Greetings, investors and enthusiasts. My name is Reinis Fischer, CEO and founder of Terramatris Crypto Hedge Fund, a quantitative DeFi crypto hedge fund focused on advanced options trading strategies. This update covers the activities and performance of the fund for the week ending January 9, 2024. Apologies for the slight delay in recording this week’s update, as I had to attend to personal matters after the passing of our beloved cat, Tiger.

About Terramatris Crypto Hedge Fund

Our fund specializes in cash-secured put options, aiming to maximize growth while minimizing risk in the cryptocurrency market. Investors can participate via our native $TERRAM Token, which is available on Raydium, a decentralized liquidity pool on the Solana blockchain. This allows seamless investment through any Web3 platform supporting Solana ($SOL).

Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

Currently headquartered in Gudauri, Georgia, we continue to refine our strategies and offer transparency about our operations. A quick disclaimer: investments in cryptocurrencies and related assets involve significant risk. Always perform due diligence before investing.

Trading Strategy Highlights

Our approach centers on selling short-term options, including:

- Cash-Secured Put Options: Typically, one-day expiries or weekly credit spreads on Bitcoin ($BTC) and Ethereum ($ETH).

- Covered Calls: Sold on existing positions in BTC, ETH, and Stellar Lumens ($XLM).

Premiums from these trades are reinvested into cryptocurrencies to maintain a diversified portfolio, which includes assets like Bitcoin, Ethereum, Stellar, USDC, Solana, Jupiter Token ($JUP), PAXG, Binance Coin ($BNB), and Ripple ($XRP). Additionally, we stake assets like Raydium ($RAY), Solana, and ByBitSolana to ensure consistent returns.

Our disciplined approach incorporates dollar-cost averaging to achieve steady, averaged entry prices for all investments.

Weekly Activity & Results

Investments: We allocated $15 daily into spot cryptocurrencies, focusing on BTC, JUP, PAXG, and PENGU this week. While smaller altcoins like JUP and PENGU were initially acquired via airdrops, we plan to shift toward more established tokens like Bitcoin, Ethereum, and Solana in the coming weeks.

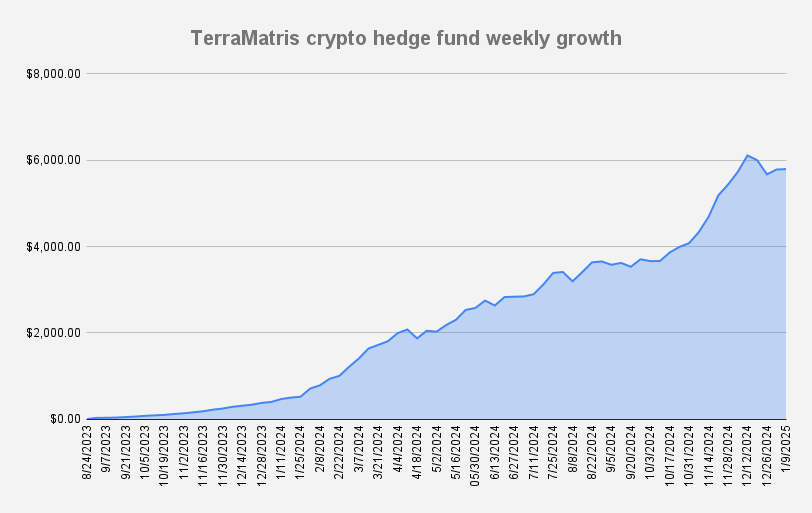

Portfolio Performance: As of January 9, our portfolio stands at $5,793, reflecting a weekly growth of 0.17%. However, due to recent market volatility, it briefly dropped from a high of $6,200 earlier in the week.

Options Trading Updates

Here’s a snapshot of our active options positions:

- Ethereum ($ETH):

- A cash-secured put with a strike price of $3,600 expiring January 31, currently in the money with ETH trading at $3,200. Losses on this trade are manageable, and adjustments are planned.

- A long covered call expiring January 31, with strike prices of $3,200 and $4,000, complements our holdings of 0.3 ETH.

- Bitcoin ($BTC):

- Newly initiated covered call at a strike price of $108,000 expiring January 31.

- Solana ($SOL):

- Two covered call positions with a strike price of $220 expiring January 31.

Market Trends & Risk Management

The crypto market remains volatile, with Ethereum trading between its 50- and 200-day moving averages, supported at $3,000. While we hope to avoid a dip below key support levels, our cash-secured approach ensures we’re not exposed to leverage or liquidation risks. Current portfolio drawdowns stand at 7%, and we anticipate potential rebounds as markets stabilize.

$TERRAM Token Updates

Our native $TERRAM token currently has a fully diluted market cap of $22,100, with a circulating supply of 10,000 tokens. It is priced at $2,21 per token but may experience slippage for larger purchases. For substantial acquisitions, we recommend over-the-counter (OTC) transactions for up to 200 tokens at a fixed price of $2.21 each.

Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

Additionally, we are advancing our buyback and liquidity program, which is triggered when our portfolio reaches $6,500. Given recent fluctuations, we expect the buyback to occur closer to the end of January.

Closing Thoughts

Thank you for your continued support and trust in Terramatris Crypto Hedge Fund. Despite recent challenges, our strategies and commitment to risk management remain steadfast. Stay tuned for next week’s update.

Disclaimer: This article is for informational purposes only and does not constitute investment advice.