Seeing MNT appear on Bybit’s options chain was a bit unexpected, but it instantly put the project on our radar.

Mantle brings together a modular Ethereum Layer-2 design, a growing DeFi ecosystem, and now — importantly for us — derivative market access. That last point makes all the difference for an options-based strategy like ours.

We began by establishing a small position via put options, collecting premiums and using part of the earned premium to accumulate spot MNT for our long-term holdings. This approach lets us scale exposure gradually, with downside protection and steady income generation — consistent with how we’ve built other long-term crypto positions in the fund.

We’re not in the business of making short-term price predictions, but we did run a few internal simulations on potential valuation ranges. Seeing MNT in the $10–$20 price range appears much more realistic than $100. Still, we do enjoy a good moonshot, and if Mantle reaches triple digits someday, we’ll gladly ride that wave.

Alongside our options exposure, we’re also exploring DeFi opportunities for MNT staking within the Mantle ecosystem and beyond. Generating additional passive yield through on-chain protocols complements our options-based income, helping us compound returns while supporting ecosystem growth.

Our MNT position is modest but strategic. The introduction of options trading gives Mantle a new level of market maturity, and for Terramatris, that’s a clear signal to start paying attention. As always, we’ll continue to sell options, collect yield, and build spot exposure over time — one premium at a time.

Introducing Terramatris SMA — Expanding Opportunities in Tailored Crypto Management

| Crypto Options | 18 seen

At Terramatris, our journey has always been rooted in one clear goal — to grow capital through options trading. From day one, our focus has been on developing strategies that generate consistent, risk-adjusted returns in the ever-evolving crypto derivatives market.

In our early days, we briefly explored managing client portfolios through Separately Managed Accounts (SMAs). While that initiative never really took off at the time, it gave us valuable insights into the infrastructure, compliance, and communication needed to manage external capital effectively. Over the years, we instead found stronger growth in pooled asset management, developing scalable structures and robust strategies through our core vehicles — the TerraM Multi-Asset Crypto Options Fund, the Solana Covered Call Growth Fund, and our native TerraM token.

Now, with a mature foundation, proven execution systems, and increased client interest, we are pleased to offer Terramatris SMA — a fully personalized solution for investors who prefer direct account management while benefiting from our expertise in options-based yield generation.

SMA Offering Highlights

- Minimum Investment: $25,000

- Strategy Focus: Options-selling and volatility strategies on BTC, ETH, SOL, XRP, DOGE, and MNT

- Execution Platforms: We operate across leading derivatives and spot exchanges including Deribit, Bybit, Deriv, Gate.io, and Binance

- Flexible Structure: Accounts can be connected via API integration or managed through direct execution, depending on client preference

- Transparency and Control: Investors retain full ownership and real-time visibility over their capital, while Terramatris provides ongoing strategy management and reporting

Built in Partnership with Our Clients

Each SMA is managed in close collaboration with the client. From initial strategy design to live portfolio monitoring, we emphasize transparency, flexibility, and clear communication. This ensures that every trading decision reflects both market conditions and the investor’s specific objectives.

A Natural Step Forward

While our primary focus remains on growing the Terramatris ecosystem through our funds and native token, the SMA offering is a strategic expansion — a way to extend our proven trading framework to a select group of investors seeking tailored solutions.

At Terramatris, we see SMAs as a continuation of our mission: leveraging advanced options trading to grow capital efficiently, responsibly, and transparently — now with an individualized touch.

Bybit to Launch XRP Options — A New Opportunity Ahead

| Crypto Options | 37 seen

During our routine login to Bybit today, we noticed an exciting update: Bybit will be adding XRP options contracts starting October 21.

At this stage, there’s limited public information about contract specifications, such as lot size, expiry intervals, or margin terms. However, the announcement itself is noteworthy, especially considering XRP’s growing liquidity and Bybit’s increasing dominance in the crypto derivatives space.

Although the Terramatris Fund currently does not hold XRP directly, this development could influence our positioning in the near future. Bybit has long been one of our go-to platforms for options trading, and depending on the contract size and leverage terms, we may explore credit spreads or covered call strategies on XRP once the instruments become available.

Overall, this is a welcome addition to the crypto options landscape — and we’ll be watching closely how the market responds once trading opens on October 21.

How Crypto Reacts to U.S. Tariff Announcements — and Why It Hurts More Than Stocks

| Research | 47 seen

When the U.S. government announces new tariffs, markets panic, and crypto tends to take the hardest hit.

We’ve seen this pattern repeatedly: a single policy shock sends stocks tumbling, bonds rallying, and Bitcoin plunging twice as hard. But why does a trade policy aimed at physical goods ripple so violently through digital assets? And how long does it usually take for crypto to recover?

Let’s break down the dynamics, the psychology, and what we’ve observed firsthand in our own portfolio after major tariff shocks.

The Immediate Reaction: Panic, Liquidations, and Correlation

Tariff announcements are not just about economics — they’re about uncertainty.

The moment new import taxes or trade restrictions are declared, global investors shift into “risk-off” mode. Equities fall, the dollar spikes, and liquidity evaporates across speculative assets.

Crypto, unfortunately, sits at the very edge of that spectrum.

Within hours of such announcements:

- Bitcoin and Ethereum typically drop 2–3× more than the S&P 500.

- Open interest on futures markets collapses.

- Billions in leveraged long positions are liquidated.

- Volatility (realized and implied) explodes.

In our experience at Terramatris, the portfolio often suffers its sharpest daily drawdowns during tariff headlines — even though the crypto market has no direct link to steel, cars, or semiconductors.

