Good morning, and welcome to this week’s update from the Terramatris Crypto Hedge Fund. My name is Reinis Fischer, CEO and founder of Terramatris. Before diving in, I want to wish everyone a happy and prosperous 2025! Let’s recap the week’s activities and explore our fund’s progress and strategies.

if you read in a newsletter, watch video here

For those unfamiliar, Terramatris is a quantitative DeFi crypto hedge fund that focuses on advanced options trading strategies. Our primary approach involves selling put options to maximize growth while minimizing risk in the cryptocurrency market. We also operate our native token, $TerraM, available for investment via the Raydium liquidity pool, powered by Solana.

Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

While the fund is primarily managed from Tbilisi, Georgia, I’ve been traveling across India and am recording this update from New Delhi after a brief trip to South Goa.

Trading Strategies

At Terramatris, we focus on high-probability trades that aim to expire worthless, minimizing losses and collecting premiums. Key strategies include:

- Short-Dated Options: Selling one-day-to-expiry put options or weekly credit spreads on Bitcoin and Ethereum.

- Covered Calls: Selling covered calls on existing positions in Ethereum and Solana.

- Reinvestment of Premiums: Reinvesting collected premiums into spot cryptocurrencies to grow our portfolio.

Risk Management

Risk management is at the core of our trading. We:

- Roll forward challenged trades for credit by buying back positions and opening new ones further out.

- Hedge with futures or stop losses when necessary.

This approach helps us maintain steady growth while protecting against significant losses.

Weekly Goals

Each week, we set ambitious goals. During the holiday season and while traveling, we’ve focused on:

- Investing a minimum of $15 daily into spot cryptocurrencies.

- Adding positions in BNB, Ethereum, Solana, and Toncoin.

Portfolio Update

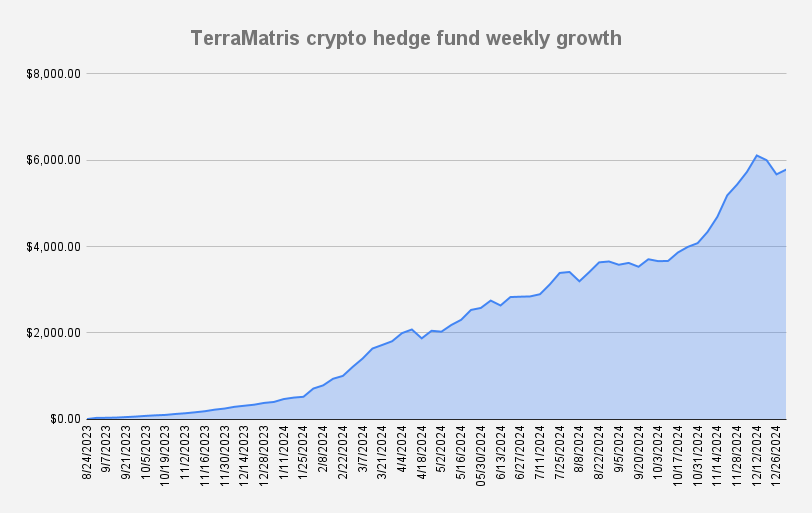

After a few challenging weeks, we’ve returned to growth. As of January 2, 2025, our fund stands at $5,783, reflecting a 1.98% weekly growth. In dollar terms, this represents an increase of $112.25.

While we haven’t yet reached our all-time high from mid-December, we are optimistic about 2025 and aim to break new records soon.

Current Positions

We’re holding a variety of options and spot positions, including:

- Ethereum: Short put options with a strike price of $3,600 (expiring January 31).

- Covered Calls: Strike price $3,200 (expiring January 31).

- Solana: Long positions with a strike price of $220 (expiring January 31).

Market Trends

Ethereum currently trades at $3,400, with Bitcoin leading market movements. While technical analysis suggests potential support at $3,000, we’re prepared for volatility and remain confident in our long-term strategy.

$TerraM Token

Exciting news for our native token, $TerraM:

- Current price: $2.21.

- Fully diluted market cap: $22,000.

- Circulating supply: 15%, with 5% in the liquidity pool and 10% distributed among holders.

Investors can swap $TerraM against USDC on platforms like Raydium and OKX. For larger investments, we also offer over-the-counter sales at fixed prices.

Swap on Raydium, ByBit or OKX.com (Solana supported wallet required)

As we progress into 2025, our goals remain ambitious. We aim to:

- Increase liquidity in our native token.

- Continue dollar-cost averaging into spot crypto daily.

- Expand and refine our options trading strategies.

Thank you for tuning in to this week’s update. If you have questions or wish to learn more about our strategies, feel free to connect via LinkedIn, YouTube, our blog, or Twitter/X.

Wishing you a prosperous 2025. See you next week from Tbilisi, Georgia!