This is purely a sentiment correlation effect: when traditional traders de-risk, they sell everything with volatility attached — and crypto is at the top of that list.

Why Crypto Reacts to Trade Policy at All

There are three main mechanisms behind this correlation:

Risk sentiment transfer

Crypto now trades as a global risk asset. Institutional money, macro funds, and retail traders all treat Bitcoin and Ethereum as high-beta plays on liquidity and optimism. When tariff news signals slower growth or global uncertainty, those positions are first to go.

Liquidity chain effect

Margin calls and equity losses force fund managers to raise cash elsewhere. Crypto holdings — especially on regulated platforms — are often liquidated to meet collateral needs.

Narrative contagion

Even if tariffs don’t touch crypto directly, the macro narrative shifts from “expansion” to “recession risk.” That shift compresses valuations across all risk assets. Algorithms trading cross-asset correlations simply follow the flow.

How Long It Usually Takes to Recover

Looking at previous episodes (2018 China tariffs, 2019 escalation, and smaller tariff scares since), crypto tends to follow a three-phase recovery pattern:

Shock & liquidation

1–3 days

Sharp 10–20 % drops, high funding rates reset, huge volumes

Relief rebound

3–10 days

Oversold bounce, short-covering, funding normalizes

Consolidation & rebuild

2–4 weeks

Range trading before resuming trend, often faster than equities

On average, major tariff-induced crypto crashes take about 2–4 weeks to fully recover, assuming no new escalation.

If tariffs deepen or retaliation follows, recovery can stretch to 6–8 weeks.

Interestingly, crypto often leads the recovery phase — once fear subsides, liquidity returns faster to Bitcoin than to equities. But timing it requires patience and strict risk control.

Our Experience: The March–April Drawdown and September Rebound

At Terramatris, we experienced a massive portfolio drop during the March–April 2025 correction, triggered by tariff fears and broader macro stress.

The portfolio lost a significant portion of value within days as leveraged long positions across exchanges were liquidated.

However, by staying disciplined — cutting leverage, keeping exposure manageable, and gradually rebuilding — the market fully recovered and went on to reach new all-time highs by September 2025.

That rebound reinforced a critical lesson:

Leverage is the biggest enemy during macro shocks.

Crypto’s volatility is already extreme; adding borrowed exposure magnifies losses exponentially.

Avoiding leverage — or using it sparingly and strategically — is the single best defense against panic-driven wipeouts.

Why Recovery Sometimes Doesn’t Come Quickly

There are reasons recovery may stall or fail entirely:

- Persistent macro fear: If tariffs escalate into a prolonged trade war, investor appetite for high-volatility assets stays low.

- Tight monetary policy: When interest rates remain high, liquidity to fuel speculative rallies dries up.

- Sentiment damage: Multiple shocks in a short period (tariffs + regulation + earnings misses) can exhaust dip buyers.

- Structural leverage wipeouts: After extreme liquidation events, traders need time to rebuild collateral and confidence.

In those cases, the crypto market may move sideways for months even if prices don’t collapse further.

Our Broader Takeaways

Through multiple tariff cycles, we’ve learned three rules that consistently protect capital:

- Keep leverage near zero when macro risk rises.

- Use volatility spikes to sell options or reposition, not to chase price.

- Expect crypto to bottom before equities — but only after forced liquidations clear.

These principles helped us navigate the March–April drawdown and come out stronger in September.

The Takeaway

Tariff announcements are a reminder that crypto is no longer an isolated niche — it’s part of the global macro risk web.

When traditional markets fear slower trade and tighter liquidity, Bitcoin bleeds with the rest of them.

But unlike industrial stocks, crypto tends to snap back faster, provided the policy shock fades instead of festers.

In other words:

“Tariffs don’t target crypto — but crypto still takes the bullet.”

For disciplined investors, that’s both a warning and an opportunity.

When the panic hits, manage risk. When the dust settles, be ready , because crypto rarely stays down for long.

ASR Reward from JUP Makes Us Happy

| Investment ideas | 30 seen

Sometimes the crypto world brings pleasant surprises — and this week, JUP Network did exactly that for us at Terramatris.

Back in January 2024, JUP tokens unexpectedly landed in our portfolio as part of a surprise airdrop. At the time, we didn’t have any specific stance on the project — we weren’t particularly bullish or bearish.

Jupiter (JUP): Why This Solana DeFi Token Caught Our Attention

We decided to allocate a small portion of our fund to JUP, categorizing it in our “moonshot sector” - assets that we’d be thrilled to see appreciate 10x–100x in a meaningful time frame but are also ready to accept could go to zero. JUP fit perfectly into that high-risk, high-upside segment of our portfolio.

Instead of letting the tokens sit idle, we continued dollar-cost averaging into JUP over time. The tokens we accumulated are staked, and we also participate in the Jupiter DAO, engaging with governance and network updates.

These are not core trading activities for our fund — rather, they represent our contemplative, experimental side, exploring promising ecosystems without risking too much capital.

One of JUP’s most interesting mechanics is its ASR (Active Staking Rewards) system, which distributes rewards once per quarter. We’ve just received our latest round — an estimated 2% in additional tokens and while that might not sound huge, it’s a solid and consistent return for an otherwise passive position.

In a market where many assets promise much but deliver little, these ASR rewards are a reminder that steady participation pays off — even if the total exposure is small.

We don’t see JUP as a pillar of the Terramatris portfolio, but rather as a speculative satellite, orbiting around our more strategic investments. Still, when surprises like this ASR reward arrive, they make us smile and keep us curious about what’s next for the Jupiter ecosystem.